做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

为了帮助小伙伴们做到错过的题不再错,我们也是推出了错题本系列文章,

今年我们针对CFA一级升级加码,精选了3个学科从有问必答选题,每个学科提取高频共性问题给大家直播讲解,希望让大家在考试中多拿几分。

本期的直播间将在5.20(下周一)准时开启,直播详情如下:

![]() 直播科目:Fixed Income(CFA一级)占比11%

直播科目:Fixed Income(CFA一级)占比11%

![]() 直播讲师:品职教研组

直播讲师:品职教研组

![]() 直播时间:2019.5.20 北京时间 19:00-20:30

直播时间:2019.5.20 北京时间 19:00-20:30

![]() 直播内容:精选问题解析、易错点分析。

直播内容:精选问题解析、易错点分析。

![]() 彩蛋:我们会提供半小时互动答疑时间,直播前我们会提前收集大家的问题,群内同学可以针对本科目考点范围提问,讲师会精选一些问题给大家解答。

彩蛋:我们会提供半小时互动答疑时间,直播前我们会提前收集大家的问题,群内同学可以针对本科目考点范围提问,讲师会精选一些问题给大家解答。

想要参与的小伙们可以扫描下方二维码回复【错题】扫码进微信群,即可解锁报名详情。

接下来小编就放上我们教研团队精心整理的CFA一级固收精选问答,希望对大家复习有所帮助哦!

精选问答1

题干

An investor in a country with an original issue discount tax provision purchases a 20-year zero-coupon bond at a deep discount to par value. The investor plans to hold the bond until the maturity date. The investor will most likely report:

A. a capital gain at maturity.

B. a tax deduction in the year the bond is purchased.

C. taxable income from the bond every year until maturity.

答案解析

C is correct.

The original issue discount tax provision requires the investor to include a prorated portion of the original issue discount in his taxable income every tax year until maturity.

The original issue discount is equal to the difference between the bond’s par value and itsoriginal issue price.

解题思路

Original Issue Discount(OID)是指债券在发行时,折价发行的债券。零息债券就属于Original Issue Discount,期间没有现金流,债券面值大于债券价格,这个折价部分实际上是支付给债券持有人的利息。这道题的考点的是零息债券的税收处理方式。

在original issue discount(OID)的税收条款下,要求将折价部分的总收益按比例打散到每一年,这样对应每一年都有期间收益(interest income),投资者对其收益缴税(income tax)。在债券到期时,因为面值与价格之差在之前各期摊销完了,所以这样的债券到期时没有capital gain。

易错点分析

错误集中在A选项,说明学习时忽略了original issue discount tax provision这个知识点。这道题也可以当作结论来记。

精选问答2

题干

Bond G, described in the exhibit below, is sold for settlement on 16June 2014.

![]() Annual Coupon 5%

Annual Coupon 5%

![]() Coupon Payment Frequency Semiannual

Coupon Payment Frequency Semiannual

![]() Interest Payment Dates 10 April and 10 October

Interest Payment Dates 10 April and 10 October

![]() Maturity Date 10 October 2016

Maturity Date 10 October 2016

![]() Day Count Convention 30/360

Day Count Convention 30/360

![]() Yield-to-Maturity 4%

Yield-to-Maturity 4%

The full price that Bond G will settle at on 16 June 2014 is closest to:

102.36

103.10

103.65

答案解析

B is correct.

The bond’s full price is 103.10. The price is determined in thefollowing manner: As of the beginning of the coupon period on 10 April 2014,there are 2.5 years (5 semiannual periods) to maturity.

These five semi annual periods occur on 10 October 2014, 10 April 2015, 10 October 2015, 10 April 2016and 10 October 2016.

PV = 2.45 + 2.40 + 2.36 + 2.31 + 92.84 = 102.36

The accrued interest period is identified as 66/180. The number of days between 10 April 2014 and 16 June 2014 is 66 days based on the 30/360 day count convention.

(This is 20 days remaining in April + 30 days in May + 16 daysin June = 66 days total). The number of days between coupon periods is assumed to be 180 days using the 30/360 day convention.

PV Full =PV×(1 +r)66/180

PV Full = 102.36×(1.02)66/180= 103.10

解题思路

首先,我们将未来五笔现金流折现到2014.4.10,得到现值之和为102.36。N=5,PMT=2.5,I/Y=2,FV=100,求得PV=102.36

然后再将这个数值复利到2014.6.16,得到full price为103.10。

我们之所以没有直接将未来五笔现金流折到2014.6.16,是因为五笔现金流的时间间隔不同,后面四笔现金流时间间隔是半年,而从6.16到10.10之间并不是半年。因此现金流就不是一个年金的形式,我们就没有办法用计算器直接求PV了。

易错点分析

将2014.4.10的PV=102.36误认为是flat price,然后加上4.10到6.16之间的accrued interest得到full price。

精选问答3

题干

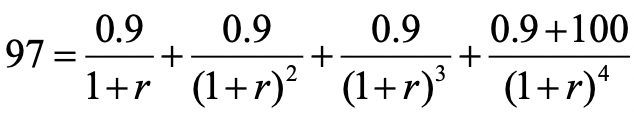

A two-year floating-rate note pays 6-month Libor plus 80 basis points. The floater is priced at 97 per 100 of par value. Current 6-month Liboris 1.00%.

Assume a 30/360 day count convention and evenly spaced periods. The discount margin for the floater in basis points (bps) is closest to:

180 bps

236 bps

420 bps

答案解析

B is correct.

The discount or required margin is 236 basis points. Given thefloater has a maturity of two years and is linked to 6-month Libor, the formulafor calculating discount margin is:

where:

![]() PV = present value, or the price of the floating-rate note = 97

PV = present value, or the price of the floating-rate note = 97

![]() Index = reference rate, stated as an annual percentage rate = 0.01

Index = reference rate, stated as an annual percentage rate = 0.01

![]() QM = quoted margin, stated as an annual percentage rate = 0.0080

QM = quoted margin, stated as an annual percentage rate = 0.0080

![]() FV = future value paid at maturity, or the par value of the bond =100

FV = future value paid at maturity, or the par value of the bond =100

![]() m = periodicity of the floating-rate note, the number of payment periods per year = 2

m = periodicity of the floating-rate note, the number of payment periods per year = 2

![]() DM = discount margin, the required margin stated as an annualpercentage rate

DM = discount margin, the required margin stated as an annualpercentage rate

Substituting given values in:

To calculate DM, begin by solving for the discount rate per period:

r = 0.0168

Now, solve for DM:

DM = 0.0236

The discount margin for the floater is equal to 236 basis points.

解题思路

浮动利率债券的Coupon Rate = Reference rate +Quoted Margin,比如一个每半年付息一次的浮动利率债券,其Coupon Rate是:6-month Libor + 50 bps,50 bps(息差Spread)就是Quoted Margin。这道题中Quoted Margin是80bps。Reference rate和Quoted Margin共同决定Coupon Rate。

给浮动利率债券未来现金流折现时,使用的折现率是Reference rate +Discount margin。

基准利率和Discount margin共同构成对这个浮动利率债券的要求回报率。所以在基准利率的基础上,加上一个Discount Margin后,折现未来现金流可以得到当前浮动利率债券。或者知道当前浮动利率债券价格和基准利率,可以反求Discount Margin。

本题知道浮动利率债券的Reference rate和Quoted margin,也就知道分子的Coupon rate;也知道浮动利率债券当前的债券价格,所以可以反求出来折现率,从而进一步求Discount margin。

易错点分析

无法区别浮动利率债券的Discount Margin和Quoted Margin。

精选问答4

题干

An investor purchases a nine-year, 7% annual coupon payment bond ata price equal to par value. After the bond is purchased and before the first coupon is received, interest rates increase to 8%. The investor sells the bond after five years. Assume that interest rates remain unchanged at 8% over thefive-year holding period.

Assuming that all coupons are reinvested over the holding period,the investor’s five-year horizon yield is closest to:

5.66%

6.62%

7.12%

答案解析

B is correct.

The investor’s five-year horizon yield is closest to 6.62%. After five years, the sale price of the bond is 96.69 and the future value of reinvested cash flows at 6% is 41.0662 per 100 of par value. The total return is 137.76 (= 41.07+ 96.69), resulting in a realized five-year horizon yield of 6.62%:

100= 137.76/(1+r)5

r = 0.0662

41.0662=7 + 7*1.08 + 7*1.08^2 + 7*1.08^3 + 7*1.08^4

96.6879=7/1.08 + 7/1.08^2 + 7/1.08^3 + 107/1.08^4

解题思路

由题干可知,一个九年期的债券持有五年。现在要我们计算五年的Horizon Yield。

首先求出5年后卖出债券时所有的Coupon + Coupon Reinvestment,将现金流复利到第五年末,得到41.07。然后求出5年后卖出时的债券价格,要算5年后卖出债券的价格,实际上是将债券剩余4年的现金流折现到第五年末。于是,N=4,PMT=7,I/Y=8,FV=100,得到 PV = -96.69,所以5年后债券的卖出价格是96.69。

将以上两个部分相加总:得到持有期总收益为137.76。

计算年化收益率:100*(1+r)^5=137.76,求出r即可。

易错点分析

1.将投资期的年化收益率算作持有期收益率;

2.不会计算持有期总收益。

精选问答5

题干

For a high-quality debt issuer with a large amount of publicly traded debt, bond investors tend to devote most effort to assessing the issuer’s:

A.default risk.

B.loss severity.

C.market liquidity risk.

答案解析

A is correct.

Credit risk has two components:default risk and loss severity. Because default risk is quite low for mosthigh-quality debt issuers, bond investors tend to focus more on this likelihoodand less on the potential loss severity.

解题思路

高质量债券,同时又是publicly traded,这样的债券流动性风险比较小,所以债券投资者关注的重点不应该是流动性风险,C选项首先可以排除。我们发现A和B选项就是信用风险的两大重要组成部分,default risk与loss severity(或者称为lossgiven default)。

由于高质量债券的投资者基本默认这样的债券不会违约,但是当“最不可能违约的债券发生违约时”,损失是很大的,因此投资者比起违约损失,更关注的是发生违约的概率,也就是defaultrisk。反之,高收益债券的投资者更关注违约损失(loss given default),因为投资者已知违约概率大,因此更关注违约后能收回多少剩余价值。

易错点分析

C选项大多数同学都可以轻易排除,主要的问题是在A和B选项之间徘徊。这里注意区分投资级(investment grade bond)与高收益债券(high yield bond)信用分析的特点。