做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天三级放上衍生品的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

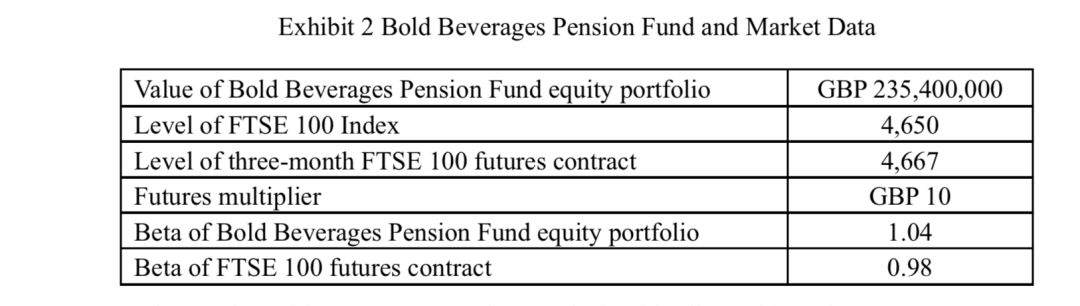

Jacob manages the equity portion of the Bold Beverages Pension Fund, which is converting its pension plan from defined benefit to defined contribution,effective three months from now.

Plan participants have three months to elect various investments for the new plan. The trustees inform Jacob that they wishto keep the value of the pension fund stable during these three months.

Determine the number of futures contracts that Jacob should sell to achieve the target. Show your calculations.

答案解析

Jacob wishes to eliminate all systematic risk in theBold Beverages Pension Fund’s equity portfolio, so the target beta must be zero.

βT = 0

The price of a futures contract = GBP 10 × 4,667 = GBP46,670.

The number of futures contracts required is:

Nf = [(βT – βS)/βf]× (S/f), where S = stock portfolio, f = futures contract.

= [(0 – 1.04)/0.98] × (GBP235,400,000/GBP 46,670) = - 5,352.74

As fractions of futures cannot be traded, Jacob should sell 5,353 FTSE 100 futures contracts.

解题思路

首先,Jacob不想承担系统性风险,所以目标β为0.

然后,用期货合约调beta;负号代表卖出。

最后,四舍五入,Jacob应该卖出5353份期货合约。

易错点分析

调beta/duration属于衍生品必考题型。

有的同学不清楚调beta的公式,pre-investing的公式,和syntheticequity的公式的对比。

Pre-investing与调beta对比:Pre-investing的公式与调beta的公式是一样的。只不过公式中的Vp代表的含义不同,在pre-investing中是用期末收到的现金,在调beta里是用期初需要调整的金额。

Synthetic equity与调beta对比:synthetic equity假设期初需要调整的金额可以获得无风险收益,所以要考虑期间投资金额的增长。而调beta不考虑这部分增加,直接用期初投资的金额。所以如果题目是用synthetic equity求解的话,一定会给risk-free rate.

Synthetic equity与pre-investing对比:两者在本质上都是用期末的Vp,只不过对于synthetic equity来说,是根据期初的投资金额复利到期末得到期末的价值,而pre-investing会已知期末预期收到多少Cash。

精选问答2

题干

Jacob wants to eliminate systematic risk in the equity portion of the fund by using futures on the FTSE 100 Index, which is the benchmark for the fund’s equity portfolio. She collects the information shown in Exhibit 2.

Three months after Jacob implements the hedge, theFTSE 100 Index is up 3.75%. The equity portion of the Bold Beverages Pension Fund is up 3.50% and the level of the expiring three month FTSE 100 futures contract that Jacob sold is 4,824. The trustees ask Jacob to assess the effectiveness of the hedge that has been in place.

Determine theeffective beta of the Bold Beverages Pension Fund equity portfolio, includingthe futures, assuming that Jacob sold 5,200 futures contracts. Show your calculations.

答案解析

The new value of the equity portfolio is GBP235,400,000 × 1.035 = GBP 243,639,000 or a gain of GBP 8,239,000.

The profit on the futures is (4,824 – 4,667) × GBP 10× (-5,200) = - GBP 8,164,000 or a profit of -3.468%.

So, the overall profit is GBP 8,239,000 – GBP8,164,000 = GBP 75,000 and the ending value of the overall portfolio is GBP235,475,000.

This is an overall return of GBP 75,000/GBP 235,400,000= 0.0003 or 0.03%.

Since the market was up 3.75%, the effective beta was 0.0003/0.0375 = 0.0085.

解题思路

首先,一开始portfolio的构成是GBP235400000的equity和short5200份futures contract.

然后,计算portfolio的profit/loss.

portfolio的profit/loss

=profit/losson equity + profit/loss on futures contracts

=235400000×3.5%+(4824– 4667) × 10 × (-5200)

=8239000-8164000

=GBP75000

接下来,计算portfolio的return=GBP 75000/ GBP 235400000=0.032%

最后,计算effective beta=return on portfolio/return on index=0.032%/3.75%=0.0085.

易错点分析

Equity和index的return因为题目中给的就是三个月的,不是年化数字,所以可以直接用,不需要再去年化。

求effective β属于衍生品中比较难又很喜欢考的一个知识点。这道题是一道很典型的题目,同学们要好好理解。

精选问答3

题干

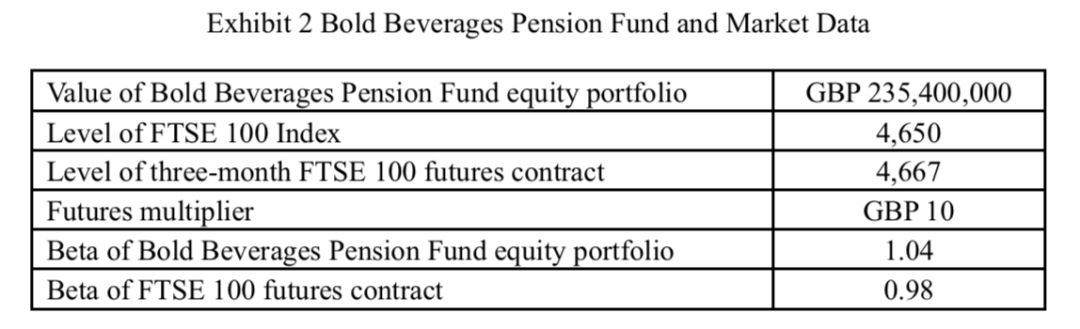

Another of Mamani's clients, Arequipa Industries (AI), is about to borrow PEN120 million for two years at a floating rate of 180-day Libor (currently 3.25%)plus a fixed spread of 90 basis points with semiannual resets, interest payments based on actual days/360, and repayment of principal at maturity.

AI'smanagement is worried that Libor might rise during the term of the loan and asks Mamani to recommend strategies to reduce this risk.

Mamani suggests a zero-cost collar on 180-day Libor with a cap of 4.70% and a floor of 2.25%,payment dates matching the loan payments (on 30 June and 31 December, with thefirst payment on 31 December), and interest based on actual days/360. She develops various examples of the collar's impact, including one using the interest rate scenario in Exhibit 1.

Using the Libor scenario shown in Exhibit 1 and underthe assumption that the zero-cost collar is put in place, the effective interest due on AI's loan for the semiannual period ended on 31 December 2013 is closest to:

A. PEN1,911,000

B. PEN1,365,000

C. PEN2,062,667

答案解析

The effective interest in period t is:

Loan balance × (Actual days in period/360) × [Libort1+ Spread - max(0,Libort–1 – Cap rate) + max(0,Floor rate – Libort–1).

120,000,000*(182/360)*[0.02+0.009-max(0,0.02-0.047)+max(0, 0.0225-0.02)]=1,911,000

解题思路

首先,当标的物是利率时,因为担心利率上升,所以collar是longcall short put (这与当标的物是股票时相反)。

所以,AI手上的头寸有:

①向银行支付的利息:-(L+0.9%)

② long call: max(0, L-4.7%)

③short put: -max(0, 2.25%-L)

(因为是zero cost collar, 我们忽略call和put的期权费)

然后,由于利率是在期初决定的,所以从13年6月30号到13年12月31号这段时间的libor要用6月30号的libor2% (而不是2.5%)。

接下来,因为2<4.7, 所以call不会行权。但是2<2.25, 所以put会行权。Putoption的payoff是-(2.25%-2%)=-0.25%,也就是要支付0.25%的利息。

最后,计算实际利息。

实际利息=本金×利率×时间

=PEN120million ×(2%+0.9%+0.25%)×(182/360)

=PEN1911000

选A。

易错点分析

collar有long put short call 和long call short put 两种。具体用哪种头寸取决于标的物是什么。

如果标的物是股票,一般担心股票价格下跌,所以用long put short call,股票价格下降有收益。

如果标的物是利率,对于borrower来说,担心利率上升,所以用long call short put,利率上升有收益。

另外,如果本题要计算effective interest rate, 还要看是否需要年化。

精选问答4

题干

James Delport is an options trader at a large bank. He sold to a client one-month putoptions on 2,000 shares of an underlying equity. The options have an exercise price of 1,300 euros (EUR) and an option premium of EUR 19.09 per share. The underlying equity is trading at EUR 1,340 per share.

The options were priced using a volatility of 24%.Delport calculates the delta of the options to be –0.3088.

Delport needs to hedge his exposure and decides to trade in the underlying equity’s shares.

i. Determine whether Delport should buy or sell shares of the underlying equity.

ii. Calculate the number of shares he shouldtrade. Show your calculations.

答案解析

![]() i. Delport needs to sell shares in theunderlying equity.

i. Delport needs to sell shares in theunderlying equity.

By selling put options to hisclient, Delport is net long the underlying equity. Therefore, the hedge needs to be a short position. He must sell shares to hedge his exposure.

![]() ii. Delport’s current exposure from selling the put options = # contracts × spot price × option delta = –2,000 × $1,340 × –0.3088 =$827,584 (long)

ii. Delport’s current exposure from selling the put options = # contracts × spot price × option delta = –2,000 × $1,340 × –0.3088 =$827,584 (long)

Therefore, the number of sharesthat must be sold equals $827,584 / $1,340 = 617.60 or 618 shares.

解题思路

![]() i.Delport手上是short put的头寸,担心股价下跌时longput的一方会行权。因此,要short stock, 在股价下跌时才会带来收益。

i.Delport手上是short put的头寸,担心股价下跌时longput的一方会行权。因此,要short stock, 在股价下跌时才会带来收益。

![]() ii计算要sell多少份股票。

ii计算要sell多少份股票。

因为delta= Δput/ Δstock.

因此Δput= delta*Δstock

股价变动一块钱时,put变动delta。也就是说delta份股票就能cover一份put.

一共有2000份put, 所以需要股票份数为2000*delta=2000*0.3088=617.6.

四舍五入,Delport需要卖618份股票。

易错点分析

有的同学看到第二句话中“He sold to a client one-month put options on 2,000 shares of an underlyingequity”中2000后面有equity就觉得应该用2000份股票来hedge.其实这个条件是用来说明有多少份put option的。同学们要区分option的underlyingstock和用来hedge option的stock.

精选问答5

题干

The Bedford Trust is focused on long-term growth and invests only in equities. The trust has an equity portfolio with a market value of $60 million, of which $20million is allocated to WTO stock.

Its trustees are considering a temporary decrease in the allocation to WTO stock in order to diversify into small-capitalization US stocks.

Osborne recommends the Russell 2000 Index as an appropriate small-capitalization index and recommends that Bedford Trust enter into an equity swap on $20 million of WTO stock with the Russell 2000.

If Bedford Trust implements Osborne’s recommendation regarding WTO, it will least likely experience a cash outflow if the returns on WTO stock and the Russell 2000 Index are:

A. WTO Return: Positive and Russell 2000 Return:Negative

B. WTO Return: Negative and Russell 2000Return: Positive

C. WTO Return: Zero and Russell 2000 Return:Negative

答案解析

答案:B

![]() B is correct. Bedford has entered into a swap that pays the return on the WTO stock and receives the return on the Russell 2000.If it pays a negative return on the WTO stock, it will receive a cash inflow;receiving a positive return on Russell 2000 Index is also a positive cashinflow.

B is correct. Bedford has entered into a swap that pays the return on the WTO stock and receives the return on the Russell 2000.If it pays a negative return on the WTO stock, it will receive a cash inflow;receiving a positive return on Russell 2000 Index is also a positive cashinflow.

![]() A is incorrect. Bedford would pay the counterparty on both the WTO and Russell 2000 Index return resulting in only a cash outflow.

A is incorrect. Bedford would pay the counterparty on both the WTO and Russell 2000 Index return resulting in only a cash outflow.

![]() C is incorrect. Bedford would pay the counterparty nothing for the WTO return, but would pay for the Russell 2000 Index return.

C is incorrect. Bedford would pay the counterparty nothing for the WTO return, but would pay for the Russell 2000 Index return.

解题思路

本题问的是最不可能有cash outflow的是哪个选项。

根据题中已知条件“Its trustees areconsidering a temporary decrease in the allocation to WTO stock in order todiversify into small-capitalization US stocks.”因此,Trust 想要一个付出WTO的return,收到小盘股return (Russel 2000 return),这样的一个swap。

正常情况是既有cash outflow, 又有cashinflow。什么情况下没有现金流流出呢?

当付出的现金流是负的时候。也就是说当WTO的return小于零的时候。

此时,Trust付出一个负的现金流,收到一个正的现金流。那么对手方不但要支付Russel 2000的return,还要支付WTO亏损的部分。这种情况下对手方就是“冤大头”, 只有现金流流出,没有现金流流入。

选B。

易错点分析

EquitySwap有两个特点:

一个就是本题所说的“冤大头”现象。

第二个就是equity return和interestrate的对比。Interest rate是在期初就决定好的。Equityreturn 期初的时候无法确定,要到期末才知道。