做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

小编先来安利一波终极助考神器,那就是传说中的品职喜茶课——千人计划,可能还是有很多人不知道是什么?在这里我们还是要简单介绍一下,就是疗效超神奇的价值千元的FRM一级二级总复习课程,只需要19.9元就可以轻松获取,具体内容可以详见👇的文章。(小编温馨提示一下,截止到5月11号截止哦,拖延症患者们赶紧行动起来)

【限时4天】终极助考神器:品职FRM千人计划已被你成功召唤,翻盘就看这个了!

快速参与通道:如果已经了解本计划的,可以直接扫码回复【FRM千人】获取参与方式。

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天二级放上操作风险的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

Which of the following approaches for calculatingoperational risk capital charges leads to a higher capital charge for a givenaccounting income as risk increases?

选项A

The basic indicator approach

选项B

The standardized approach

选项C

The advanced measurement approach

选项D

All of the above

答案解析

C is correct. The basic indicator approach uses a factorof α= 15%. The standardized approach uses a fixed factor ranging from 12% to18%, so is not risk sensitive (except for changes across business lines). TheAMA is the most risk-sensitive method.

解题思路

这题考的主要是对operationalrisk的几种算capitalrequirement方法的理解问题,很多同学看到题面都会直接觉得考的是哪种方法会产生多的capitalrequirement,然后就会选择最初级的方法BIA,因为最初级的方法因为比较粗糙往往会产生较大的资本需求。

而实际上这题的着眼点在sensitivity,当风险增加时,哪种方法产生的capital charge的增量最大,这个角度来看的话,因为BIA和standard approach都是给业务条线设定固定factor的方法,而AMA只要公司自己建模,经过监督机构核准的(比如LDA方法),拿LDA方法来说,PD和LGD两个维度的模型参数变化会使模型的结果比固定factor的前两种方法对风险变化更加敏感。

精选问答2

题干

You are a manager of a renowned hedge fund and are analyzinga 1,000- share position in an undervalued but illiquid stock BNA, which has acurrent stock price of USD 72 (expressed as the midpoint of the current bid-askspread).

Daily return for BNA has an estimated volatility of 1.24%. The averagebid-ask spread is USD 0.16. Assuming returns of BN A are normally distributed,what is the estimated liquidity-adjusted daily 95% VAR, using the constantspread approach?

选项A

USD 1,389

选项B

USD 1,469

选项C

USD 1,549

选项D

USD 1,629

答案解析

C is correct. Conventional VAR is $72 x 1,000 x 1.24% x1.645 = $1,469. The spread effect is $0.16 x 1,000 = $80, for a total of$1,549. As usual, we see that the spread liquidity component is small.

解题思路

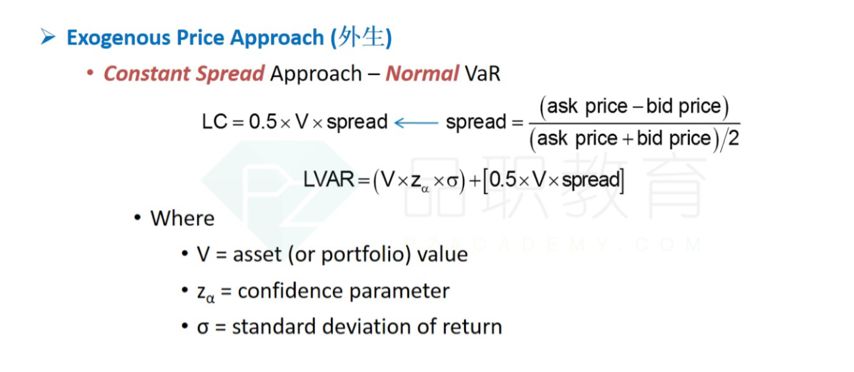

这题var的部分没有问题,很多同学的疑问在最后spreadeffect的调整上,问为什么不是0.16*72*1000。这里首先借助下外生流动性部分的讲义:

这里后面的调整spread其实是百分比形式的,也就是代入公式的spread应该是0.16/72。所以最后spread effect的调整应该是:

0.5*72*1000*0.16/72,分子分母两个72抵消了的。这个公式中的细节可能会被不少同学忽略,需要重视一下。

精选问答3

题干

Consider a bank that wants to have an amount of capitalso that it can absorb unexpected losses corresponding to a firmwide VAR at the1 % level. It measures firmwide VAR by adding up the VARs for market risk,operational risk, and credit risk. There is a risk that the bank has too littlecapital because

选项A

It does not take into account thecorrelations among risks.

选项B

It ignores risks that are notmarket, operational, or credit risks.

选项C

It mistakenly uses VAR to measureoperational risk because operational risks that matter are rare events.

选项D

It is meaningless to add VARs.

答案解析

B is correct. VAR can be added across different types ofrisk, but this will provide a conservative estimate of capital asdiversification effects are ignored. So answer a. would be for too much capital.

Answer c. is not correct because rare events can be factored into operationalVAR. Most likely, the bank may have too little capital for other types of riskthan those measured by these three categories.

解题思路

这题不少同学会误选A,可能是因为“不考虑correlation是一个缺点”这个观念比较根深蒂固。而实际上这道题问的是哪个选项会使目前的capital是低估的,也就是哪个选项考虑之后会使capital charge更大。

这时候A就明显错了,因为考虑了correlation会减小风险的总估计值。而B选项把没考虑的风险加上去的话会增加风险的总估计值的。

精选问答4

题干

In a market crash, which the following are usually true?

I. Fixed-income portfolios hedged withshort Treasury bonds and futures lose less than those hedged with interest rateswaps given equivalent durations.

II. Bid-offer spreads widen because oflower liquidity.

III. The spreads between off-the-run bondsand benchmark issues widen.

选项A

I II and III

选项B

II and III

选项C

I and III

选项D

None of the above

答案解析

B is correct. In a crash, bid-offer spreads widen, as doliquidity spreads. Statement I. is incorrect because Treasuries usually rallymore than swaps, which leads to greater losses for a portfolioshort Treasuries than swaps.

解题思路

很多同学问这题I为什么错了,主要是金融危机期间,市场恐慌,flight toquality效应显著,这时候大家都抛售风险资产购买国债,导致国债价格上升。

此时国债价格的上升速度远高于利率互换,那些固定收益对冲的组合中short国债或者国债期货的受到的损失肯定是大于short IRS的。

II和III就是反应了金融危机时的流动性问题,此时spread会增大。

精选问答5

题干

Which of the following statements regarding bestpractices in implementing a RAROC approach is correct?

选项A

A successful RAROC approach isfocused on maximizing profits earned by the firm.

选项B

A restriction on the firm'sgrowth due to leverage limitations may result in higher profits.

选项C

The data collection processthroughout the firm should be decentralized to allow the various business unitsto ensure the utmost accuracy of data.

选项D

Metrics involving credit risk,market risk, and operational risk to compute economic capital are generallyclearly defined and may be computed objectively.

答案解析

B is correct. A restriction on the firm’sgrowth due to leverage limitations may result in higher profits because itrequires the firm to be "creative" and to optimize a scarce resource(the limited amount of capital available).

Response A is not correct. A successfulRAROC approach is focused on the level of profits earned by the firm inrelation to the level of risks taken.

Response C is not correct. The datacollection process should be the responsibility of the RAROC team; the processshould be centralized with built-in edit and reasonability checks to increasethe accuracy of the data.

Response D is not correct. Metrics involvingoperational risk are not as defined as credit and market risk, therefore, thereis often a significant amount of subjectivity involved in the computations.

解题思路:

A选项:成功的RAROC方法侧重于公司在一定风险水平方面获得的一定水平的利润,而不是只考虑利润最大化,所以A错。

B选项:通过限制杠杆,堵死妄图只通过增加杠杆(这种增加风险的行为)来增加收益的“不归路”,这可以刺激公司的创新能力,因为公司只能通过创新,优化有限的资源,创造同样风险下更高收益的业务和项目来谋求公司成长。B对。

C选项:数据要在businessline之间decentralized,这样会不方便raroc team对数据有一个统一和准确的收集整理。数据收集的集中有利于数据编辑和合理性检查,可以提高数据的准确性。C错。

D选项:涉及操作风险的指标不像信用和市场风险那样定义,因此,计算中经常涉及大量的主观性,D错。

精选问答6

题干

Great North Bank and Trust utilizes the advancedmeasurement approach (AMA). The risk managers in the bank have been verycareful to meet all the requirements of the Basel Committee's guidelines.

They have chosen a very large number of operational risk categories (ORCs) for riskmanagement. Which of the following problems is most likely to result fromchoosing too many operational risk categories?

选项A

Too many losses that fall below thebank’s data threshold.

选项B

A loss of granularity.

选项C

An. inability to capture thecomplexities and idiosyncrasies of the bank's operations when modelingoperational risks.

选项D

Loss data that is too high for eachcategory.

答案解析

A is correct. Very low and very high numbers ofORCs are both problematic, especially when used in conjunction with the LDA.

When a bank uses only one or a few categories, granularity is lost. However,when a bank uses a very high number of ORCs, the number of losses in eachcategory is likely to fall below the model’s data threshold.

The importance ofthe bank’s business lines may be one factor used to determine the level ofgranularity (i.e., the number of ORCs).

解题思路:

对风险的分类太多和太少都不好,尤其是用LDA方法的时候。分类太多的话,每种分类下的的风险会比较少以至于低于公司的数据阈值,超出风险阈值的风险报告会很少。所以选A。

B选项的颗粒性即多样细分性,分类多时才会有每类的颗粒感,所以分类过多时不是loss of granularity,B错。

C选项:分类多时候可以抓住操作风险的复杂性等等,较少时才会有inability to capture the complexities and idiosyncrasies的问题。

D选项:操作风险划分得种类过多时,每一个小的种类因为太过细分了,所以它的损失就会就会偏低。而不是too high,D错。

配图来源网络