做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

距离考试还有8天,还没复习完一轮的FRM一级考生小明去寺庙拜见大师求指引。

小明问:大师我的一级还有救吗?看不完呀!

大师伸出了一根食指☝️,接着比出了✌️,最后摆了下👋。

小明说:您的意思是这个时候一定要一心备考,心存胜念,不要慌是吗?

大师敲了下小明的头:

我是说看一下⬇️品职的海报,☝️一级✌️两倍速👋 5小时能看完,还不抓紧抱佛脚参加!

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

临近考试,大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天二级放上信用风险的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

A three-year credit-linked note (CLN) with underlying company Z has a LIBOR+60bp semiannual coupon. The face value of the CLN is USD100. LIBOR is 5% for all maturities. The current three-year CDS spread forcompany Z is 90bp. The fair value of the CLN is closest to

选项A: USD100.00

选项B: USD111.05

选项C: USD101.65

选项D: USD99.19

答案解析

ANSWER: D

Because the current CDS spread is greater than the coupon, the CLN must be selling at a discount. The only solution is d.More precisely, we can use the spread duration from Equation: which is the sum of the present value factor over three years. Assuming a flat termstructure this is years. Multiplying by (90-60) = 30bp gives afall of 0.81% which gives $99.19.

考点解析:

这题首先是历史背景情况,当时科技股全在大涨,相对于大盘有更高的收益,即return drift upward,因此要对漂移进行处理,否则这时候会计量的var会小。assuming zero drift就是不对漂移做处理。

解题思路

首先这题里的CLN是一个note,也就是一个债券,求的是债券的fair value。按照答案的解析做法:先计算利差久期,spreadduration=1/1.05+1/1.05^2+1/1.05^3=2.72,乘以spread的差额90-60=30bps,2.72*0.3%=0.81%,因为折价,所以是100*(1-0.81%)=99.19

另外一个更容易理解的方法:这个债券现在的现金流是6笔,2.8,2.8,2.8,2.8,2.8,102.8。

题目说真实的spread是5%+90bps=5.9%,直接按这个折现率折现(rate=2.95%,N=6,pmt=2.8,fv=100)得到PV=99.19。

精选问答2

题干

A risk analyst seeks to find out the credit-linked yield spread on a BB-rated one-year coupon bond issued by a multinational petroleum company. If the prevailing annual risk-free rate is 3%, the default rate for BB-rated bonds is 7%, and the loss given default is 60%, then the yield tomaturity of the bond is

选项A: 2.57%

选项B: 5.90%

选项C: 7.45%

选项D: 7.52%

答案解析

解题思路

frm由于是邀题制,所以题目会有或多或少的不规范或者近似的情况,其中对coupon和rf这些数据省略和近似的情况比较多,这时候需要揣度一下出题人的意思,本题的原理其实就是右边在分子上显示风险,左边在分母上显示风险,两边结果等值。

也就是左边:1/(1+ytm)YTM显示风险;

右边:(1-7%*60%) / (1+rf)分子上显示风险

两边相等求出YTM。

精选问答3

题干

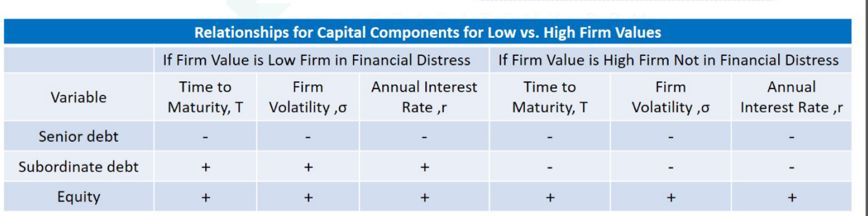

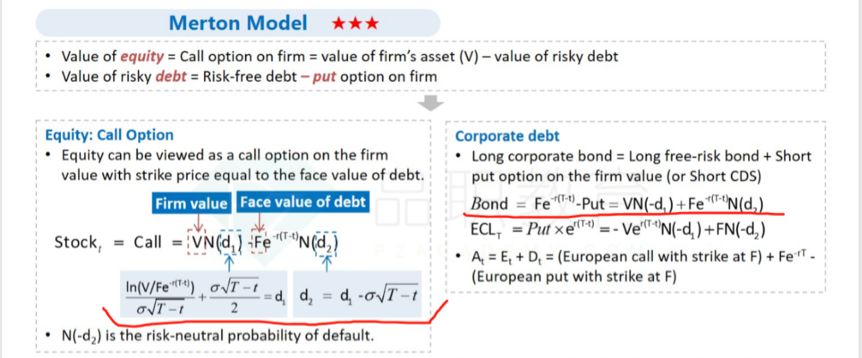

You have a large position of bonds of firm XYZ. You hedge these bonds with equity using Merton’s debt valuation model. The value of the debt falls unexpectedly, but the value of equity does not fall, so you make aloss. Consider the following statements:

I. Interest rates increased.

II. Volatility fell.

III. Volatility increased.

IV. A liquidity crisis increased the liquidity component of the credit spreads.

Which statements are possible explanations for why your hedge did not work out?

选项A:I and II only

选项B:I and III only

选项C: I, III, and IV only

选项D: Ill and IV only

答案解析

ANSWER: B

We need to identify shocks that decrease the value of debt but not that of equity. An increase in the risk-free rate will decrease the value of the debt but not the equity (because this decreases leverage).

An increase in volatility will have the opposite effect on debt and equity. Finally, a liquidity crisis cannot explain the divergent behavior,because, as we have seen during 2008, it would affect both corporate bonds and equity adversely. Answers I and III are correct.

解题思路

1、本题是通过卖股票来对冲,也就是说它的投资组合将是 long bonds + short equity. 当债券价格下跌时,只要equity价格跟着下跌,那么就可以通过short equity来赚钱,cover部分或者全部的损失。

2、volatility上升的时候equity value increase, debt decrease,这样一来他的投资组合正好全亏,所以hedge doesn't work。

精选问答4

题干

Consider the following information. You have purchased 10,000 barrels of oil for delivery in one year at a price of $25/barrel.

The rate of change of the price of oil is assumed to be normally distributed with zero mean and annual volatility of 30%.

Margin is to be paid within two days ifthe credit exposure becomes greater than $50,000. There are 252 business days in the year.

Assuming enforceability of the margin agreement, which of thefollowing is the closest number to the 95% one-year credit risk of this dealgoverned under the margining agreement?

选项A: USD50,000

选项B: USD58,000

选项C: USD61,000

选项D: USD123,000

答案解析

ANSWER: C

The worst credit exposure is the $50,000 plus the worst move over two days at the 95% level. The worst potential moveis . Applied to the position worth $250,000, this gives a worst move of $10,991. Adding this to $50,000 gives $60,991.

解题思路

这里其实也算是求VaR了,只不过求的是变化价格的VaR。因为题目里说,the rate ofchange of the price服从正态分布 N(0,30%),所以1.645*30%*根号下2/252再乘总头寸,这就是95%下的价格变动的VaR。

精选问答5

题干

Which one of the following deals would have the greatest credit exposure for a $1,000,000 deal size (assume the counterparty in each dealis an AAA-rated bank and has no settlement risk)?

选项A

Pay fixed in an Australian dollar(AUD) interest rate swap for one year.

选项B

Sell USD against AUD in aone-year forward foreign exchange contract.

选项C

Sell a one-year AUD cap.

选项D

Purchase a one-year certificateof deposit (CD).

答案解析

ANSWER: D

The CD has the whole notional at risk.Otherwise, the next greatest exposures are for the forward currency contractand the interest rate swap. The short cap position has no exposure if thepremium has been collected. Note that the question eliminates settlement riskfor the forward contract.

解题思路:

A选项,在利率互换协议中,无需交换本金,只需定期交换利息差额,所以敞口不大;

B选项,在远期外汇市场,按规定好的汇率将美元换成澳元。同样,在到期进行交割时,是不用对名义本金进行交割的。只交割远期汇率与当时的即期汇率之间的差额。所以其风险敞口跟A选项类似;

C选项,cap的作用是在利率互换中,防止浮动利率超过一个限定的值,这个值可以认作是cap,相当于是防止利率过于上升的一种权利。卖cap这个过程中,投资者得到premium、收到钱后,那么也就没有credit exposure了;

D选项,是存款的意思,到期时银行将本金一次性交还给投资者。所以有最大的credit exposure。(注意这不是EAD)

精选问答6

题干

A bank has booked a loan with total commitment of $50,000 of which 80% is currently outstanding. The default probability of the loan is assumed to be 2% for the next year and loss given default (LGD) is estimated at 50%.

The standard deviation of LGD is 40%. Drawdown on default (i.e., thefraction of the undrawn loan) is assumed to be 60%. The expected and unexpectedlosses (standard deviation) for the bank are

选项A

Expected loss = $500, unexpectedloss = $4,140

选项B

Expected loss = $500, unexpectedloss = $3,220

选项C

Expected loss = $460, unexpectedloss = $3,220

选项D

Expected loss = $460, unexpectedloss = $4,140

答案解析

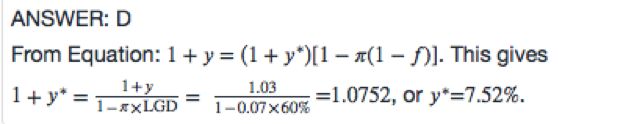

ANSWER: D

First, we compute the exposure at default.This is the drawn amount, or plus the drawdown on default, whichis , for a total of CE= $46,000.

The expected loss is this amounttimes or EL = $460. Next, we compute the standarddeviation of losses using Equation; Taking thesquare root gives 0.090. Multiplying by $46,000 gives $4,140.Ignoring gives the incorrect answer of $3,220. Note that the unexpected loss is much greater than the expected loss.

解题思路:

这道题首先是考了EAD的计算,就是已经贷款出去的部分drawn amount也就是40000,还要加上剩余部分drawn down的部分也就是10000*60%。

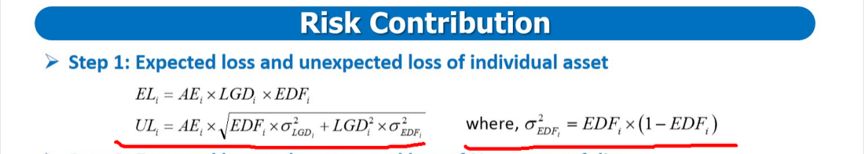

其次,考了一个一级也出现过的公式,虽然在二级没有在一级时候那么重要,但是还是需要牢记的,见下图:

精选问答7

题干

You are given the following information about a firm. The market value of assets at time 0 is 1,000; at time 1 is 1,200. Short-term debtis 500; long-term debt is 300. The annualized asset volatility is 10%.According to the KMV model, what are the default point and the distance todefault at time 1?

选项A:800 and 3.33

选项B: 650 and 7.50

选项C:650 and 4.58

选项D:500 and 5.83

答案解析

ANSWER: C

The default point is given by short-termliabilities plus half of long-term liabilities, which is 500+300/2=650 .The distance to default at point 1 is (1200-650)/(1200*0.1)=4.58.

解题思路:

这题提问的都是套用公式时出现的差错,首先这题没有ROA的情况下就要用(A-K)/ σA这个公式了。其次英文解析中有同学问为什么要乘以1200是因为要算波动率,题目中给的波动率是10%。因为要除以的波动率是绝对数值,而不是百分比数。

精选问答8

题干

Assume that a bank enters into a USD 100 million, four-year annual-pay interest rate swap, where the bank receives 6% fixedagainst 12-month LIBOR. Which of the following numbers best approximates the current exposure at the end of year 1 if the swap rate declines 125 basispoints over the year?

选项A:USD 3,420,069

选项B:USD 4,458,300

选项C:USD 3,341,265

选项D:USD 4,331,382

答案解析

ANSWER: A

The value of the fixed-rate bond is Subtracting $100 for the floating leg gives an exposure of $3.4 million. Moreintuitively, the sum of the coupon difference is 3 times , or around $3.75 million without discounting.

解题思路:

因为利率互换本身就是固定浮动两端的差额,以本题为例:swap的价值是收固定端的价值减付浮动端的价值,(利率互换不交换本金是因为交换的金额一样无意义,并不代表本金不代表价值)。答案的方法是从基础原理考虑的算法。当然按照变换的利差也可以算,就是3个1.25以4.75%折现。

精选问答9

题干

Which of the following is true about predatory lending and predatory borrowing?

选项A

Both underprovide credit.

选项B

Both overprovide credit.

选项C

Predatory lending underprovidescredit and predatory borrowing overprovides credit.

选项D

Predatory lending overprovidescredit and predatory borrowing underprovides credit.

答案解析

选B.

Predatory borrowing is when the borrower misrepresents themselves to obtain credit they otherwise would be denied.Predatory lending is providing credit that is welfare decreasing and should notbe provided.

解题思路:

这题主要说的是银行这类借贷机构的掠夺性借款贷款,比如次贷危机前。通过误导借款方和贷款方把钱融进来或者贷出去,这样不匹配借款者或者贷款者的信用情况,相当于“多提供了信用”。overprovide就是相对于客户的实际情况多提供了信用。

配图来源网络