做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

临近考前,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天二级放上投资风险的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

Which of the following statements about tracking error and value at risk(VaR) is least accurate?

选项A

Tracking error and VaR are complementarymeasures of risk.

选项B

Tracking error and VaR are complementarymeasures of risk.

选项C

Tracking error is the standard deviationof the excess of portfolio returns over the return of the peer group.

选项D

VaR can be defined as the maximum lossover a given time period.

答案解析

C is correct. All of the statements are accurate with the exception of theone relating to the peer group. Tracking error is the standard deviation of theexcess of portfolio returns over the return of an appropriate benchmark, not peer group.

解题思路

题目问的是least accurate,B、C和D其实都有些问题,但这道题C选项错的更明显。C选项中不应该是peer group,而应该是benchmark。

B选项的话,有一些VaR确实不用假设收益率服从正态分布,但大部分是假设收益率服从正态分布的。

D选项的话还得加上一定置信区间内。

还有部分同学对A选项有疑问。VaR和tracking error是互补的。VaR是衡量一定时间内、一定置信度下会遭受的最大损失,投资经理可以根据VaR进行资本分配、投资选择;而tracking error衡量的是投资组合收益率与基准收益率的偏离程度,也就是超额收益alpha的偏离程度,投资经理主要用它来衡量主动投资的风险。

精选问答2

题干

What would be an ideal approach for a hedge fund investor who is concernedabout the problem of risk sharing asymmetry between principals and agentswithin the hedge fund industry?

选项A

Focus on investing in funds for whichthe fund managers have a good portion of their own wealth invested.

选项B

Focus on diversifying among the variousniche hedge fund strategies.

选项C

Focus on funds with improved operationalefficiency and transparent corporate governance.

选项D

Focus on large funds from the"foresight-assisted" group.

答案解析

A is correct. The incentive fee structure within the hedge fund industry has not really changed over the years, and there is incentive for managers to take undue risks in order to earn fees.

Thus, there should be a focus oninvesting in finds for which the fund managers have a good portion of their ownwealth invested.

解题思路

principlas and agents problem讲的是代理人和委托人因目标不同导致代理人损害了委托人的利益。 hedge fund 亏损了由客户承担,赚钱了基金经理能得到20%incentive fee,所以基金经理会倾向于挑风险很大的产品投资反正亏损和他没关系,但这样会危害到客户利益。如果他自己的钱也在这个基金中,他就和客户有一样的目标,不希望亏钱,也就解决了principlas and agents problem。

而C选择中,尽管C选项解决代理问题,但是不能解决risk sharingbetween principal的问题。因为这个方案里GP没投钱,不承担风险。

精选问答3

题干

A risk manager assumes that the joint distribution of returns is multivariate normal and calculates the following risk measures for a two-asset portfolio:

If asset 2 is dropped from the portfolio,what is the reduction in portfolio VAR?

选项A:USD15.0

选项B:USD38.3

选项C: USD 44.0

选项D: USD 46.6

答案解析

B is correct. This is 61.6 minus the portfolio VAR of asset 1 alone, whichis USD 23.3, for a difference of 38.3.

解题思路

不少同学认为应该选C,类似问题为“ individual var不是不能直接相加得到portfolio var吗?

组合的VaR不等于单个资产的VaR相加,因为还要考虑资产的相关性。这题的思考方法是这样的,组合整体的VaR是61.6,将资产2从组合中移除时,组合只剩下资产1,资产1的VaR是23.3,变动就等于61.6-23.3=38.3。

拿走之前组合的VAR是61.6,拿走之后组合的VAR就等于资产1的VAR等于23.3,两者作差得到reduction。这并没有用到“两个individual VAR之和等于组合的VAR”

精选问答4

题干

Identify the risk in a convertible arbitrage strategy that takes long positions in convertible bonds hedged with short positions in Treasuries andthe underlying stock.

选项A

Short implied volatility

选项B

Long duration

选项C

Long stock delta

选项D

Positive gamma

答案解析

D is correct. This position is hedged against interest rate risk, so b. iswrong. It is also hedged against directional movements in the stock, so c. is wrong.

The position is long an option (the option to convert the bond into thestock) so is long implied volatility, so a. is wrong. Long options positions have positive gamma.

解题思路

题目中一共有三个头寸,longconvertible bond 、short treasury、short stock。convertiblebond赋予债券持有人在潜在有利条件下(在未来转股价格低于股票价格时)转股的权利,所以其实相当于是含权债券,所以应该是long impiledvolatility。

而同时Long option就会带来positive的gamma(可以顺带着复习下,不仅是看涨期权,long一个看跌期权也可以带来正的gamma)。short treasury即short duration。同理short stock就是short stock delta。

精选问答5

题干

A database of hedge fund returns is constructed as follows. The first year of the database is 1994. All funds existing as of the end of 1994 that awilling to report their verified returns for that year are included in that year.

The database is extended by asking the funds for verified returns before1994. Subsequently, funds are added as they are willing to report verifiedreturns to the database. If a fund stops reporting returns, its returns are deleted from the database, but the database has an agreement with funds thatthey will keep reporting verified returns even if they stop being open to new investors. Which of the following four statements are correct?

I. The database suffers from backfilling bias.

II. The database suffers from survivorship bias.

III. The database suffers from anerrors-in-variables bias.

IV. The equally weighted annual return average of fund returns will under-estimate the performance one would expectfrom a hedge fund.

选项A

All the above statements are correct.

选项B

Statements I and II are correct.

选项C

Statements I, II, and III are correct.

选项D

Statements II and IV are correct.

答案解析

B is correct. The database includes histories before 1994 and thereforesuffers from backfill bias. Next, funds that stop reporting are deleted fromthe database, so it has survivorship bias.

Errors-in-variables bias arises inother contexts, such as regression. Finally, the average of fund returns will be too high (not too low) because of these two biases. Hence, I. and II. are correct.

解题思路:

error in variable bias就可以近似理解成变量的偏误,比如说,给回归模型建模时,遗漏了某个变量,而导致了variable bias。

还有部分同学对第四个命题有疑问。因为回填偏误和幸存者偏差的存在,一些基金的收益率是会被高估的。如果等权重加权的话,那么这些被高估的收益率本不应该占到这么高的比例,所以收益率是被高估而不是低估。因此命题四错误。

精选问答6

题干

Over the past year, the HIR Fund had a return of 7.8%, while its benchmark,the S&P 500 index, had a return of 7.2%. Over this period, the fund's volatility was 11.3%, while the S&P index's volatility was 10.7% and thefund's TEV was 1.25%.

Assume a risk-free rate of 3%. What is the information ratio for the HIR Fund and for how many years must this performance persist to be statistically significant at a 95% confidence level?

选项A

0.480 and approximately 16.7 years

选项B

0.425 and approximately 21.3 years

选项C

3.840 and approximately 0.2 years

选项D

1.200 and approximately 1.9 years

答案解析

A is correct. The information ratio is (7.8 — 7.2)/1.25 = 0.48.Statistical significance is achieved when the t-statistic is above the usualvalue of 1.96.

By Equation (29.5), the minimum number of years T forstatistical significance is (1.96/IR)2 = 16.7. Note, however, that there is no need to perform the secondcomputation because there is only one correct answer for the IR question.

解题思路:

对风险的分类太多和太少都不好,尤其是用LDA方法的时候。分类太多的话,每种分类下的的风险会比较少以至于低于公司的数据阈值,超出风险阈值的风险报告会很少。所以选A。

B选项的颗粒性即多样细分性,分类多时才会有每类的颗粒感,所以分类过多时不是loss of granularity,B错。

C选项:分类多时候可以抓住操作风险的复杂性等等,较少时才会有inability to capture the complexities and idiosyncrasies的问题。

D选项:操作风险划分得种类过多时,每一个小的种类因为太过细分了,所以它的损失就会就会偏低。而不是too high,D错。

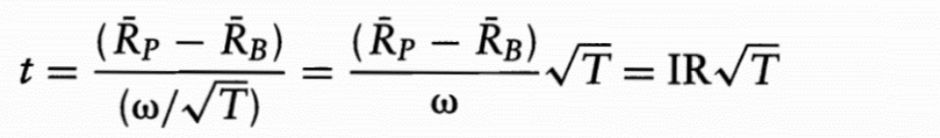

第一问算信息比例没有问题,主要问题在第二问,第二问牵扯到了假设检验。这里做了一个T检验,检验超额收益是否在长期是存在的。这个T检验的统计量公式如下:

根据T检验的判别法则,只要统计量的数值大于95%的临界值1.96,那么拒绝原假设H0,即基金经理没有为组合增添价值。

所以现在有了1.96的临界值,有了IR,就是能反求出T的数值:

t=(tstat/IR)^2=(1.96/0.48)^2=16.7

所以本题选A。

配图来源网络