做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天三级放上经济学的错题本,大家一起来看看这些题都会做吗?

精选问答1:风险溢价方法

题干

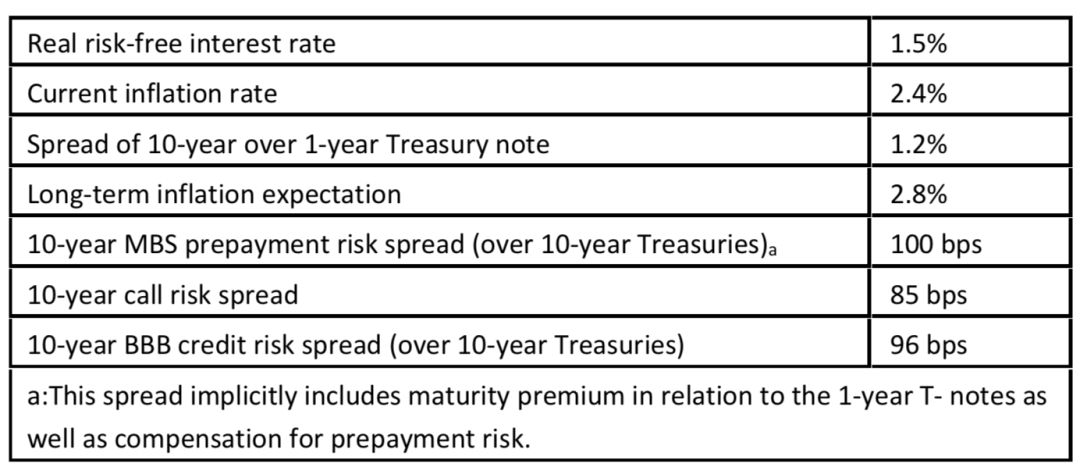

Stanford has an international fixed income portfolio. Recently he wants to diversify his portfolio by considering that add three new securities as follows:

1-year US Treasury note (noncallable)

10-year BBB/Baa rated corporate bond (callable);

10-year mortgage-backed security (MBS) which is back by government.

Only when the expected spread/premium of the equally weighted investment is at least0.6 percent (60 bps) over the 10-year Treasury bond, will Stanford add theinvestments. Stanford has gathered some information as follows:

Will Stanford add these three bonds?

解题思路

首先我们计算一下被考虑加入新组合中的三类债券各自的spread。

相比较于10-year treasury bond,1-year us treasury note (noncallable)的spread为0-1.2%=-1.2%

相比较于10-year treasury bond,10-year bbb/baa rated corporate bond (callable)的spread为0.96%(credit spread)+0.85%(call riskspread)=1.81%

相比较于10-year treasury bond,10-year mortgage-backed security (mbs) (government-backed collateral)的spread为1%-1.2%(prepaymentrisk spread)=-0.2%

注意,表格中a注释已经说明,prepayment risk spread的1%里已经包含了对1-year t- note的期限溢价。

而10-year treasury bond,10-yearmbs这两种债券都是10年其(都有对于1年期债券的期限溢价1.2%),所以相对于10-year treasury bond,要把10-year mortgage-backed security的期限溢价1.2%扣去。

接着考虑到这三类证券是被等额投资的。所以我们将其取平均就得到最终的spread ,即:(-1.2% +1.81%-0.2%)/3 = 0.14%

相比较于10-year treasury bond,新投资的spread只比其高出 0.14% <60bps ,因此stanford不会做出新增债券的投资。

易错点分析

表格注释中的1%里已经包含了期限溢价,所以计算时要特别留心。注意到之所以会产生prepayment risk,很大一部分原因也是和期限风险有关的。假设这份结构化债券的期限非常短,比如明天到期,那么也不会存在prepayment risk。所以题目中给出了这个小a注释,这本身也是合情合理的。

精选问答2:GK模型

题干

Robert Spencer is a market forecaster with Windsor Investment Management, a U.K.-basedwealth management firm.

Spencer is asked to review the current economic conditions and market outlook for the U.K. andto set long-term market return expectations for domestic equities.

These expectations will form the basis of Windsor’s future client asset allocations.Spencer gathers the U.K. capital market data:

Dividend yield is 4.0%

Equity repurchase yield is -0.5%

Using the information above and the Grinold-Kroner model, calculate the Income return?

答案解析

Income return is the sum of the dividend yield (i.e., D/P, which is 4.0%) and the equity repurchase yield (i.e., the negative of the expected change in share soutstanding, - ∆S) which is -0.5%. Therefore: Income return = D/P - ∆S = 4.0 - 0.5 = 3.5%

解题思路

Income return等于dividend yield与repurchase yield之和

本题中,repurchase yield 是等于“-δS”,而不是“δS”,所以直接带入0.5%得到D/P+ (- ∆S)= 4.0 +(- 0.5) = 3.5%

易错点分析

因为“δS”本身代表了公司在外发行的股票数目的变化。如果它是个正数,表明在外发行的股票数增加,那么因此稀释了个股收益,所以repurchase yield就是个负数。如果“δS”是个负数,表明公司在外发行的股票数减少,因此增加了个股的收益,所以repurchase yield就是个正数。

精选问答3:Tobin’sq

题干

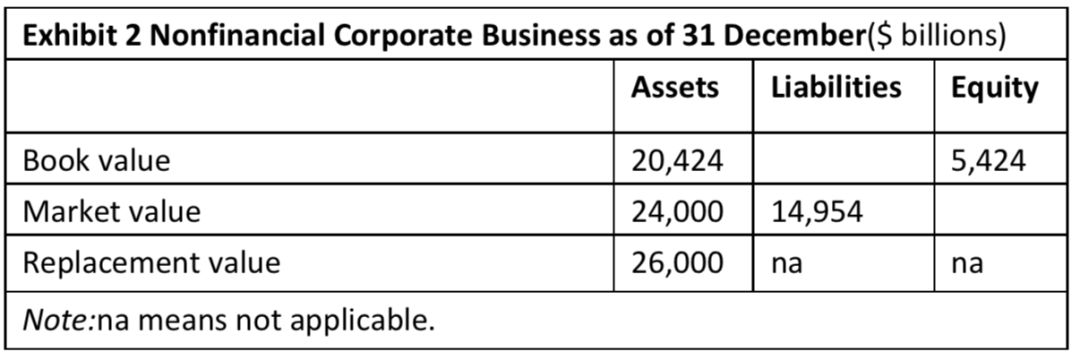

Sorenson decides to calculate Tobin’s q and determine the relative value of the market assuming an equilibrium level ofapproximately 1.0. Exhibit 2 provides partial information about the US economy that will be useful in her analysis.

Based on the data in Exhibit 2 and the calculation of Tobin's q, the market is best described as:

选项A:undervalued

选项B: fairly valued

选项C:overvalued

答案解析

A is correct.

Tobin's q is calculated as follows: (Liabilities at market value + Equitiesat market value) ÷ Assets at replacement cost(14,954 + 9,046) ÷ 26,000 = 0.92

With a Tobin's q less than 1.0, the market would be considered undervalued.

解题思路

教材中,关于Tobin’s q公式的分母给出的表述形式为“Assets at Market Value or Replacement Cost”。本质上分母的含义就应该是“replacement cost”——重置成本。

但是因为这个重置成本很难估计,所以实务中才会用Assets at Market Value作为其替代。所以这两个说法的数据都可以作为分母使用。

易错点分析

就这道题目而言,还是优选“replacement cost”的数据作为分母,因为它代表了分母的真正的含义。并且题目中并没有给我们关于该公司股权以及债务的市值,所以这里的Market value 是要作为Tobin’s q 公式的分子进行使用。

精选问答4:利用经济信息预测收益

题干

Analyst Bob is studying the economy of A country. The 1-month rates and 1-year ratesbetween Jan 20X6 and March 20X7 are shown in the following table, and also thespreads between the two rates are given:

Which choice is more favorable for investors?

Option1: buying a 1-year security and then rolling that security over each year at thethen-prevailing yield.

Option2: buying a 1-month Eurodollar security and then rolling that security over eachmonth at the then-prevailing yield, from 1 March 20X6 to 1 March 20X7.

选项A:Option 2

选项B:Option 1

选项C:Uncertain

答案解析

B is correct.

解题思路

通过观察上表,我们不难发现长期利率( 1-Year Rates )与短期利率(3-Month Rates)是差额由大变小,由正转负,并且长期短期利率最终都下降了,那表明经济开始下滑,债券的价格最终会上升。那么此时我们扩大债券的久期就可以增加投资的投资回报。那么投资者就应该选择第一种投资方式。

易错点分析

注意到,前期利率在高位波动不需要过多关注。因为想要锁定一个比较高的利率水平,只能在利率下跌之前锁定,利率下跌之后就无法锁定了。所以预期到利率最终将要下跌,就应该在利率下跌前开始锁定住较高的利率水平。

精选问答5:

题干

Schmidt says that his company’s objective is to accumulate sufficient assets to fulfillthe firm’s obligations under its long-term insurance and annuity contracts.

For competitive reasons, the company wants to quickly detect significant cyclicalturns in equity markets and to minimize tracking errors with respect to theequity index.

Schmidt asks Carmichael to identify the forecasting approach thatis most appropriate.

Carmichael’s best answer to Schmidt’s question about a recommendedforecasting approach is to use:

选项A: a top-down approach.

选项B:a bottom-up approach.

选项C:both top-down andbottom-up approaches.

答案解析

C is correct.

On the one hand, because the insurance company wants to minimize tracking errors with respect to the equity indexes, Carmichael should recommend the top-down approach because the forecast does not need to focus on individual security selection.

On the other hand, because the insurance company wants to detect quickly any significant turn in equity markets,

Carmichael should recommend thebottom-up approach because the bottom-up approach can be effective inanticipating cyclical turning points.

解题思路

判别经济周期的变化是bottom-up方法的优势,因为top-down通常是用model和历史数据来分析宏观经济,这一过程就会造成滞后性。而bottom-up方法从分析个股以及企业着手,企业家是对经济周期很敏感的一群人,会先于经济周期调整存货,所以通过分析企业能提前甄别经济周期的变化。

与此同时,该公司还希望最小化与股指的trackingerrors,那么也要考虑宏观经济的影响,所以top-down的方法也是必要的。

易错点分析

此外,关于两者方法的比较,我们还需要知道以下小结论:

对于macro hedge fund manager,他更应该使用“top-down”的方法。而对于active manager,他更应该使用“bottom-up”的方法。

如果分析师认为经济即将发生转折,那么他应该使用“bottom-up”的方法。而如果分析师认为公司的变化滞后于当前经济形势的发展,那么他应该使用“top- down”的方法。