做过的题你都能拿分吗?

自昨天千人计划结束以后,很多小伙伴们都在跪求能不能再给次机会啊,这里小编不得不感慨一下,拖延症伤不起啊!每日提醒怎么还有人错过DDL啊!不过,作为一个良心公众号,我们的初衷一直都是尽可能多地帮助更多考生,为此我们特地开启下面的投票,不知道你想不想有CFA千人计划的限时返场呢?

如果小伙伴们呼声很高的话,说不定返场就来啦!毕竟价值千元的男神女神的总复习课,你愿意错过吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几天里,我们会陆续发放的高频问答,希望对大家的备考有所帮助。接下来小编就放上我们教研团队精心整理的CFA一级经济精选问答,希望对大家复习有所帮助哦!

考点一:Breakeven Point

精选问答1

The demand schedule in a perfectly competitive market is given by P=93-1.5Q (for Q≤62)and the long-run cost structure of each company is:

Total cost: 256+2Q+4Q2

Average cost: 256/Q+2+4Q

Marginal cost: 2+8Q

New companies will enter the market at any price greater than:

A 8

B 66

C 81

答案:

B is correct.

The long-run competitive equilibrium occurs where MC=AC=P for each company. Equating MC and AC implies 2+8Q=256/Q+2+4Q.

Solving for Q gives Q=8. Equating MC with price gives P=2+8Q=66. Any price above 66 yields an economic profit because P=MC>AC, so new companies will enter the market.

解题思路

这题主要考察以下两个考点,第一个是是盈亏平衡点(breakeven point)。在完全竞争市场上,P=ATC是厂商的盈亏平衡点。而在P>ATC时,利润会吸引新厂商进入。

第二个考点:单个厂商在完全竞争市场上均衡条件下有P =MR =MC=AC;根据此公式,本题联立MC=AC 即可求出答案。

易错点分析

很多同学都有这样的疑问:为什么不可以联立P=MC或者P=AC直接来求解。那是因为我们算盈亏平衡点时,需要用到单个厂商的需求曲线(一条水平直线),而非整个市场的需求曲线。但是题目中给的需求曲线公式却是整个市场的,因此不可选用。所以本题中均衡条件下的完全竞争市场满足P=AC,所以可直接用MC=AC来计算此题。求解类似题目需要注意区分单个厂商和整个市场的需求曲线。

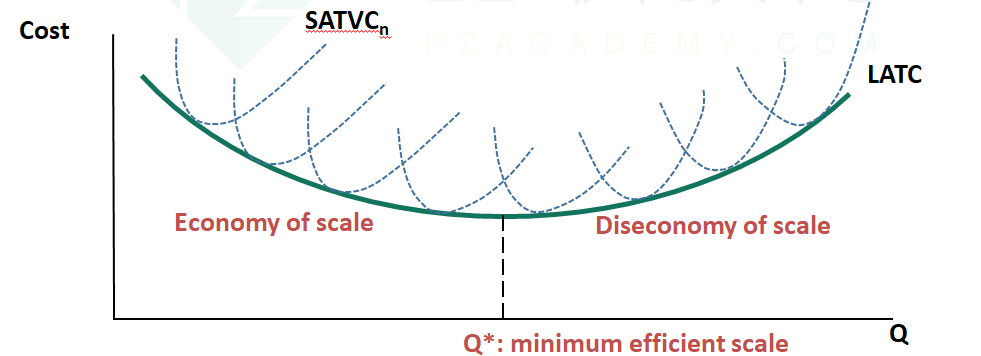

考点二:Economies of Scale

精选问答2:

A firm that increases its quantity produced without any change in per-unit cost is experiencing:

A economies of scale

B diseconomies of scale

C constant returns to scale

答案:

C is correct.

Output increases in the same proportion as input increases occur at constant returns to scale.

解题思路

题目中说到产量增加,“单位成本”不变,这就是指规模报酬不变的意思。换言之,规模报酬不变条件下,成本和产量等比例地增加。

易错点分析

有些同学误选了A。如果题干说随着产出增加, “总成本”不变,那才指是规模经济。因为总产出增加,总成本不变,单位成本必然下降(如下图所示),那么才可以选A选项。所以在做类似题目的时候,大家需要看清题目究竟问的是“单位成本”还是“总成本”。

考点三:Profit Maximum

精选问答3

A profit maximum is least likely to occur when:

A average total cost is minimized

B marginal revenue equals marginal cost

C the difference between total revenue and total cost is maximized

答案:

A is correct.

The quantity at which average total cost is minimized does not necessarily correspond to a profit maximum.

解题思路

Profit=TR-TC;

①当两者之差达到最大值时,说明此时的profit为最大值;

②求导方法,TR'-TC'=0时,此时profit达到最大值,该等式成立的条件即MR=MC。

易错点分析:

这道题不少同学都没有看清least likely,最后选择错误。选择A是因为判断profit大小时,不能单由cost判断,还要考虑revenue和产量。Cost最低的时候,Revenue和产量可能同时比较小,如此总的Revenue就很低,那么厂商能够获得的利润也很低。

考点四:影响LM曲线平移的因素

精选问答4

An increase in the price level would shift the

A IS curve.

B LM curve.

C aggregate demand curve.

答案:

B is correct.

The LM curve represents combinations of income and the interest rate at which the demand for real money balances equals the supply. For a given nominal money supply, an increase in the price level implies a decrease in the real money supply.

To decrease the demand for real money balances, either the interest must increase or income must decrease. Therefore, at each level of the interest rate, income (= expenditure) must decrease—a leftward shift of the LM curve.

解题思路

影响LM的平移的因素就是实际货币供给。实际货币供给=名义货币供给/物价水平。因此,物价水平的改变可以影响LM曲线的平移。

易错点分析

这道题有些同学选择了C选项。C选项中提及的总需求AD曲线,该曲线的横坐标就是物价水平P,因此,物价水平的变动只会引起曲线上的点沿着曲线移动,而非曲线的平移。

此外还需注意到,一国总产出可以表示为Y=C+I+G+(X-M),等式右边第一项消费C和总产出Y有关,第二项投资I和利率水平r有关。那么剩下来的两项政府支出G以及净出口(X-M)便是影响IS曲线平移的因素,这些因素和物价水平没有关系。

考点五:

充分就业时的产出水平。

精选问答5

The full employment, or natural, level of output is best described as:

A the maximum level obtainable with existing resources.

B the level at which all available workers have jobs consistent with their skills.

C a level with a modest, stable pool of unemployed workers transitioning to new jobs.

答案:

C is correct.

At the full employment, or natural, level of output the economy is operating at an efficient and unconstrained level of production.

Companies have enough spare capacity to avoid bottlenecks, and there is a modest, stable pool of unemployed workers (job seekers equal job vacancies) looking for and transitioning into new jobs.

解题思路

充分就业时仍然会存在一部分失业,但是这部分失业是稳定温和的,并且这些失业工人可以通过培训实现再就业。

易错点分析

这道题会有不少同学误选了A选项。A选项暗含了利用所有劳动力的意思,但是我们说充分就业的情况下,依然存在结构性失业以及摩擦性失业。所以相比较C选项,A选项的说法不够准确。

考点六:

target exchange rate

精选问答6

A country that maintains a target exchange rate is most likely to have which outcome when its inflation rate rises above the level of the inflation rate in the target country?

A. An increase in short-term interest rates.

B. An increase in the domestic money supply.

C. An increase in its foreign currency reserves.

答案:

A is correct.

Interest rates are expected to rise to protect the exchange rate target.

解题思路

如果A国盯住B国的汇率,那么A国通胀上涨会导致A国的货币对B国货币贬值。为了阻止A国货币的贬值,A国可以实施一个紧缩的货币政策,从而降低通胀,提升利率水平,吸引外资流入,稳定汇率水平。所以A选项正确。

易错点分析

这道题有不少同学会在C选项上犹豫。如果A国增加自己的外汇储备,就相当于与卖出本国的货币,买进外国的货币。那么大量的本国货币投放如市场,类似于实施了一个扩张的货币政策。这会导致A国汇率降低而不是升高。此外,B选项增加货币供给也是一个扩张的货币政策,它会导致利率水平下降,资本外逃,币值下跌,也不入选。

考点七:Trade restrictions

精选问答7

A large country can:

A benefit by imposing a tariff.

B benefit with an export subsidy.

C not benefit from any trade restriction.

答案:

A is correct.

By definition, a large country is big enough to affect the world price of its imports and exports. A large country can benefit by imposing a tariff if its terms of trade improve by enough to outweigh the welfare loss arising from inefficient allocation of resources.

解题思路

在国际贸易领域,大国对一款产品的需求量占比过高,会对该类产品的世界价格水平产生影响。大国设置关税后会大幅降低全球范围上对于该种商品的需求量,从而导致该种商品世界价格的下降,大国的消费者因此获利。

易错点分析

注意到,国际贸易中的大国并不是指该国国土面积比较大,或者指该国的GDP比较高。而是指该国对某种商品的需求量占比非常高。对于这题,有很多同学会选C选项。既然A选项入选,C选项就错误。对于这个结论,大家可以记忆一下。

考点八:经常性账户与资本流

精选问答8

Because of a sharp decline in real estate values, the household sector has increased the fraction of disposable income that it saves. If output and investment spending remain unchanged, which of the following is most likely correct?

A A decrease in the government deficit.

B A decrease in net exports and increased capital inflow.

C An increase in net exports and increased capital outflow.

答案:

C is correct.

The fundamental relationship among saving, investment, the fiscal balance, and the trade balance is S=I+(G-T)+(X-M). Given the levels of output and investment spending, an increase in saving (reduction in consumption)must be offset by either an increase in the fiscal deficit is not one of the choices, so an increase in net exports and corresponding increase in net capital outflows (increased lending to foreigners and/or increased purchases of assets from foreigners) is the correct response.

解题思路

这题需要运用S=I+(G-T)+(X-M)这个公式。题中说到房地产的价值下降导致增加储蓄。假设投资(I)不变,根据该公式我们可以知道储蓄(S)增加时财政赤字(G-T)和净出口(X-M)会增加。A选项政府赤字下降显然是错误的,B选项的净出口下降也是错误的,因此选择C。

易错点分析

解析中的公式是由总收入=总支出联立得来的。即把C+I+G+X-M=C+S+T转化一下可得S=I+(G-T)+(X-M)。S为储蓄;I为投资;(G-T>0)为财政赤字;(X-M)为净出口。

而此题的capital outflow 表示资本账户外流。进出口代表的是经常性账户,它和资本账户是此消彼长的关系。当进出口增加时,贸易盈余所产生的多余外汇就要到国外市场进行投资,所以资本账户资金外流,这便是net capital outflows。

考点九:利率平价公式

精选问答8

A forward premium indicates:

A an expected increase in demand for the base currency.

B the interest rate is higher in the base currency than in the price currency.

C the interest rate is higher in the price currency than in the base currency.

答案:

C is correct.

To eliminate arbitrage opportunities, the spot exchange rate (S), the forward exchange rate (F), the interest rate in the base currency ( ib) , and the interest rate in the price currency ( ip) must satisfy:

F/S=(1+ip)/(1+ib)

According to this formula, the base currency will trade at forward premium (F > S) if, and only if, the interest rate in the price currency is higher than the interest rate in the base currency (ip) > (ib) .

解题思路

如果汇率标价形式为p/b那么利率平价公式可以写作:F/S=(1+ip)/(1+ib)

根据题意,如果F大于S,那么等式左边大于1,所以等式右边也要大于1。这就要求等式右边分子数值要大于分母数值。那么就意味着标价货币的利率要大于基础货币的利率。所以C选项正确,B选项错误。

易错点分析

有的同学会误选A。基础货币预期的需求量增加,并且其他条件比如基础货币供给不变,才会产生 forward premium。但是其它情况题目中并没有直接说明。所以A选项说法没有C选项好,优选A