做过的题你都能拿分吗?

临近考试,大战在即,不知道大家复习的怎么样呢?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,其实刷题就是一个熟能生巧的事情,即使可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法,哪些知识点是易错的点,哪些是协会的惯用套路,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了FRM一级、二级学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的这周,我们在每天都会发布一级、二级学科各一门的高频问答,希望对大家的备考有所帮助。今天一级放上金融市场与产品的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

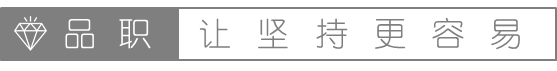

The yield curve is upward sloping. You have a short T-bond futures position. The following bonds are eligible for delivery:

The futures price is 103-17/32 and the maturity date of the contract is September 1. The bonds pay their coupon semiannually on June 30 and December 31. The cheapest to deliver bond is:

选项A:bond A

选项B: bond C

选项C:bond B

选项D:Insufficient information

答案解析

ANSWER: B (Bond C)

The cost of delivering each bond is the price divided by the conversion factor. This gives, respectively,(102+14/32)/0.98 = 104.53, 103.49, and 103.34. Hence the CTD is bond C. Allother information is superfluous.

Or we can use the complete method: cost=Bond price - Future price* conversion factor, and we can find choice B is the answer.

解题思路

解题思路:在求最便宜交割债券时,AI是可以约掉、不用考虑的。因为short方在T时刻收到的钱是FP*CF + AI,然后short方挑选一个最便宜的债券给long方,这个最便宜的债券的价格是SP + AI,这个相当于是short方的成本。所以short方的收益时 FP*CF - SP。要挑选最便宜交割债券,即最大化这个收益。而这个收益表达式中不含AI。

具体选择方案为:求使得(FP*CF-SPt)达到max的bond,或者求使得(SPt-FP*CF)取min的bond。次数求(SPt-FP*CF),ABC三支债券计算出的值分别为0.9769,-0.0434,-0.18675,选择bond C,答案是B。

精选问答2

题干

An interest rate cap runs for 12 months based on three-month LIBOR with as trike price of 4%. Which of the following is generally true?

选项A

The cap consists of three caplet options with maturities of three months, the first one starting today based onthree-month LIBOR set in advance and paid in arrears.

选项B

The cap consists of four caplets starting today, based on LIBOR set in advance and paid in arrears.

选项C

The implied volatility of each caplet will be identical no matter how the yield curve moves.

选项D

Rate caps have only a single optionbased on the maturity of the structure.

答案解析

ANSWER: A

Interest rate caps involve multiple options, or caplets. The first one has terms that are set in three months. Itlocks in Max[ R( t+3 )−4%, 0 ]. Payment occurs inarrears in six months. The second one is a function of Max[ R( t+6 )−4%, 0 ]. The third is a function of Max[ R( t+9 )−4%, 0 ] and is paid t+12. The sequence then stops because the cap has a term of 12 months only. This means there are three caplets.

解题思路

我们知道利息在期末支付,但利率在期初决定,即3时刻支付的利息利率由0时刻决定,6时刻支付的利息利率由3时刻决定,以此类推,总共有4笔利息。

但第一笔利息,即3 时刻的利息利率是确定的,因为0时刻的LIBOR是已知的,对于确定的利率不需要用期权管理风险。但其他三笔的利率是不确定的,所以一共需要3个CAPLET。

以6时刻为例,它的利率由3时刻决定,3时刻的LIBOR不确定,所以需要 long caplet,这个期权是从0时刻开始,3时刻到期,在3时刻的时候,投资者要决定是否执行期权,此时就是用3时刻的LIBOR与执行价格进行比较,如果3时刻的LIBOR>4%,则行权。

易错点分析:

对于interest rate cap的理解。

精选问答3

题干

An investor buys a Treasury bill maturing in one month for $987. On thematurity date the investor collects $1,000. Calculate effective annual rate (EAR).

选项A: 17%

选项B: 15.8%

选项C: 13%

选项D:11.6%

答案解析

ANSWER: A

The EAR is defined by FV/PV = ( 1+EAR )^ T. So EAR = ( FV/PV ) ^(1/T) −1 . Here, T = 1/12. So, EAR = (1,000/987)^12−1=17.0%.

解题思路

有效年利率是指在按照给定的计息期利率和每年复利次数计算利息时,能够产生相同结果的,每年复利一次的年利率。举例来说,某债券的名义年利率为10%,每年支付利息两次(年复利次数为2),则其有效年利率为多少?那么答案就是(1+10%/2)^2=1+EAR。

而YTM,它相当于投资者按照当前市场价格,购买并且一直持有债券到满期,同时再投资率(市场利率)保持不变时可以获得的年平均收益率。或者说,它是可以使投资购买国债获得的未来现金流量的现值=债券当前市价的那个贴现率。

精选问答4

题干

The one-year U.S. dollar interest rate is 2.75% and one-year Canadian dollar interest rate is 4.25%. The current USD/CAD spot exchange rate is1.0221-1.0225. Calculate the one-year USD/CAD forward rate. Assume annualcompounding.

选项A:1.0076

选项B:1.0074

选项C:1.0075

选项D:1.03722

答案解析

ANSWER: A

The spot price is the middle rate of$1.0223. Using annual (not continuous) compounding, the forward price is F= S(1+r ) ( 1+R* ) = 1.0223×1.0275 1.0425 =1.0076.

解题思路:

对于外汇远期中S的选取,如果题目没有说是Long/short某国货币,那就取中间值。如果给了,比如说是要long美元,且现在挂牌价是1.0221-1.0225, 则买美元的现价是1.0225。

剩下的就是代入到计算外汇远期的公式中进行求解就可以了。

精选问答5

题干

The owner of 300,000 bushels of corn wishes to hedge his position for a sale in 150 days. The current price of corn is $1.50/bushel and the contract size is 5,000 bushels.

The interest rate is 7%, compounded daily. The storagecost for the corn is $18/day. Assume the cost of storage as a percentage of the contract per year is 1.46%. The price for the appropriate futures contract used to hedge the position is closest to:

选项A:$6,635

选项B: $7,248

选项C: $7,656

选项D: $7,765

答案解析

D is correct.

Since both the interest and the storage costs compound on a daily basis, a continuous time model is appropriate to approximate theprice of the contract. The cost of storage as a percentage of the contract peryear is:

u=365× 18 1.5×300,000 =0.0146

Using Equation 6, the futures price per bushel is:

F=$1.5× e ( 0.07+0.0146 )( 150/ 365 ) = $1,553 x 5,000 bushels per contract = $7,765.

解题思路:

讲义里,the present value of known storage costover the life of the forward contract表示的U;而这里的u和讲义里的u一样,表示将仓储成本年化成“连续复利”的成本率。(见讲义164页)

根据题目,每天corn的仓储成本为18美元,乘上365是整年所有corn的仓储成本。而300,000*1.5,表征的是所有corn 的总价值。将两者相除,表示的是仓储成本占价值的占比(可以类比于红利分红占总票面价值的计算)。

最后再用期货的价格公式,即可计算出价格。

精选问答6

题干

A portfolio manager returns 10% with a volatility of 20%. The benchmark returns 8% with risk of 14%. The correlation between the two is 0.98. The risk-free rate is 3%. Which of the following statements is correct?

选项A:$0.32.

选项B:$0.65

选项C: $1.31

选项D: $2.97

答案解析

选C。

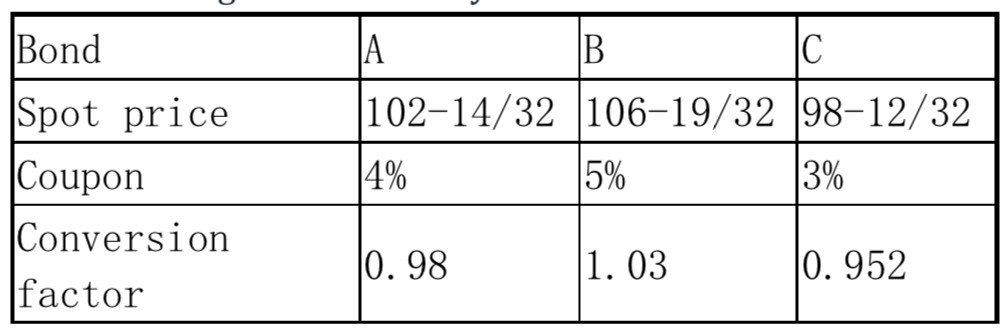

The up-move factor is U= e σ t = e 0.08 0.25 =1.041

The down-move factor is D=1/U=1/1.041=0.961

The probability of an up move in JTE stock=e rt −D U−D = e 0.055(0.25) −0.961 1.041−0.961 =0.66

The probability of a down move inJTE=1-0.66=0.34

Stock tree

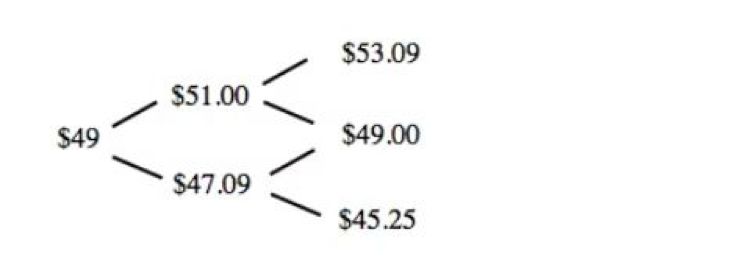

Option Tree

The $50 call option is in-the-money when the stock price finishes at $53.09 and the call has a value of $3.09.The present value of the expected payoff in the up node at the end of three monthsis: ₤$3.09×0.66)+($0×0.34) e 0.055×0.25 =$2.01

Since this is an American option, we need to see if it is optimal to exercise the option early. The payoff from early exercise in the up node of the first 3-month period ismax($51-50,0)=$1.00.Since $1.00<$2.00. it is not optimal to exercise theoption early. The value of the option today is calculated as: [(2.01*0.66)+(0*0.34)] / e^(0.055*0.25) = 1.31

解题思路:

二叉树算期权价值中,u的公式里涉及的t,是一步二叉树的时间间隔,而不是整个期权的时间间隔。本题中一步时间间隔是0.25年,所以t=0.25,而不是0.5。

精选问答7

题干

Which of the following items are functions of the clearinghouse?

I. Determine which contracts trade.

II. Receive margin deposits from brokers.

选项A:I only

选项B:II only

选项C: Both I and II

选项D: Neither I nor II.

答案解析

B is correct.

The clearing house acts as buyer toevery seller and seller to every buyer, thus virtually eliminating default risk.It also collects margin payments from clearing members(brokers).

解题思路:

它们之间的区别如下:

Exchange:交易所是投资者根据预先制定的交易制度,进行集中交易的场所。它的主要职能为:1、提供交易场地、交易平台 2、指定标准交易规则,并负责监督、执行交易规则 3、制定标准的期货合约 4、解决交易纠纷

Clearing House: 清算机构是负责对期货交易所内交易的期货合约,进行交割、清算和结算操作的独立机构。所以它的主要职能是:1、充当每笔交易的媒介 2、每天为会员进行净头寸的集中结算和清算。p.s.: 清算机构既可以是交易所的一个附属部门,也可以是一家独立的公司。