做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天一级放上衍生品的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

An arbitrage transaction generates a net inflow of funds:

A.throughout the holding period.

B.at the end of the holding period.

C.at the start of the holding period.

答案解析

C is correct.

Arbitrage is a type of transaction undertaken when two assets or portfolios produce identical results but sell for different prices. A trader buys the asset or portfolio with the lower price and sells the asset or portfolio with the higher price, generating a net inflow of funds at the start of the holding period.

Because the two assets or portfolios produce identical results, a long positionin one and short position in the other means that at the end of the holding period, the payoffs offset. Therefore, there is no money gained or lost at theend of the holding period, so there is no risk.

解题思路

这道题的意思是,套利是两种资产或投资组合产生相同结果但以不同价格出售时进行的一种交易。交易者以较低的价格购买资产或投资组合,以较高的价格出售资产或投资组合,所以在持有期开始时产生净资金流入。

由于这两个资产或投资组合产生相同的结果,一方的多头头寸和另一头的空头头寸意味着在持有期间结束时,收益抵消。因此,在持有期结束时没有收益或损失的资金,因此没有风险。

易错点分析

这道题目很多同学都会有疑惑,不明白为何会在持有期初有一个净资金流入。总觉得交割之后在持有期末才会有这个现金的流入。还有一些同学会把套利和其他的一些买卖策略所混淆。这里要注意,关于套利有两个关键词:无风险,和不花钱。我们可以根据这个来判断是不是存在套利机会,并不是所有的long short strategy都是代表着套利。

精选问答2

题干

If the net cost of carry of an asset is positive, then the price of a forward contract on that asset is most likely:

A.lower than if the net cost of carry was zero.

B.the same as if the net cost of carry was zero.

C.higher than if the net cost of carry was zero.

答案解析

A is correct.

An asset’s forward price is increased by the future value of any costs and decreased by the future value of any benefits:F0(T)=S0(1+r)T-(γ-θ)(1+r)T.If the net cost of carry (benefits less costs) is positive, the forward priceis lower than if the net cost of carry was zero.

解题思路

对于这道题来说,首先我们要知道远期的定价公式,其次我们要知道net cost ofcarry=benefits-costs。当net cost of carry等于0时,相当于F0(T)=S0(1+r)T;当net cost of carry是positive的即net cost of carry大于零时,此时相当于要多减去(γ-θ)(1+r)T,远期的价格就会变小,小于net cost of carry等于0时的远期价格。所以这道题选A。

易错点分析

有些同学没有弄清楚net cost of carry的概念,会把net cost of carry等同于cost来看。他们觉得远期价格要加上成本减去未来收益,那现在有成本应该加上一块,价格应该更高才对。

概念混淆就会产生这样的理解偏差。还有一些同学没有看清楚题目,题目问的是positive的net cost of carry的远期合约的价格会大于还是小于还是等于net cost of carry等于0时的远期合约的价格,有些同学就会把前后两个比较项弄反了,从而选错答案,这就很可惜了。所以我们在做题的过程中还是要看清题目,圈出关键词,以免因为粗心而丢分。

精选问答3

题干

If the present value of storage costs exceeds the present value of its convenience yield, then the commodity’s forward price is most likely:

A.less than the spot price compounded at the risk-free rate.

B.the same as the spot price compounded at the risk-free rate.

C.higher than the spot price compounded at the risk-free rate.

答案解析

C is correct.

When a commodity’s storage costs exceed its convenience yield benefits, the net costof carry (benefits less costs) is negative. Subtracting this negative amountfrom the spot price compounded at the risk-free rate results in an addition to the compounded spot price.

The result is a commodity forward price which is higher than the spot price compounded. The commodity’s forward price is less than the spot price compounded when the convenience yield benefits exceed the storage costs and the commodity’s forward price is the same as the spot price compounded when the costs equal the benefits.

解题思路

这道题目我们通过公式可以更好地理解。当我们看到题目中的storage cost和convenience yield,就应该条件反射联想到Forward的定价公式:FP=S+Carrying costs-Carrying benefits。因为这道题目说的是现值,我们做一个小小的公式变换:

FP=(St-PV benefit+PV cost)×(1+rf)T=St(1+rf)T+(PV cost-PV benefit)×(1+rf)T

题目说cost的PV大于benefit的PV,所以公式中红色部分就大于0,就可以得到FP大于St(1+rf)^T的答案了。

易错点分析

这道题目有些同学看着题目直接想容易想不明白,看到答案这么长的文字更是一头雾水。还有同学会在现值这一块想不明白,知道FP=S+Carrying costs-Carrying benefits,不知道怎么转换成现值的形式来思考,容易陷入自己的思想误区。

也有同学忘记了convenience yield的概念,没有把它和benefit等同起来。所以对于远期合约定价公式,我们不能只记住表面的公式,还应该对这个公式有更深层次的理解。

精选问答4

题干

When interest rates are constant, futures prices are most likely:

A.less than forward prices.

B.equal to forward prices.

C.greater than forward prices.

答案解析

B is correct.

When interest rates are constant, forwards and futures will likely have the same prices.The price differential will vary with the volatility of interest rates.

In addition, if futures prices and interest rates are uncorrelated, forward and futures prices will be the same.

If futures prices are positively correlatedwith interest rates, futures contracts are more desirable to holders of long positions than are forwards.

This is because rising prices lead to future profits that are reinvested in periods of rising interest rates, and falling prices lead to losses that occur in periods of falling interest rates.

If futures prices are negatively correlated with interest rates, futures contractsare less desirable to holders of long positions than are forwards. The more desirable contract will tend to have the higher price.

解题思路

这道题目问的是当利率是一个常数,期货和远期的价格大小是怎样的。首先我们要知道,为什么远期和期货的价格是有区别的。两者payoff相同,但远期是期末一次性结算,期货是每日结算,每天都有现金流,导致两者的定价会有差异。

利率是一个常数,说明利率大小和标的物的市场价格之间的相关系数为0,此时long position赚钱亏钱跟利率没有什么太大的关系,早拿到钱和晚拿到钱是没有什么差别的,所以此时两者的价格是相等的。

当它们之间的相关系数为positive时,代表利率会随着标的物的市场价格的上涨而上涨,此时long position赚钱,如果提前拿到现金流,就可以再投资出去,因为利率上升的情况下再投资的机会更好,只有期货是可以提前拿到这个现金流的,所以此时期货的价格会高于远期的价格。

反之,当它们之间的相关系数为negative时,代表利率会随着标的物的市场价格的上涨而下跌,此时long position赚钱,但是利率下跌再投资的机会不是很好,所以不希望提前拿到现金流,更希望晚拿到这笔钱,所以此时远期合约的价格会高于期货。

易错点分析

这道题目出错是因为有些同学把constant理解为利率是连续的意思了。所以想半天想不明白。还有同学一直没理清楚这个知识点的逻辑,容易把价格大小记反了。

关于这个知识点李老师在R57的Futures Pricing andValuation中进行了详细的讲解,建议这块有点混淆的同学再去听一下课程哦。只有在理解知识点的基础上我们才能更高效的做题。

精选问答5

题干

Which of statements about European put option is not correct?

A.The value of a European put option is positive correlated with risk-free interest rate.

B.The relationship between the time to expiration and the value of a European put option is not clear.

C.The value of a European put option is positive correlated with the volatility ofthe underlying.

答案解析

A is correct. The value of a European put option will decrease as the risk-free interest rate increases, so they are negative correlated.

解题思路

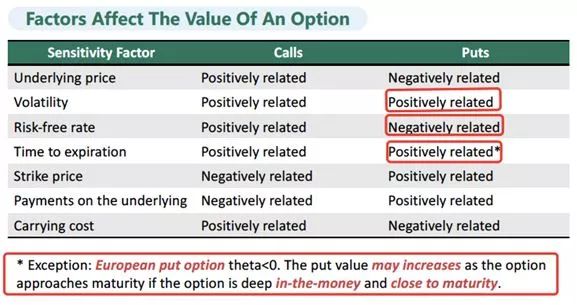

这道题目考察的是影响欧式看跌期权定价的因素。涉及到的部分如下图红框所示:

由表可知,A选项的描述是错误的,B选项和C选项的描述是正确的。但这边要注意一下B选项,欧式看跌期权的价值跟Time to expiration可能是positive,也有可能是negative的。因为看跌期权的收益是有限的(股价最低跌到0),当在到期之前期权是deep in the money,此时又不能提前行权,只能焦急等待赶快到期行权。此时距离到期时间越长,对投资者越不利。

易错点分析

关于这个知识点很多同学会遗漏关于欧式看跌期权的这个特殊情况,只记得关于Time to expiration这个因素对于看涨期权和看跌期权的影响都是positive的,所以觉得B选项也是错误的。所以这一点同学们还是要注意以下。另外这张表也是我们需要记忆的重点,但也希望同学们不要死记,还是要在理解的基础上进行记忆哦。