做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

小编先来安利一波终极助考神器,那就是传说中的品职喜茶课——千人计划,可能还是有很多人不知道是什么?在这里我们还是要简单介绍一下,就是疗效超神奇的价值千元的FRM一级二级总复习课程,只需要19.9元就可以轻松获取,具体内容可以详见👇的文章。(小编温馨提示一下,截止到5月11号截止哦,拖延症患者们赶紧行动起来)

【限时4天】终极助考神器:品职FRM千人计划已被你成功召唤,翻盘就看这个了!

快速参与通道:如果已经了解本计划的,可以直接扫码回复【FRM千人】获取参与方式。

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天二级放上市场风险的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

In early 2000, a risk manager calculates the VAR for a technology stock fund based on the past three years of data. The strategy of the fund is to buy stocks and write out-of-the-money puts. The manager needs to compute VAR. Which of the following methods would yield results that are least representative of the risks inherent in the portfolio?

选项A

Historical simulation with full repricing

选项B

Delta-normal VAR assuming zero drift

选项C

Monte Carlo style VAR assuming zero drift with full repricing

选项D

Historical simulation using delta equivalents for all positions

答案解析

D is correct.

Because the portfolio has options, methods A or C based on full repricing would be appropriate. Next, recall that technology stocks had a big increase in price until March 2000.

From 1996 to 1999, the NASDAQ index went from 1,300 to 4,000. This creates a positive drift in the series of returns. So, historical simulation without an adjustment for this drift would bias the simulated returns upward, thereby underestimating VAR.

考点解析:

这题首先是历史背景情况,当时科技股全在大涨,相对于大盘有更高的收益,即return drift upward,因此要对漂移进行处理,否则这时候会计量的var会小。assuming zero drift就是不对漂移做处理。

解题思路

看提问情况,对B和D的疑问多一些,D选项用historical simulation在互联网泡沫的背景下肯定是高估的,而delta normal的VAR至少还是假设了基础资产收益呈正态分布的delta*(u-z*sigama),相对而言,D比B高估的更直接。

精选问答2

题干

A trader buys an at-the-money call option with the intention of delta-hedging it to maturity. Which one of the following is likely to be the most profitable over the life of the option?

选项A

An increase in implied volatility

选项B

The underlying price steadily rising over the life of the option

选项C

The underlying price steadily decreasing over the life of the option

选项D

The underlying price drifting back and forth around the strike over the life of the option

答案解析

D is correct. An important aspect of the question is the fact that the option is held to maturity. Answer A is incorrect because changes in the implied volatility would change the value of the option, but this has no effect when holding to maturity.

The profit from the dynamic portfolio will depend on whether the actual volatility differs from the initial implied volatility. It does not depend on whether the option ends up in-the-money, so answers B and B are incorrect. The portfolio will be profitable if the actual volatility is small, which implies small moves around the strike price (answer D).

解题思路

首先要明白这题考的不是期权利润而是动态对冲的理念。

delta对冲是瞬时对冲,要想一直实现对冲目的,就必须要动态对冲,即不断根据标的资产的价格变动,来调整对冲比例。如果标的资产的真实波动率过大,即每次调整投资组合的幅度过大,就会带来过大的成本。因此,真实波动率越小,动态投资组合的调整成本也越小,即越profitable。

ATM的option的delta大致是在0.5的,这时候gamma最大,一旦underlying上升或者下降,ITM或者OTM的option的delta都会有显著变化,导致对冲的头寸需要调整,增加成本,而一直围绕行权价波动的话,delta一直是0.5左右,对冲的头寸比较稳定,成本就比较低。

精选问答3

题干

Trader A purchases a down-and-out call with a strike price of USD 100 and a barrier at USD 96 from Trader B. Both traders need to unwind their delta hedge at the barrier. Which trader is more at risk if there is a price gap (discontinuity) that prevents them from exiting the trade at the barrier?

选项A

Trader A has the bigger risk.

选项B

Trader B has the bigger risk.

选项C

They both have the same risk.

选项D

Neither trader has any risk because both are hedged.

答案解析

Each trader replicates dynamically the down-and-out call as a hedge. Trader B sold the option, so needs to replicate a long position in this call.

The hedge ratio for a down-and-out call resembles the usual one except that it has an abrupt discontinuity, dropping to zero below the barrier.

Just above the barrier, Trader B is long the asset in the amount of the hedge ratio (e.g., 0.4). When the price jumps down below the barrier, Trader B will be stuck with a large loss. Intuitively, this loss is the gain to Trader A, who has the opposite position.

解题思路

首先这个知识点是奇异期权的知识点,这里是barrier相当于一个触发价格,down-and-out call是一个看涨期权但是在基础资产下降到一个特定价格(即barrier)时,这个期权就自动终止了,对于本题而言,barrier就是96。

然后考到的知识点是动态对冲。首先,双方进行该笔期权的交易,目的都是为了进行套期保值对冲。所以,可以推出,A的投资组合是标的资产的空头+call的多头。B的投资组合是标的资产的多头+call的空头。

对于本题的down-and-out障碍期权,如果价格下跌触碰到障碍水平,那么该障碍期权就将out失效。所以,此时,A就只剩下标的资产的空头,获得资产下跌的收益,B将只剩下标的资产的多头,遭受损失。

精选问答4

题干

In May of 2005, several large hedge funds had speculative positions in the collateralized debt obligations (CDOs) tranches. These hedge funds were forced into bankruptcy due to the lack of understanding of correlations across tranches. Which of the following statements best describes the positions held by hedge funds at this time and the role of changing correlations? Hedge funds held a:

选项A

long equity tranche and short mezzanine tranche when the correlations in both tranches decreased.

选项B

short equity tranche and long mezzanine tranche when the correlations in both tranches increased.

选项C

short senior tranche and long mezzanine tranche when the correlation in the mezzanine tranche increased.

选项D

long mezzanine tranche and short equity tranche when the correlation in the mezzanine tranche decreased.

答案解析

D is correct. A number of large hedge funds were short on the CDO equity tranche and long on the CDO mezzanine tranche. Following the change in bond ratings for Ford and General Motors, the equity tranche spread increased dramatically.

This caused losses on the short equity tranche position. At the same time, the correlation decreased for CDOs in the mezzanine tranche, Which led to losses in the mezzanine tranche.

解题思路

这题要经过两次判断,首先是违约率环境的高低,因为Mezzanine层次的表现主要取决于违约率,违约率低的时候更像Senior,因此不太会遭受损失,相反则像Equity,因为很可能遭受损失。

之后就把mezzanine和判断好的那边打包一起看待。然后通过correlation判断相对价值,相关性高的话senior相对也不怎么值钱了,相关性低的话senior会被保护的比较好。

精选问答5

题干

Which of the following statements about VAR estimation methods is wrong?

选项A

The delta-normal VAR method is more reliable for portfolios that implement portfolio insurance through dynamic hedging than for portfolios that implement portfolio insurance through the purchase of put options.

选项B

The full-valuation VAR method based on historical data is more reliable for large portfolios that contain significant option-like investments than the delta-normal VAR method.

选项C

The delta-normal VAR method can understate the true VAR for stock portfolios when the distribution of the return of the stocks has high kurtosis.

选项D

Full-valuation VAR methods based on historical data take into account nonlinear relationships between risk factors and security prices.

答案解析

Full-valuation methods are more precise for portfolios with options, so answers B and D are correct. The delta-normal VAR understates the risk when distributions have fat tails, so answer C is correct.

Answer A is indeed wrong. The delta-normal method will be poor for outright positions in options, or their dynamic replication.

解题思路:

delta-normal的方式是一阶导数,如果按照泰勒公式展开还有二阶导、三阶导等等,二阶导即Gamma,一般认为到了二阶导,大部分的价值变动的因素已经被涵盖,根据成本效益原则就不再去求三阶甚至以上的了,但是full valuation是包含了全部的影响因素,因而在计量风险方面比delta-normal要准确。

很多同学对A为什么错有疑问,A选项之所以不对,是因为动态对冲需要不断的调整资产组合,会产生更多的成本。不符合资产收益率服从正态分布的前提条件

精选问答6

题干

Assume the profit/loss distribution for XYZ is normally distributed with an annual mean of $20 million and a standard deviation of $10 million. The 5% VaR is calculated and interpreted as which of the following statements?

选项A

5% probability of losses of at least $3.50 million.

选项B

5% probability of earnings of at least $3.50 million.

选项C

95% probability of losses of at least $3.50 million.

选项D

95%probability of earnings of at least $3.50 million.

答案解析

D is correct. The value at risk calculation at 95% confidence is: -20 million + 1.65 x 10 million = -$3.50 million. Since the expected loss is negative and VaR is an implied negative amount, the interpretation is that XYZ will earn less than +$3.50 million with 5% probability, which is equivalent to XYZ earning at least $3.50 million with 95% probability.

解题思路:

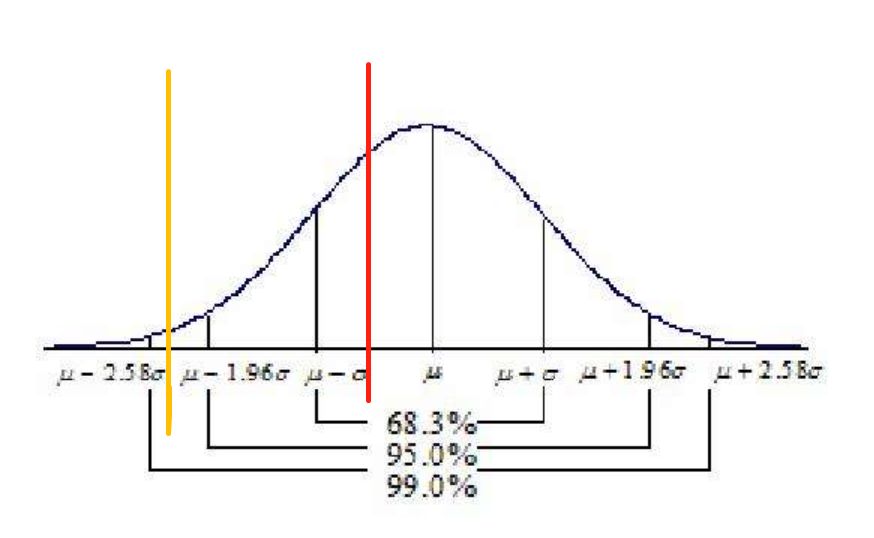

这题中是VaR的一种特殊情况。一般而言,我们提到VaR首先想到的肯定是最大损失,这是因为我们平时的期望收益(u)跟)0考得很近,比如下图红色线条为0,那么减去1.96倍标准差的值必然小于0(在红线左侧)。

但是极端情况,比如期望收益特别大,但是标准差特别小,比如黄色线条是0,你会发现即便减去1.96倍标准差,结果还是正数,此时就由我们平时的最大损失变成了最小收益的概念。

一个比较绕口但是容易理解的思路是,正常计算VaR,通常我们得到一个小于0的数字,取绝对值,我们把它叫做最大损失,但是现在计算完了是大于0的,我们可以说最大损失是-3.5million,损失是负数便是收益,所以换言之,最小收益是3.5million.

精选问答7

题干

What is the effect on the value of a callable convertible bond of a decrease in interest rate volatility and stock price volatility?

选项A

An increase in value due to both interest rate volatility and stock price volatility

选项B

An increase and decrease in value, respectively

选项C

A decrease and increase in value, respectively

选项D

A decrease in value due to both

答案解析

A decrease in stock price volatility decreases the value of the equity conversion option and thus the convertible bond price.

A decrease in interest rate volatility decreases the value of the interest rate call option. Because the bond investor is short the interest rate option, this increases the value of the convertible.

解题思路:

callable convertible bond=bond - call option on bond + call option on stock

可赎回可转债的一般性态仍是债券,发行人有权利将其赎回,这一般是当债券的利率变低(也就是债券价格变高)时赎回,所以,这个赎回权,既可以看成是债券价格的call option,也可以看成是利率的put option。

当利率的波动率下跌时,无论是债券的call option,还是利率的put option,它们的价格都会下降,而又因为你是short,所以对于callable convertible bond,价格是上升的。

或者换个角度来理解,callable convertible bond可以拆分为callable bond再加一个convertible的权利(也就是call option on stock),这样要理解利率波动性对整个callable convertible bond的影响,只要看利率对callable bond的影响就可以了。

站在发行人的角度来理解:利率的波动性下降,那利率下降的可能性、幅度就不会那么大,那我就需要一个“弱一点的”保护,所以callable bond的价格就可以更高一些了,因为保护越强,对发行人而言,价格就得越便宜。

精选问答8

题干

Which of the following is most accurate with respect to delta-normal VAR?

选项A

The delta-normal method provides accurate estimates of VAR for assets that can be expressed as a linear or nonlinear combination of normally distributed risk factors.

选项B

The delta-normal method provides accurate estimates of VAR for options that are near or at-the-money and close to expiration.

选项C

The delta-normal method provides estimates of VAR by generating a covariance matrix and measuring VAR using relatively simple matrix multiplication.

选项D

The delta-normal method provides accurate estimates of VAR for options and other derivatives over ranges even if deltas are unstable.

答案解析

The delta-normal approach will perform poorly with nonlinear payoffs, so answer A is false. Similarly, the approach will fail to measure risk properly for options if the delta changes, which is the case for at-the-money options, so answers B and D are false.

解题思路:

这题主要是问C选项的,协方差矩阵可以衡量多个资产的方差,收益率也可以用矩阵(向量)来表示。只要他们的联合分布是服从正态分布,即使是多元正态分布,那也可以像计算单个资产的VaR一样来计量多个资产的VaR

精选问答9

题干

Which of the following statements is not an advantage of spectral risk measures over expected shortfall? Spectral risk measures:

选项A

consider a manager’s aversion to risk.

选项B

are a special case of expected shortfall measures.

选项C

have the ability to modify the risk measure to reflect an investor's specific risk aversion.

选项D

have better smoothness properties when weighting observations.

答案解析

Spectral risk measures consider aversion to risk and offer better smoothness properties.

Expected shortfall is a special case of spectral risk measures.

解题思路:

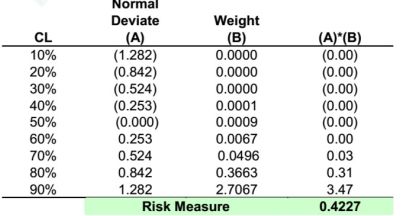

谱风险度量的方法如下图,confidence level越大,即损失越大,它分配的权重也就越大。一直到40%,它都有分配权重。而ES法中,它只计算了尾部个别几个数据的平均值。所以谱分析法的权重分配更平滑一些。

配图来源网络