NO.PZ2019012201000050

问题如下:

Winthrop and Tong agree

that only the existing equity investments need to be liquidated. Tong suggests

that, as an alternative to direct equity investments, the new equity portfolio

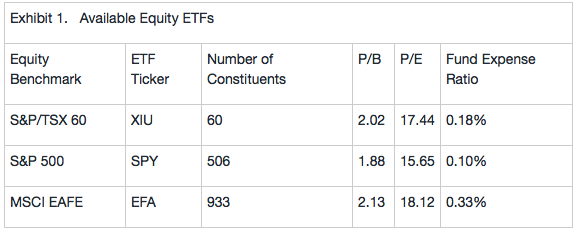

be composed of the exchange-traded funds (ETFs) shown in Exhibit 1.

Based

on Exhibit 1 and assuming a full-replication indexing approach, the tracking

error is expected to be highest for:

选项:

A.

XIU

B.

SPY

C.

EFA

解释:

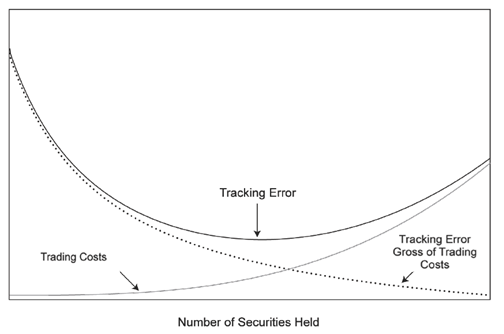

An index that contains a large number of constituents will tend to

create higher tracking error than one with fewer constituents. Based on the

number of constituents in the three indexes (S&P/TSX 60 has 60, S&P 500

has 506, and MSCI EAFE has 933), EFA (the MSCI EAFE ETF) is expected to have

the highest tracking error. Higher expense ratios (XIU: 0.18%; SPY: 0.10%; and EFA:

0.33%) also contribute to lower excess returns and higher tracking error, which

implies that EFA has the highest expected tracking error.

股票数量多,跟踪误差大,可以用这个思路来解题吗?还是说fund expense ratio和股票数量是必然正相关关系吗 ?