NO.PZ2018111501000016

问题如下:

Raymond, a US analyst, is managing a fund with EUR-denominated assets. In order to protect the assets from downside return movement, he decides to use option contracts. However, he also wants to reduce hedging costs. Assume the fund performance is measured in USD, he will most likely choose to:

选项:

A.buy an USD/EUR ATM put option

B.write an USD/EUR OTM call option

C.buy an USD/EUR OTM put option.

解释:

C is correct.

考点:Strategies to Modify Risk and Lower Hedging Costs

解析:

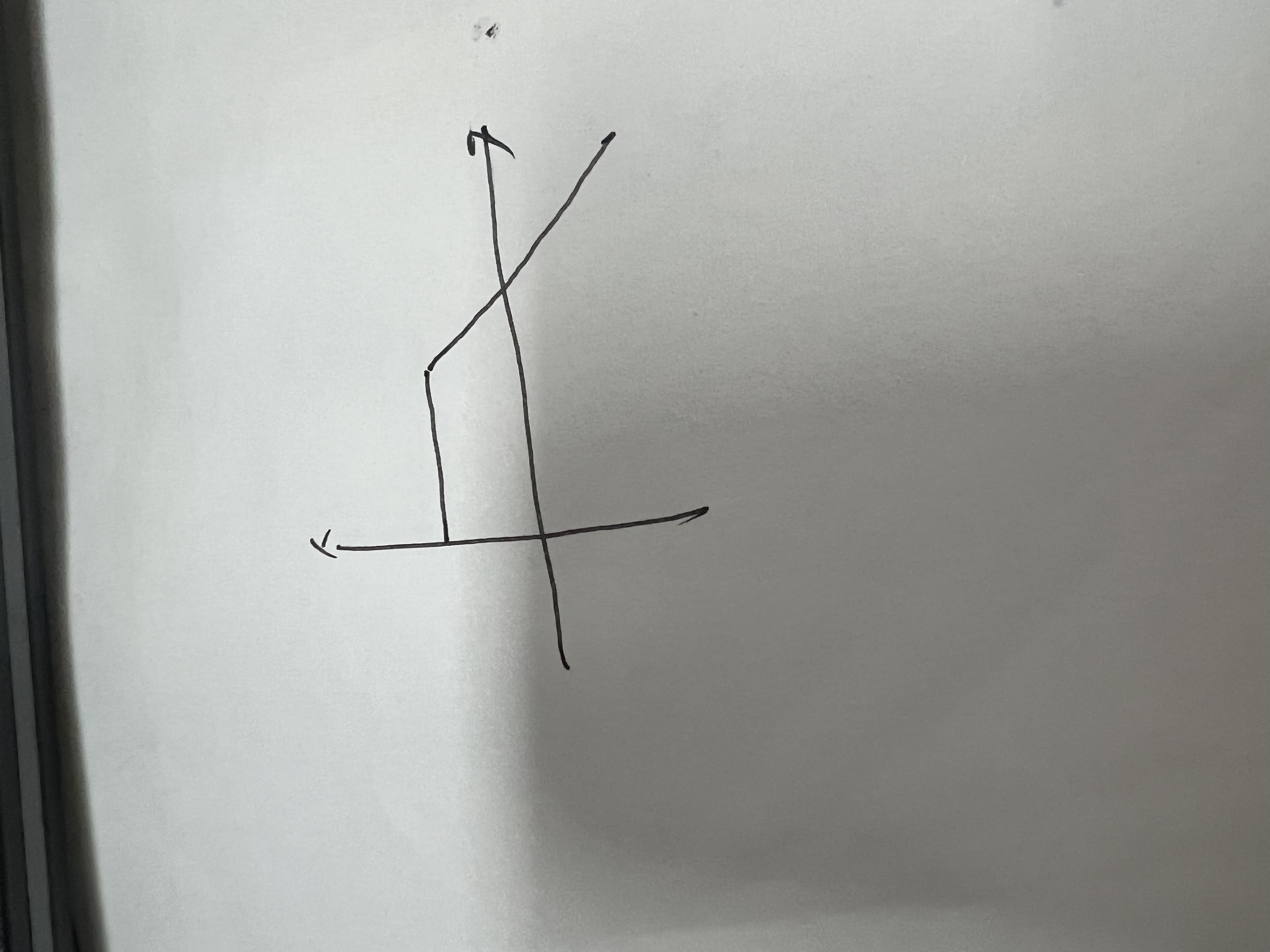

为了避免外汇资产下跌,应该买put option(注意是DC/FC的外汇报价方式),所以B选项排除。由于这个分析师需要降低对冲成本,那么选择OTM put option更符合他的要求。

write OTM call为什么不能保护下行风险?EUR下行的时候,获得一个premium