做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天三级放上交易执行的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

A trader decided to sell 30,000 shares of a company. At the time of this decision, the quoted price was € 53.20 to € 53.30.Because of the large size of the order, the trader decided to execute the salein three equal orders of 10,000 shares spread over the course of the day.

When she placed the first order, the quoted price was € 53.20 to € 53.30, and she sold the shares at € 53.22. The trade had a market impact, and the quoted pricehad fallen to € 53.05 to € 53.15 when she placed the next order. Those shareswere sold at € 53.06. The quoted price had fallen to € 52.87 to € 52.98 when she placed the last order. Those shares were sold at € 52.87.

Suppose this was the market closing price of the shares that day. Answer the followingquestions. Ignore commissions.

What is the implementation shortfall estimate of the total cost of executing the sale?

答案解析

The quotation midpoint that prevailed at the time of the decision to trade was € 53.25. This is the benchmark price, andthe implementation shortfall estimate of the cost of executing the first orderis 10,000 × (€53.25-€53.22) = €300.

The implementation shortfall estimate ofthe cost of executing the second order is 10,000 × (€53.25 – €53.06) = €1,900.The implementation shortfall estimate of the cost of executing the third orderis 10,000 × (€53.25 – €52.87) = €3,800. So, the implementation shortfall estimate of the total cost of executing the three orders is €300 + €1,900 +€3,800 = €6,000.

解题思路

这道题比较特殊,decision price取的是quoted price的midpoint。这给了我们另外一个如何决定decision price的思路,但考试时题目都会说清应该以什么作为decision price。

这个是一个sell order,按照我们正常的流程来做,由于不需要分解implementation shortfall,所以直接算出paper portfolio和actual portfolio,然后做差即可。paper portfolio=30000*(53.25-52.87)=11400,actual portfolio=10000*(53.22-52.87)+10000*(53.06-52.87)+10000*(52.87-52.87)=5400。因此Implementation Shortfall=11400-5400=6000。

最后的等式与原版书的答案是一致的,因为这一题没有佣金,且订单全部执行了,在这种特殊的情况下才能按原版书的答案来解答,我们平时在做题时,还是按正常的流程来做。

易错点分析

1.无法分辨decision price;

2.没有看清头寸方向。

精选问答2

问题

A trader plans to place a larger order to buy 100,000 shares of company XYZ. He uses an ECN(Electronic Crossing Network) to execute but only 5,000 shares are purchased.

The next day, he decides to use a broker to buy the remaining shares. Which of the following can explain why the remaining shares are traded using a broker?

The shares of company XYZ isvery liquid.

The trader intends to execute quickly.

The trader intends to minimize market impact.

答案解析

C is correct.

解题思路

这道题中trader试图在Electronic Crossing Network上交易,但是没能达成。在Electronic Crossing Network上进行交易,可以最小化market impact,但是有比较大的机会成本,可能找不到对手方,于是他去找broker,目标依然不变。

换句话说,这个人想要最小化市场冲击,Electronic Crossing Network可以满足,broker也能满足,可惜Electronic Crossing Network上没找到对手方,所以就去找broker去了。

在第一次选择用crossing的时候,就已经表明了trader的态度,不希望手里的大单造成太大的市场冲击。但由于无法完成交易,才选择了broker,但是trader的初衷不会改变。

因为倘若要追求交易的速度,也就是B选项,trader完全可以在一开始就按照市场价格买入,甚至高于市场价格买入。但追求交易速度的同时,一定会有很强的market impact,这样一来就违反了trader的初衷。

易错点分析

错误集中在B选项。

精选问答3

问题

Famed Investments has a C$25 million portfolio. It follows an active approach to investment management and, on average, turns the portfolio over twice a year. That is, it expects to trade 200 percent of the value of the portfolio over the next year.

Every time Famed Investments buys or sells securities, it incurs execution costs of 75 basis points, on average. It expects an annual return before execution costs of 8 percent. What is the expected return net of execution costs?

答案解析

The average execution cost for a purchase of securities is 75 basis points, or 0.75 percent, and the average execution cost for a sale of securities is also 0.75 percent.

So, the average execution for a round-trip trade is 2 × 0.75%, or 1.5%. Since the portfolio is expected to be turned over twice, expected execution costs are 1.5% × 2 = 3%. Therefore,the expected return net of execution costs is 8%-3% = 5%.

解题思路

本题的关键信息是turns the portfolio over twice a year,也就是说这个组合里所有的股票都要买入卖出两次。一次交易费为75bp,买入、卖出算两次交易,因此75bp先乘以2。全年要经历两次买入卖出,所以再乘以2。因此交易费用共为3%。扣除交易成本之前的年收益率8%,扣除交易费用后剩下的净收益为5%。

易错点分析

容易将交易费用误认为是150bp。

精选问答4

问题

Consider the following situation:

1. A trader places a sell order of 50,000shares on NYSE

2. A trader representing informed investorsplaces a sell order of 50,000 shares on NYSE

Which of the orders will have a greatermarket impact?

the first order

the second order

they have the same impact.

答案解析

B is correct.

解题思路

这道题只要理解市场冲击的本质就可以迎刃而解。市场冲击指的是某个交易带来的市场价格影响。本题中,交易1和交易2的区别仅仅在于第二个交易中涉及到知情交易者,在做投资时,人们往往会跟随着知情投资者进行相同的交易。这样一来,第二个交易就会带来更大的市场冲击。

一般来说:

当其他情况相同时,交易量越大的交易市场冲击更大;

当其他情况相同时,交易在crossing network完成时,市场冲击更小。

易错点分析

这个知识点的考察出现在原版书的课后题中,原版书正文中并没有给出具体阐释,所以容易忽略此知识点。

精选问答5

题干

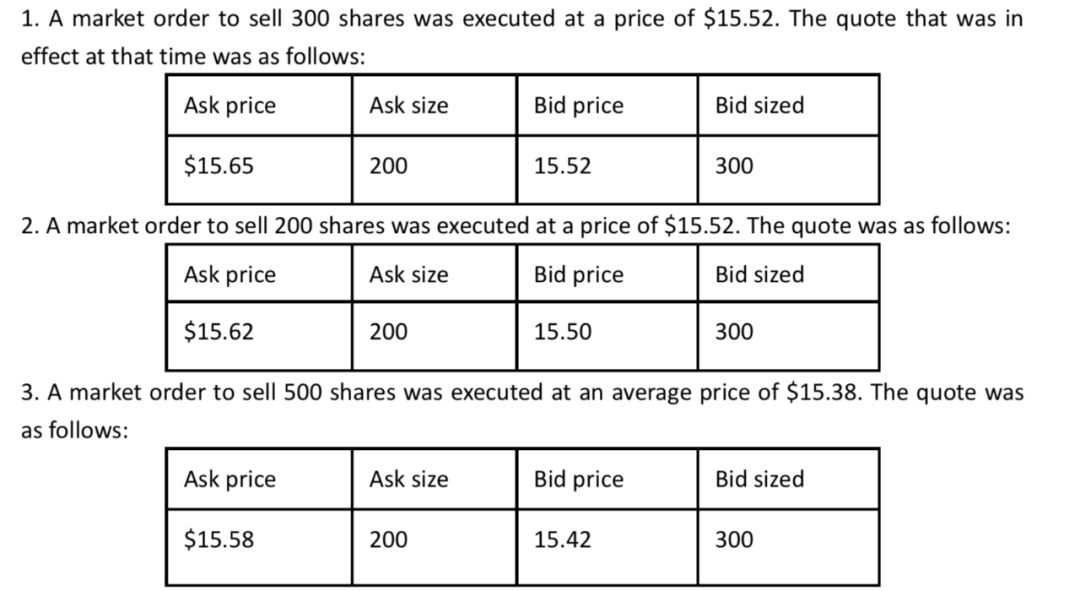

A firm’s chief trader needs to sell 1,000shares of ABC Company. The ticket was split into three trades executed in asingle day as follows:

This order exceeded the quoted bid size and“walked down” the limit order book (i.e., after the market bid was used, theorder made use of limit order(s) to buy at lower prices than the market bid).

答案解析

Incorporating behavioral finance does not have adirect impact on portfolio risk. In some cases, this approach will help encouragea reduction in portfolio risk, but it may also help other clients to take onmore risk as appropriate.

Investing as the client expects and improvements to client retention metrics are both benefits of incorporating behavioral finance.

解题思路

一个市场指令从进入市场到被执行,市场上的quoted price都是在实时发生变化,trader和dealer作为对手方其实是在博弈。market spread是订单进入时bid和ask的价差,而effective spread是指令的执行价格和订单进入市场时mid-quote之间的两倍距离。只有当effective spread小于market(quoted)spread时,才说明trader的交易成本较小,是我们希望发生的情形。所以才会有执行价格落入market spread之内的情况发生,即一个卖单的执行价格大于市场上bid price的情况。

Quote driven markets是dealer通过彼此之间竞争,调整报价产生的市场。effective spreads是衡量的是trader实际的交易成本,effective spreads小于quoted spreads说明dealer在报价上更有竞争力,从而会带来price improvement。

易错点分析

对于这道题的题干,很多同学对于第二个指令很有困惑,市场上的bid price是15.50,而我们的交易价格是15.52,为什么能以高于市场上的bid price进行交易,如何成交?