做过的题你都能拿分吗?

临近考试,小编相信大家都开始启用“题海”战术,疯狂刷题,可是你现在做过的题,你考场碰到都能做对吗?

同为备考党的我,小编只想说,如果只做过一遍,那怕是有点难。

我相信大家都是从题海战术里走出来的朋友们,这其实就是一个熟能生巧的事情,即时可能你对某个知识点不理解,但是同一个题型你做完3次后,就有一种闭着眼睛我都能认出你的熟悉感,剥掉题干的外壳,其实都是同一个套路。

那么到底哪些题目是有典型考法的,哪些知识点是比较易错的点,这就是大家考前需要拿个小本本记下来的事情。

看到这里,是不是大家都有一种蠢蠢欲动,要赶紧去做笔记的想法?

知道目前大家都在争分多秒学习,贴心的品职教研组的小哥哥、小姐姐们也是熬夜赶工(心疼一下),帮大家整理了CFA三个级别学科的错题本,希望在最后的时候能给大家起到助力的作用。

在接下来的几周里,我们会陆续发放三个级别的高频问答,希望对大家的备考有所帮助。今天二级放上公司理财的错题本,大家一起来看看这些题都会做吗?

精选问答1

题干

The payment of a 10 percent stock dividend by a company will result in an increase in that company’s:

A current ratio.

B financial leverage.

C contributed capital.

答案解析

C is correct.

解题思路

发放10%的股票股利的意思是如果原来公司有100股股票,那么发放完10%的股票股利之后,公司的股票数量将变成110股。

发放股票股利与现金股利不同,企业没有真金白银流出。那发放股票股利的钱从哪出?答案是和现金股利一样,也是从公司的留存收益里面出(10%股票股利的数量×每股股价)。因此股本的增加正好抵消掉了RE的减少,整个equity不变。

原版书这里用的原话是:A stock dividend is accounted for as a transfer of retained earnings to contributed capital.

![]() 选项A,current ratio=CA/CL, 根据上面两点可知,发放股票股利并不影响流动资产也不影响流动负债,因此A不发生变化。

选项A,current ratio=CA/CL, 根据上面两点可知,发放股票股利并不影响流动资产也不影响流动负债,因此A不发生变化。

![]() 选项B financial leverage财务杠杆等于D/E,同样,发放股票股利,公司的债券和权益也不发生变化,因此B也没影响。

选项B financial leverage财务杠杆等于D/E,同样,发放股票股利,公司的债券和权益也不发生变化,因此B也没影响。

![]() 选项C:发放股票股利会使得公司股票数量上升,因此contributed capital股东的投入资本增加。contributed capital是股东权益中的一个科目。

选项C:发放股票股利会使得公司股票数量上升,因此contributed capital股东的投入资本增加。contributed capital是股东权益中的一个科目。

易错点分析

这道题不难但是提问同学特别多,关键问题就是没理解股票股利的本质,大家都认为既然是发股票,那么权益肯定是上升的,为何财务杠杆不受到影响。

其实股票股利和现金股利的本质是一样,虽然股东拿到的一个是现金而一个是股票,但股票是有价值的,因此企业也要从留存收益中来支付。因此支付股票股利是equity内部科目发生变化,但整体是没有变化的。

精选问答2

题干

Maximilian Böhm is reviewing several capital budgeting proposals from subsidiaries of his company. Although his reviews deal with several details that may seem like minutiae, the company places a premium on the care it exercises in making its investment decisions.

The first proposal is a project for RichieExpress, which is investing $500,000, all in fixed capital, in a project that will have operating income after taxes of $20,000 and depreciation of $40,000 each year for the next three years.

Richie Express will sell the asset in three years, paying 30 percent taxes on any excess of the selling price over bookvalue. The proposal indicates that a $647,500 terminal selling price will enable the company to earn a 15 percent internal rate of return on the investment. Böhm doubts that this terminal value estimate is correct.

What terminal selling price is required for a 15 percent internal rate of return onthe Richie project?

A $588,028

B $593,771.

C $625,839.

答案解析

C is correct.

解题思路

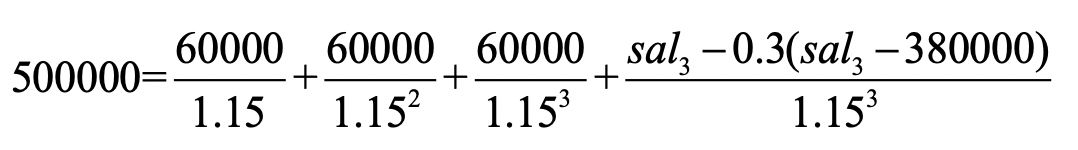

这道题让我们根据项目的IRR来计算最后一期变卖资产的价格,既给出IRR相当于隐含假设此时项目的NPV等于零,即未来产生的现金流折现就等于初始投资额。其它条件都给出了,带入公式只有一个未知数就是最后一期的销售价格:

有两地方需要注意:

![]() 这道题直接给的就是税后利润EBIT(1-T),那么OCF直接加折旧就好。

这道题直接给的就是税后利润EBIT(1-T),那么OCF直接加折旧就好。

![]() 固定资产在三年后并没有折完,所以在第三年末账面价值不等于零而是380000。

固定资产在三年后并没有折完,所以在第三年末账面价值不等于零而是380000。

这道题在计算上没有简便的方法(不能用计算器直接求解),需要按部就班来算。

易错点分析

这道题正好与咱们平时做题思路不同,它是逆着来的相当于已知NPV让我们反求公式里面的其它科目,很多同学第一次做时非常懵圈,特别是题干又和IRR扯到一起,可能一时间也想不起IRR是什么以及它代表什么。

所以这道题出的挺好的,它打破了我们一贯的思路,在现金流项目中我们不能总是一成不变根据条件代入公式计算,如果让你倒推,也要能马上反应过来。

精选问答3

题干

Barbara Simpson is a sell-side analyst with Smith Riccardi Securities. Simpson covers the pharmaceutical industry. One of the companies she follows, Bayonne Pharma,is evaluating a regional distribution center. The financial predictions for theproject are as follows:

Fixed capital outlay is € 1.50 billion.

Investment in net working capital is € 0.40 billion.

Straight-line depreciation is over a six-year period with zero salvage value.

Project life is 12 years.

Additional annual revenues are € 0.10 billion.

Annual cash operating expenses are reduced by € 0.25 billion.

The capital equipment is sold for € 0.50 billion in 12 years.

Tax rate is 40 percent.

Required rate of return is 12 percent.

Simpson is evaluating this investment to see whether it has the potential to affect Bayonne Pharma’s stock price. Simpson estimates the NPV of the project to be € 0.41 billion, which should increase the value of the company.

Simpson is evaluating the effects of other changes to her capital budgeting assumptions. She wants to know the effect of a switch from straight-line to accelerated depreciation on the company’soperating income and the project’s NPV.

She also believes that the initial outlay might be much smaller than initially assumed. Specifically, she thinks the outlay for fixed capital might be € 0.24 billion lower, with no change in salvage value.

When reviewing her work, Simpson’s supervisor provides the following comments. "I note that you are relying heavily on the NPV approach to valuing the investment decision. I don’t think you should use an IRR because of the multiple IRR problem that is likely to arise with the Bayonne Pharma project.

However, the equivalent annual annuitywould be a more appropriate measure to use for the project than the NPV. Isuggest that you compute an EAA."

How would you evaluate the comments by Simpson’s supervisor about not using the IRR and about using the EAA? Thesupervisor is:

A incorrectabout both.

B correct about IRR and incorrect about EAA.

C incorrect about IRR and correct about EAA.

答案解析

A is correct.

解题思路

这道题定性的考查了企业在做资本预算时评判项目方法的选择,评判项目我们主要用到的就是NPV和IRR,而由于IRR的缺点比较明显,NPV是我们最常用到的方法。IRR的最致命缺点有两个:

![]() 项目如果不是传统的现金流模式(项目的现金净流出和净流入交替出现而非传统的一次流出,之后都是流入的情况),可能会出现多个IRR或没有IRR的情况。

项目如果不是传统的现金流模式(项目的现金净流出和净流入交替出现而非传统的一次流出,之后都是流入的情况),可能会出现多个IRR或没有IRR的情况。

![]() IRR假设项目的再投资收益率还等于IRR。我们知道企业通常都是从最好(收益率最高)的项目做起,因此假设企业在好的项目结束后还能以同样高的收益率再投资是不现实的。

IRR假设项目的再投资收益率还等于IRR。我们知道企业通常都是从最好(收益率最高)的项目做起,因此假设企业在好的项目结束后还能以同样高的收益率再投资是不现实的。

NPV和IRR的方法我们从一级就开始学,应该不是崭新的知识点,在二级我们增加了期限不同互斥项目的评判方法即EAA和最小公倍数法。

有上述理解之后,我们再看这道题有两句话需要我们判断对错。第一句话S同学说大量的使用NPV方法是因为,如果使用IRR,BP项目容易产生多个IRR的情况。IRR容易出现多个IRR的情况是发生在非传统现金流项目的时候,但是根据这道题目的描述,BP项目的现金流是传统形式的,因此S同学对于大量使用NPV而不选择IRR的原因说错了。

第二句话S同学说在对BP项目进行评价时,应该使用EAA法而非NPV的方法。我们说EAA适用于不同期限且互斥的项目时,这道题并无互斥项目,也没有涉及期限不同项目的比较,它仅仅是对于一个独立项目的评价,那么我们应该选择NPV法。

易错点分析

这个IRR法会产生多个或没有IRR的问题在二级相当于是复习,但没想到提问的同学很多,看来还是一级学的不够扎实。此外,就是EAA法的适用性,这个是2级的全新的知识点,只有当题目出现互斥且期限不同的项目时才会用到,而这道题中的项目是“free-standing完全独立的”因此,我们用NPV法就可以了。

精选问答4

题干

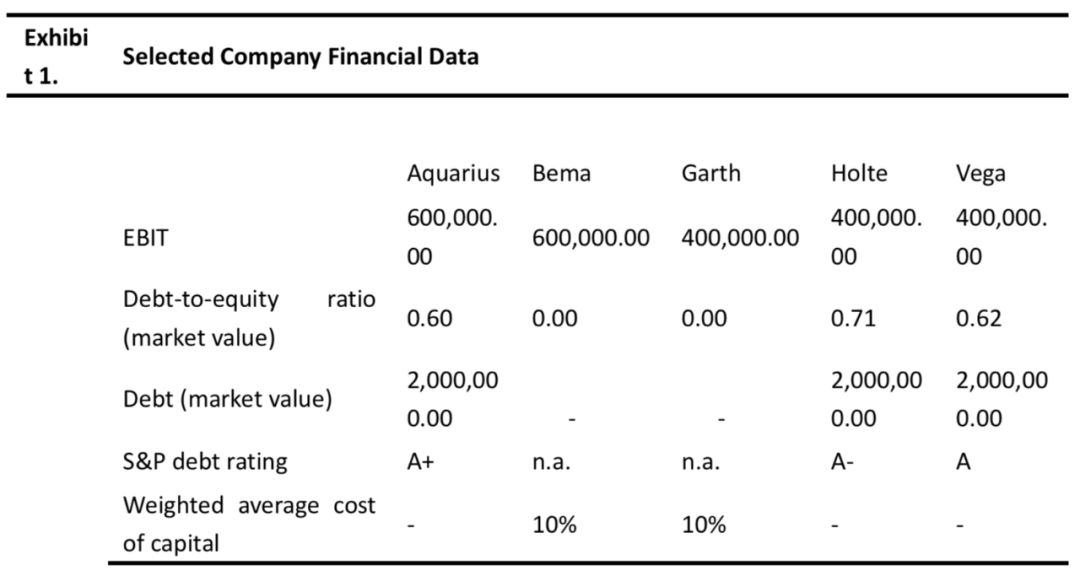

Lindsay White, CFA, is an analyst with a firm in London, England. She is responsible for covering five companies in the Consumer Staples industry.

White believes the domestic and global economies will grow slightly below average over the next two years, but she is also concerned about the possibility of a mild recession taking hold.

She has been asked to review the companies that shecovers, and she has collected information about them, presented in Exhibit 1.

White has estimated that earnings before interest and taxes (EBIT) will remainconstant for all five companies for the foreseeable future. Currency is interms of the British pound (£).The marginal corporate tax rate is 30% for all five companies.

Based on conversations with management of the five companies, as well as on her own independent research and analysis, White notes the following:

Aquarius:

• has lower bonding costs than does Bema.

• has a higher percentage of tangible assets to total assets than does Bema.

• has a higher degree of operating leverage than does Bema.

Garth:

• invests significantly less in research and development than does Holte.

• has a more highly developed corporate governance system than does Holte.

• has more business risk than does Holte.

In addition, White has reached variousconclusions regarding announcements by Bema, Garth, and Vega:

Announcement

Bema has announced that it will issue debt and use the proceeds to repurchase shares. As a result of this debt-financedshare repurchase program, Bema indicates that its debt/equity ratio will increase to 0.6 and its before-tax cost of debt will be 6%.

Conclusion

As a result of the announced program,Bema’s total market value should decrease relative to Aquarius’s.

Announcement

Garth has announced that it plans toabandon the prior policy of all-equity financing by the issuance of £1 millionin debt in order to buy back an equivalent amount of equity. Garth’s before-tax cost of debt is 6%.

Conclusion

This change in capital structure is reasonable, but Garth should take care subsequently to maintain a lower D/Eratio than Holte.

Announcement

Vega has announced that it intends to raise capital next year, but is unsure of the appropriate method of raising capital.

Conclusion

White has concluded that Vega should apply the pecking order theory to determine the appropriate method of raising capital.

Based on Exhibit 1 and White’s notes, whichof the following is least consistent with White’s conclusion regarding Bema’s announcement?

选项A Bema’s bonding costs will be higher than Aquarius’s.

选项B Bema will have a lower degree of operating leverage than does Aquarius.

选项C Bema will have a lower percentage of tangible assets to total assets than does Aquarius.

答案解析

B is correct.

If Bema’s degree of operating leverage declines relative to that of Aquarius, Bema’s business risk will also decline relative to Aquarius.

All else being equal, this decline would be expected to increaseBema’s market value relative to Aquarius; e.g., by decreasing Bema’s costof equity.

解题思路

这道题问根据表格和white的notes,选项哪一个说法与white的结论是不一致的。white的结论是bema的市值相比aquarius会下降。那我们就来来分析一下,看看哪个选项和这个结论说法是不一致的。

![]() 选项A:Bema 绑定成本大于Aquarius 。bonding cost,绑定成本,是股东为了使管理层和自己利益一致化(为防止管理层乱花钱,不以股东利益最大化作为前提)而花费的成本。如果Bema的绑定成本大于A对公司来说是不利的,那么市值应该会下降。因A选项说的与W的结论不一致。

选项A:Bema 绑定成本大于Aquarius 。bonding cost,绑定成本,是股东为了使管理层和自己利益一致化(为防止管理层乱花钱,不以股东利益最大化作为前提)而花费的成本。如果Bema的绑定成本大于A对公司来说是不利的,那么市值应该会下降。因A选项说的与W的结论不一致。

![]() 选项B :Bema 的经营性杠杆比Aquarius要小。如果公司的经营性杠杆比较低,这就说明公司的商业风险比较小,投资风险小的公司,投资者的要求回报率也会比较低。

选项B :Bema 的经营性杠杆比Aquarius要小。如果公司的经营性杠杆比较低,这就说明公司的商业风险比较小,投资风险小的公司,投资者的要求回报率也会比较低。

公司的价值等于未来公司产生的现金流折现,要求回报率是分母,分母较小,折现的价值就越大。因此B公司的市值将会上升,因B选项说的与W的结论不一致。

![]() 选项C: Bema 有形资产占总资产的比例比Aquarius要小。我们估计企业价值使用的是现金流而非企业经营利润。因此在计算自由现金流时我们要加回折旧等非现金支出。

选项C: Bema 有形资产占总资产的比例比Aquarius要小。我们估计企业价值使用的是现金流而非企业经营利润。因此在计算自由现金流时我们要加回折旧等非现金支出。

Bema有形资产越小,折旧就越小,现金流就越小,那么我们估计出来的价值就越小。因此这个选项符合bema的市值相比aquarius会下降的说法。

这道题让我们选说法不一致的,所以选B。

易错点分析

这道题不简单,做错的同学很多也很正常。它从提问开始就比较绕,三个选项的结论都不是一下子就能得出的,它既考察了大家的英文阅读理解、对基础知识的掌握,还考察了大家的综合分析能力。因此大家平时的除了多做题,多积累,还要多进行举一反三的练习。

二级的题目虽然看着庞大,但是所有的条件都会给全,建议大家在平时就开始培养独立思考的能力,题目看不懂就多看几遍,一定是哪句话的没理解透彻所以导致做不出来,多几次这样的主动思考,对于分析能力的提升很有帮助。

精选问答5

题干

Concept 1 "A company invests indepreciable assets, financed partly by issuing fixed-rate bonds. If inflationis lower than expected, the value of the real tax savings from depreciation andthe value of the real after-tax interest expense are both reduced."

For Concept 1, the statement is correct regarding the effects on:

A.the real tax savings from depreciation,but incorrect regarding the real after-tax interest expense.

B.both the real tax savings from depreciation and the real after-tax interest expense.

C.neither the real tax savings from depreciation nor the real after-tax interest expense.

答案解析

C is correct.

The value of the depreciation tax savings is increased, and the value of the real after-tax interest expense is also increased. Due to the lower inflation, the value has increased (essentially discounting at a lower rate).

解题思路

题干有两个前提条件,第一,公司投资了需要折旧的资产(固定资产),其发行的是固定利率债券。第二,当未来真实的通货膨胀低于当前的预期。

![]() 固定资产是以成本进行折旧,如果未来真实的通胀低于当前的预期,说明固定资产的价值应该更小,根据当前资产账面进行折旧的数额大于了真实的折旧额,又由于折旧是税前列支,折旧越大,节税效果越好。因此第一个说法是错误的。

固定资产是以成本进行折旧,如果未来真实的通胀低于当前的预期,说明固定资产的价值应该更小,根据当前资产账面进行折旧的数额大于了真实的折旧额,又由于折旧是税前列支,折旧越大,节税效果越好。因此第一个说法是错误的。

![]() 根据条件公司发行的是固定利率的债,那么每一期的利息费用就是固定的,当通胀低于预期,说明未来钱更值钱了,实际支付出去的利息费用上升了,相当于企业付出了更多的钱。因此第二个说法也是错误的。

根据条件公司发行的是固定利率的债,那么每一期的利息费用就是固定的,当通胀低于预期,说明未来钱更值钱了,实际支付出去的利息费用上升了,相当于企业付出了更多的钱。因此第二个说法也是错误的。

易错点分析

这道题关键在于要弄清我们是在未来真实情况和当前预估作比较以及具体的传导机制。当前也就是初始投资期我们是不知道未来真实通胀是什么样子的,只能根据当下来做一个估计,如果按照当下估计的通胀情况企业是如何折旧和如何支付利息,再与真实情况相比较。通货膨胀率比预期低,前者是:折旧带来的税收减免增加。后者则是:钱更值钱了,实际支付出去的利息费用上升了。