做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

小编先来安利一波终极助考神器,那就是传说中的品职喜茶课——千人计划,可能还是有很多人不知道是什么?在这里我们还是要简单介绍一下,就是疗效超神奇的价值千元的FRM一级二级总复习课程,只需要19.9元就可以轻松获取,具体内容可以详见👇的文章。(小编温馨提示一下,截止到5月11号截止哦,拖延症患者们赶紧行动起来)

【限时4天】终极助考神器:品职FRM千人计划已被你成功召唤,翻盘就看这个了!

快速参与通道:如果已经了解本计划的,可以直接扫码回复【FRM千人】获取参与方式。

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天一级放上数量分析的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

Monte Carlo simulation is a widely used technique in solving economic and financial problems. Which of the following statements is not a limitation of the Monte Carlo technique when solving problems of this nature?

选项A

High computational costs arise with complex problems.

选项B

Simulation results are experiment-specific because financial problems are analyzed based on a specific data generating process and set of equations.

选项C

Results of most Monte Carlo experiments are difficult to replicate.

选项D

If the input variables have fat tails, Monte Carlo simulations are not relevant because it always draws random variables from a normally distributed population.

答案解析

A disadvantage of Monte Carlo simulation is that imprecise results may be present when he assumptions of model inputs or data generating process are unrealistic.

The distribution of input variables does not need to be the normal distribution. The problem arises when a variable in the real world is fat-tailed, but a model could erroneously draw option prices from a normal distribution.

解题思路

选择D是因为,蒙特卡洛模拟中的随机变量,并不一定要服从正态分布,是可以根据实际情况,来设定它服从其他分布的。也因此,历史上从未发生的数据,都可以被获取到,解决what if问题。D所说的并不对,因此就不是一个limitation。

还有同学对B选项有疑问:蒙特卡洛模拟的结果(输出),要依赖模拟之前对模型的假设,所以它每一次试验(模拟)都是specific的。所以说对模型的假设、通过这个假设所输入的数据,就会非常重要,影响模拟的结果。所以就比较容易出误差。

易错点分析:

蒙特卡洛模拟中,并不要求变量服从正态分布。

精选问答2

题干

Consider the following linear regression model: Y=a+bX+e. Suppose a=0.05, b=1.2, SD(Y) = 0.26, and SD(e) = 0.1. What is the correlation between X and Y?

选项A

0.923

选项B

0.852

选项C

0.701

选项D

0.462

答案解析

解题思路

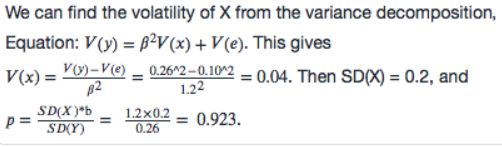

首先通过线性回归式,在两边同取方差,得到解析中第二行的式子,即:

V(y)=V(a+bX+e)=b^2 * V(x)+V(e),所以V(x)=0.04,然后把X的标准差求出:SDx=0.2

最后以下这个公式,即可计算得出相关系数rho。

易错点分析:

考察带有残差项的线性回归算相关系数,本题将线性回归、方差的性质和协方差与相关系数的考点综合在一起考察,稍微有点综合。

精选问答3

题干

A portfolio manager is interested in the systematic risk of a stock portfolio, so he estimates the linear regression: R_p–R_f = α + β * [ R_M –R_f ]+ ε ,where R_p is the return of the portfolio at time t, R_M is the return of the market portfolio at time t, and R_f is the risk-free rate, which is constant over time. Suppose that α = 0.008,β= 0.977, σ( R_p ) = 0.167, and σ( R_M ) = 0.156.

What is the approximate coefficient of determination in this regression?

选项A

0.913

选项B

0.834

选项C

0.977

选项D

0.955

答案解析

the R-squared is given by β^2 * σ_M^2 / σ_P^2 = 0.977^2 × 0.156^2 / 0.167^2 =0.83

解题思路

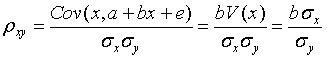

在一元线性回归中,R^2=XY相关系数的平方,而相关系数=b*X的标准差/Y的标准差。把相关系数平方一下,就得到R方了。

即:β=ρ*σp/σm,变形后ρ=β*σm/σp,再等号两边同取平方。

精选问答4

题干

Assume you are using a GARCH model to forecast volatility that you use to calculate the one-day VAR. If volatility is mean reverting, what can you say about the T-day VAR?

选项A

It is less than the T^0.5 × one-day VAR.

选项B

It is equal to T ^0.5× one-day VAR.

选项C

It is greater than the T^0.5 × one-day VAR.

选项D

It could be greater or less than the T^0.5 × one-day VAR

答案解析

If the initial volatility were equal to the long-run volatility, then the T-day VAR could be computed using the square root of time rule, assuming normal distributions.

If the starting volatility were higher, then the T-day VAR should be less than the T ^0.5× one-day VAR.

Conversely, if the starting volatility were lower, then the T-day VAR should be more than the long-run value. However, the question does not indicate the starting point. Hence, answer d. is correct.

解题思路:

波动率是均值回归的。如果初始的波动率=长期波动率,那么因为它有均值回归的特点,之后每天的波动率都等于长期的波动率也就等于现在的波动率,VaR可以使用平方根法则。

但是,如果现在的波动率小于长期波动率,那么根据均值回归的特点,它之后的波动率会慢慢回归,也就是要变大。波动率要慢慢变大,那么VaR也就要慢慢变大。就会大于最开始的VaR乘上根号n。

反之,也是一样的道理。

易错点分析

要分清波动率均值回归还是return均值回归。

如果是价格的均值回归,也就是说随着时间的推移,它价格越来越回归到长期均值水平,那么它的波动率就会越来越小。

精选问答5

题干

Consider two stocks, A and B. Assume their annual returns are jointly normally distributed, the marginal distribution of each stock has mean 2% and standard deviation 10%, and the correlation is 0.9. What is the expected annual return of stock A if the annual return of stock B is 3%?

选项A

2%

选项B

2.9%

选项C

4.7%

选项D

1.1%

答案解析

The information in this question can be used to construct a regression model of A on B. We have R A =2% + 0.9*( 10%/10% )*( R_B −2% ) + ε . Next, replacing R_B by 3% gives R_A = 2% + 0.9*(3% - 2%) = 2.9%.

解题思路:

何老师在课上有讲过这种题型,是应该用线性回归来做。当时用的是Y=a+bX+随机项ε这一形式。这个形式和本题解析只是形式上的区别。

本题把2%移到等式左边,就相当于是用Ra-2%=β(Rb-2%)+随机项 来做回归(这形式有点像单因素模型那的回归)。

如果用Ra=a+β*Rb+随机项ε 来做回归,截距项就是0.2%。

因为Ra-2%=β(Rb-2%)+随机项,也就是本题的回归Ra=2%+β(Rb-2%)+随机项中,β(Rb-2%)里,-2%*β=-1.8%,把它开出来和2%相加,就变成0.2%,也就是何老师上课讲的形式。

易错点分析:

求这种条件期望时,可以转化成线性回归的形式来做。

精选问答6

题干

An analyst calculates the sum of squared residuals and total sum of squares from a multiple regression with four independent variables to be 4,320 and 9,105, respectively. There are 65 observations in the sample.

The critical F- value for testing H0 = B1 = B2 = B3 = B4 = 0 vs. HA: at least one Bj ≠ 0 at the 5% significance level is closest to:

选项A

2.37.

选项B

2.53.

选项C

2.76.

选项D

3.24.

答案解析

This is a one-tailed test, so the critical F-value at the 5% significance level with 4 and 60 degrees of freedom is approximately 2.53.

解题思路:

1、因为是联合检验H0=B1=B2=...=0,所以用F-test。

2、F-test的自由度是一对数字:前一个数字,因为four independent variables (k),所以是4,后一个数字=n-k-1=65-4-1=60 (65 observations, 4 independent variable)。

3、最后去查F(4,60),得到2.53 (只需要你判断出要求的是F(4,60),之后就可以查表了。考试是是给你几个F(a,b)的值,让你选)。并且注意,F检验是单尾检验,而不是双尾。