做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

距离考试还有8天,还没复习完一轮的FRM一级考生小明去寺庙拜见大师求指引。

小明问:大师我的一级还有救吗?看不完呀!

大师伸出了一根食指☝️,接着比出了✌️,最后摆了下👋。

小明说:您的意思是这个时候一定要一心备考,心存胜念,不要慌是吗?

大师敲了下小明的头:

我是说看一下⬇️品职的海报,☝️一级✌️两倍速👋 5小时能看完,还不抓紧抱佛脚参加!

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天一级放上估值与风险建模的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

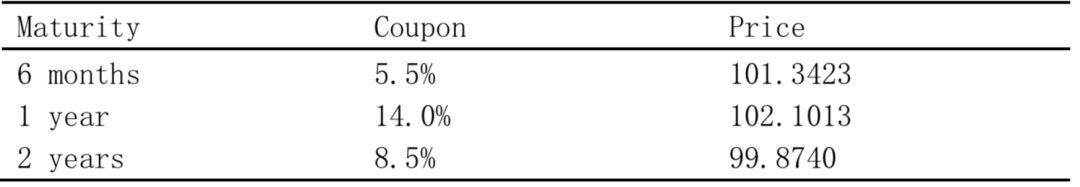

Which of the following is the closest to the discount factor for d(0.5)?

选项A:0.8923

选项B:0.9304

选项C:0.9525

选项D:0.9863

答案解析

101.3423=102.75d(0.5) d(0.5)=0.9863

解题思路

对于为期六个月,年利率为5.5%的债券,现金流仅仅在6个月末发生,本金为100,利息为100*5.5%/2=2.75,用现金流折现等于价格计算d(0.5),即答案中的式子101.3423=102.75*d(0.5)

精选问答2

题干

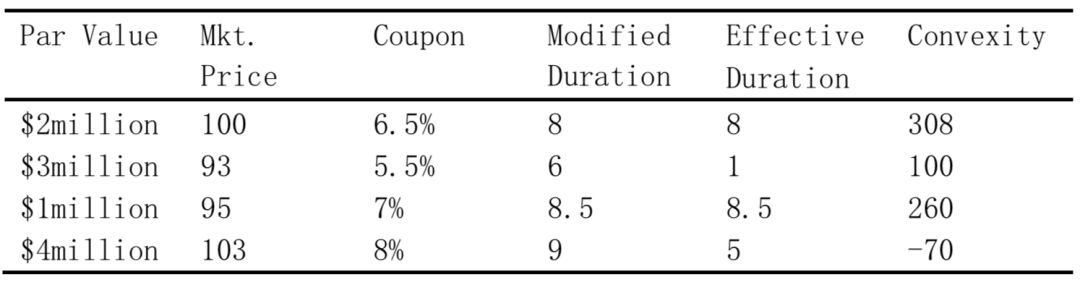

A bond dealer provides the following selected information on a portfolio of fixed-income securities.

What is the price value of a basis point for this portfolio?

选项A:$5,551.18

选项B:$7,026.60

选项C:$3,234.08

选项D:$4,742.66

答案解析

D Price value of a basis point be calculated using effective duration for the portfolio and the portfolio's market value, together with a yield change of 0.01 %. Convexity be ignored for such a small change in yield.4.81x 0.0001 x 9,860,000 = $4,742.66

解题思路

易错点分析:首先要分辨出2,4是含权债:正常的普通债券,它们的久期与有效久期应该是相同的,至少相差的不会这么大。尤其是债券4,更明显了,因为它的凸度都是负的。比如说callable bond,它的凸度就有一段是呈负的。

因为有含权债,所以用effective duration以market value为权重,加权平均求得。

精选问答3

题干

A portfolio consists of two zero-coupon bonds, each witha current value of $10. The first bond has a modified duration of one year andthe second has a modified duration of nine years. The yield curve is flat, andall yields are 5%.

Assume all moves of the yield curve are parallel shifts.Given that the daily volatility of the yield is 1%, which of the following isthe best estimate of the portfolio’s daily value at risk (VAR) at the 95% confidence level?

选项A:USD 1.65

选项B:USD 2.33

选项C:USD 1.16

选项D:USD 0.82

答案解析

ANSWER: A

The dollar duration of the portfolio is1. Multiplied by 0.01 and 1.65, this gives $1.65.

解题思路

本题中,利率的daily volatility是1%,即它首先求出了利率变动的VaR,又因为债券组合的价格跟利率是相关的,所以通过久期把债券价格和利率变化关联起来,债券价格的VaR,可以通过利率变动的VaR*债券组合的价格和久期,来计算得到。

精选问答4

题干

The duration of a portfolio can be computed as the sum of the value-weighted durations of the bonds in the portfolio. Which of the following is the most limiting assumption of this methodology?

选项A

All the bonds in the portfoliomust change by the same yield.

选项B

The yields on all the bonds in the portfolio must be perfectly correlated.

选项C

All the bonds in the portfolio must be in the same risk class or along the same yield curve.

选项D

The portfolio must be equally weighted.

答案解析

选B.

A significant problem with using portfolio duration is that it assumes all yields for every bond in the portfolio are perfectly correlated. However, it is unlikely that yields across nationalborders are perfectly correlated.

解题思路:

组合的duration等于组合里所有债券duration的加权平均,这一公式成立的基础是所有债券的收益率曲线是共有的,或者说所有债券的收益率曲线变化相同。这个假设很难成立,比如一个组合里包含多国度的公司债和政府债。国家不同,利率变动不一样,而且公司债和国债的收益率曲线变动也很难完全一致。

A选项:Duration是衡量yield变动一个单位,债券价格变动多少的。portfolio duration也是这么计算得来的。所以A是计算portfolioduration的先决条件,不是缺点。

C选项错在:即使这些债券同在一个riskclass,有着相同的收益率曲线,但是不能保证在利率变化的时候,他们自己的收益率完全同增同减。不能同增同减的时候duration的加权平均就会不准确。

精选问答5

题干

When using the Monte Carlo approach to estimate the value of mortgage-backed securities (MBSs), the model should:

选项A

use one consistent volatility measure for all interest rate paths.

选项B

use a short/long yield volatility approach.

选项C

use annual interest rates over the entire life of the mortgage security.

选项D

ignore the distribution of the interest rate paths used to determine the the oretical value.

答案解析

B is correct.

When using the Monte Carlo approach to estimate the value of MBSs, the model should use more than one volatility measure for all interest rate paths.

It is very common to use a short/ longyield volatility approach to estimate monthly rates. Although the information regarding the distributions of interest rate paths is oftentimes ignored, itcontains valuable information and should be considered.

解题思路:

本题中的short/long yield volatility approach,就是在用蒙特卡洛模拟对MBS进行估值的建模过程中,对短期设定一个volatility,然后对长期再设定一个不同的volatility,并且一般而言短期的波动率要比长期的波动率更大。这也符合市场实际情况。

精选问答6

题干

Which of the following is the closest tothe discount factor for d(1.0)?

选项A:0.8897

选项B:0.9394

选项C:0.9525

选项D:0.9746

答案解析

选A.

102.1013=7d(0.5)+107d(1)

102.1013=7(0.9863)+107d(1)

95.1972=107d(1)

d(1)=0.8897

解题思路:

这题本质还是利用债券的未来现金流量用折现因子折现等于价值来做的。半年的折现因子d(0.5)可以用第一个债券来算,

101.3423=102.75*d(0.5),d(0.5)=0.9863。一年的折现因子d(1)可以用第二个债券来算,102.1013=7*d(0.5)+107d(1),d(0.5)已经通过第一个债券求得,代入求解得到d(1)=0.8897。

精选问答7

题干

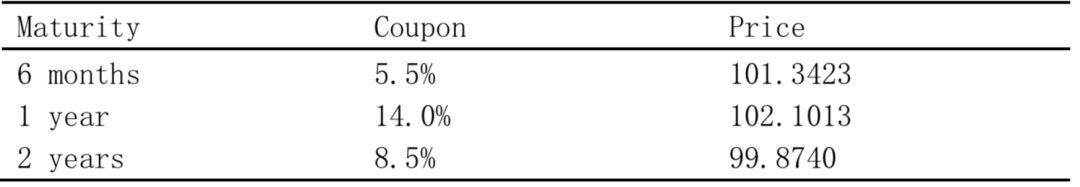

Given the following bonds and forward rates

1-year forward rate one year from today=9.56%

1-year forward rate two years from today=10.77%

2-year forward rate one year from today=11.32%

Which of the following statements about theforward rates, based on the bond prices, is true?

选项A

The 1-year forward rate one yearfrom today is too low.

选项B

The 2-year forward rate one yearfrom today is too high.

选项C

The 1-year forward rate two yearsfrom today is too low.

选项D

The forward rates and bond pricesprovide no opportunities for arbitrage.

答案解析

选C.

Given the bond spot rates on the zero-coupon bonds, the appropriate forward rates should be:

1-year forward rate one year from today= 9.56%

1-year forward rate two years from today= 13.11%

2-year forward rate one year from today=11.32%

The 1-year forward rate two years fromtoday is too low.

解题思路:

这题首先要理解forward的表述方式:比如说2year forwardrate one year from today 就是一年以后开始的,为期两年的远期利率。 in 1 year 就相当于是一年以后。

计算方法来说拿1-year forward rate two years from today举例就是:[(1+0.09)^3/(1+0.07)^2]-1=13.11%。

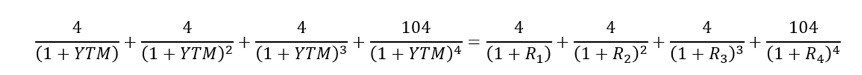

还有同学问到把YTM换成spot rate的情况,如果对于零息债券来说,其实是等价的。对于支付coupon的bond,每一期的CF,用ytm折现的话,那每一期都是用相同的ytm;如果是用spot rate折现,那就是用第i年的spot rare_i来折现,即除以(1+ spot rate_i)^i。假设债券是合理定价的,即其交易价格等于理论价格,那么债券的现金流用YTM折现,和用Spot rate折现得到的值相等:

我们可以发现,YTM是Spot rate某种程度上的平均值,所以YTM一定是小于Spot rate最大值,大于Spot rate最小值的。