做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天三级放上风险管理的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

Company A is an oil company in an Asian country. It mainly exports oil to US and the company’s income is closely linkedto the oil price.

Company A’s home country relies heavily on oil exports. Thus, movements in oil prices in US dollars and the US dollar value of the home country’s currency are strongly positively correlated.

A decline in oil prices would reduce the company’s sales in US dollar terms, all else being equal. On the other hand, the appreciation of the home country’scurrency relative to the US dollar would reduce the company’s sales in terms ofthe home currency.

Li, a junior analyst in a risk management firm, wants to know whether the oil company should hedge market risk and currency risk?

The company should hedge currency risk but should not hedge market risk.

The company should hedge market risk and currency risk.

The company should not hedge market risk and currency risk.

答案解析

C is correct.

解题思路

这道题目的传导机制:当油价上升时,美元的利润会上升,但本币升值,换回本币的利润下降了。反之亦然,当油价下降时,美元的利润会下降,但此时本币贬值,换回本币的利润上升了。在这道题目中,market risk和currency risk两者之间存在一个天然的对冲效果。两者均不用hedge。

易错点分析

1.无法厘清传导机制。

2.单独考虑market risk和currency risk是否需要对冲,忽略了彼此之间的天然对冲效果。

精选问答2

问题

Li is a junior analyst in a risk management firm. His supervisor has computed that a portfolio held in the fixed-income department has a 99 percent monthly VaR of $15 million. Regarding the VaR figure, Li wants to know what is meant in terms of a maximum loss?

There is a 99% chance that the department will lose no more than $15 million in one month.

There is a 99% chance that the department will lose at least $15 million in one month.

There is a 1% chance that the department will lose at least $15 million in one month.

解题思路

A is correct.

错误选项集中在B选项。很多同学看到”a 99 percent monthly VaR of $15 million”这句话,误以为15 million左边占总面积的99%。这样就违反了VaR的本质,VaR 代表的是尾部的极端损失,极端损失是小概率事件,不可能占比99%。尾部面积如果占99%,就不是小概率极端损失了。

因此,根据VaR的本质我们可以判断出分位点右边的面积是99%,左边的面积是1%。题目想要我们从最大损失的角度来描述VaR,即有99%的概率损失不会超过15 million,所以选A。

易错点分析

1.没有看清楚描述VaR的方向。

2.错误理解题目表述的意思。

精选问答3

问题

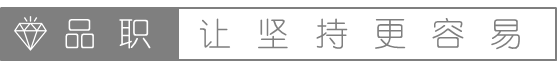

The table below shows the probability distribution of annual returns on a portfolio with a market value of € 20million.

Based on the probability distribution,determine the 1% yearly VaR.

4 million

6 million

8 million

解题思路

选A.

这道题可以数形结合,通过画图辅助我们理解题意。1%的VaR对应的点一定是该点左边的面积为1%。Less than -40%,-40%到-30%,-30%到-20%,这三个区间加总起来的面积是1%,所以第三个区间的右边端点就是分位点,即VaR。

损失30%的点对应的左边面积是0.002+0.002=0.004,不足0.01,而只有损失20%的点对应的左边面积才是0.002+0.002+0.006=0.01达到了1%。图形可以更直观的帮助我们理解题意,遇到此类题目不妨画图。

易错点分析

不知道分位点究竟取-30%还是-20%。

精选问答4

问题

Sue Ellicott supervises the trading function at an asset management firm. In conducting an in-house risk managementtraining session for traders, Ellicott elicits the following statements fromtraders:

Trader 1:"Liquidity risk is not amajor concern for buyers of a security as opposed to sellers."

Trader 2:"In general, derivatives canbe used to substantially reduce the liquidity risk of a security."

Ellicott and the traders then discuss two recent cases of a similar risk exposure in an identical situation that onetrader (Trader A) hedged and another trader (Trader B) assumed as aspeculation.

A participant in the discussion makes the following statementconcerning the contrasting treatment:

Trader 3:"Our traders haveconsiderable experience and expertise in analyzing the risk, and this risk isrelated to our business. Trader B was justified in speculating on the riskwithin the limits of his risk allocation."

State and justify whether each trader’s statement is correct or incorrect.

答案解析

![]() Trader 1’s statement is incorrect. Buyersare concerned about the transaction costs of trades as much as sellers, so asecurity’s liquidity is highly relevant to buyers. In certain cases, such as a short position in a stock with limited float, the liquidity risk for thepurchase side of a trade can be considerable.

Trader 1’s statement is incorrect. Buyersare concerned about the transaction costs of trades as much as sellers, so asecurity’s liquidity is highly relevant to buyers. In certain cases, such as a short position in a stock with limited float, the liquidity risk for thepurchase side of a trade can be considerable.

![]() Trader 2’s statement is incorrect.Derivatives usually do not help in managing liquidity risk because the lack ofliquidity in the spot market typically passes right through to the derivatives market.

Trader 2’s statement is incorrect.Derivatives usually do not help in managing liquidity risk because the lack ofliquidity in the spot market typically passes right through to the derivatives market.

![]() Trader 3’s statement is correct. Businesses need to take risks in areas in which they have expertise and possibly acomparative advantage in order to earn profits. Risk management can entailtaking risk as well as reducing risk.

Trader 3’s statement is correct. Businesses need to take risks in areas in which they have expertise and possibly acomparative advantage in order to earn profits. Risk management can entailtaking risk as well as reducing risk.

解题思路

![]() Trader 1的表述是错误的,双方都存在liquidityrisk,买方担心买不到,卖方担心卖不掉的风险都存在。结合解答中的举例“astock with limited float”来理解。

Trader 1的表述是错误的,双方都存在liquidityrisk,买方担心买不到,卖方担心卖不掉的风险都存在。结合解答中的举例“astock with limited float”来理解。

该股票的流动性不好,short的一方其实是融券的一方,投资者认为股价会跌,所以借来股票将其卖掉换得现金,随后等股价下跌了再在市场是拿着现金把股票买回来然后还回去。那么short的一方需要把股票买回来,但是股票的流动性不好,所以他不一定能买的到。这就面临着liquidityrisk。

![]() Trader 2的表述是错误的,因为如果现货市场流动性较差,就会影响到衍生品市场的流动性。

Trader 2的表述是错误的,因为如果现货市场流动性较差,就会影响到衍生品市场的流动性。

![]() Trader 3:如果trader对于风险控制很有经验,并且风险和从事的行业息息相关,是否可以对风险进行speculation。hedge的目的是要对冲风险,不想承担风险而选择进行对冲。speculation就是主动去承担风险以求更高的回报。所以trader B只要在满足他自己的risk allocation的前提条件下,可以去主动承担风险,因此这句话是对的。

Trader 3:如果trader对于风险控制很有经验,并且风险和从事的行业息息相关,是否可以对风险进行speculation。hedge的目的是要对冲风险,不想承担风险而选择进行对冲。speculation就是主动去承担风险以求更高的回报。所以trader B只要在满足他自己的risk allocation的前提条件下,可以去主动承担风险,因此这句话是对的。

易错点分析

不理解trader 1的表述

精选问答5

问题

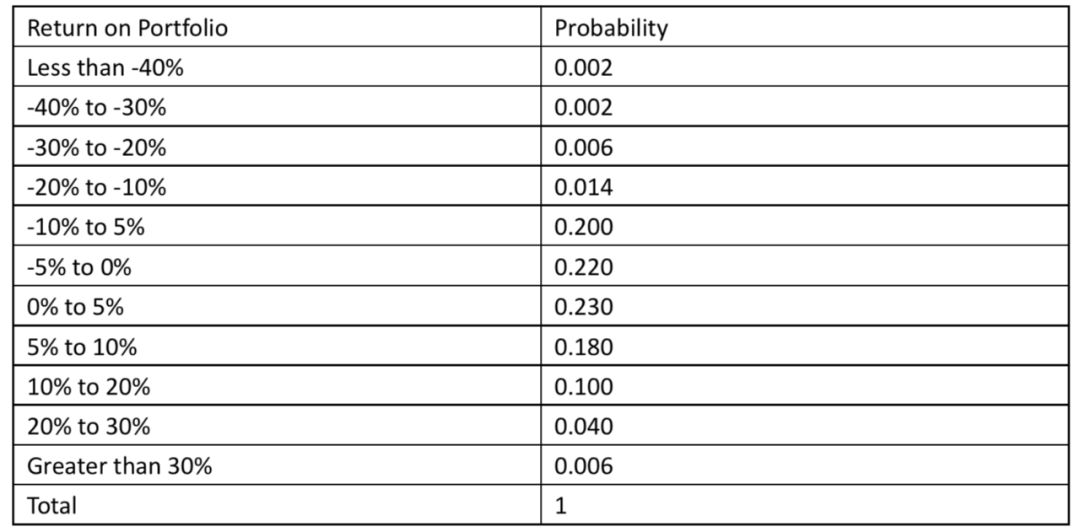

Shephard turns his attention to the loan portfolio. He asks Armstrong, “To which industries does Apollo have substantial loan exposure?” Armstrong indicates Apollo has three in dustry-specific lendingunits and shows him the data contained in Exhibit 1.

Based on the information in Exhibit 1 andassuming Mercury uses the Analytical Method for calculating value at risk,which of Mercury’s industry-specific lending units most likely has the lowestannual VAR?

Based on the information in Exhibit 1 andassuming Mercury uses the Analytical Method for calculating value at risk,which of Mercury’s industry-specific lending units most likely has the lowestannual VAR?

A. Energy

B. Technology

C. Media& Entertainment

答案解析

B is correct. Given the assumptions inExhibit 1 of an expected return of zero, independent daily returns, and a250-day year, annualized VAR = n-day VAR*(250/n)1/2

For Energy, annualized VAR = 300*(250/10)1/2= 1,500

For Technology, annualized VAR =200*(250/5)1/2 = 1,414.21

For Media & Entertainment, annualizedVAR = 100*(250/1)1/2 = 1,581.14

Therefore, Technology has the lowest annualized VAR.

解题思路

我们先将三个VaR的时间进行统一,全部转换成annualized VaR。由于题目中给出expected return=0的条件,所以我们可以通过平方根法则直接转换VaR。分别得到三个行业的annualized VaR:1. Energy(5%):1500;2. Technology(1%):1414.21;3. Media(3%): 1581.14。

然后考虑显著性水平,1414.21代表1%的VaR。试想,如果将这个1%的VaR转换成3%的VaR,那么损失的绝对值一定会变得更小。因为1%比3%更极端,损失的绝对值一定更大。相反,从1%向更高概率去转换,损失的绝对值会得变小。还没有转换的时候已经是绝对值最小的损失了,更不用说转换以后了,因此对应的lowest VaR就是1414.21。

这道题只需要我们进行排序,不需要算出具体的VaR,此外3%显著性水平对应的critical value我们也不知道,因此更不需要转换成具体的数值。

易错点分析

由于不知道3%显著性水平下对应的critical value,所以很多同学觉得无从下手。