NO.PZ2019012201000072

问题如下:

Leeter makes the following

statements about quantitative strategies:

1 Manager

experience and discretion in identifying new trends in the market are important

components of any quantitative strategy.

2 Loss aversion

bias is more prominent with quantitative strategies than with fundamental

strategies.

3 Generally,

quantitative methods rely on information coefficients between firm returns and

model factors.

Which of Leeter’s

statements concerning the quantitative approach to active management is most

accurate?

选项:

A.Statement 1

Statement 2

Statement 3

解释:

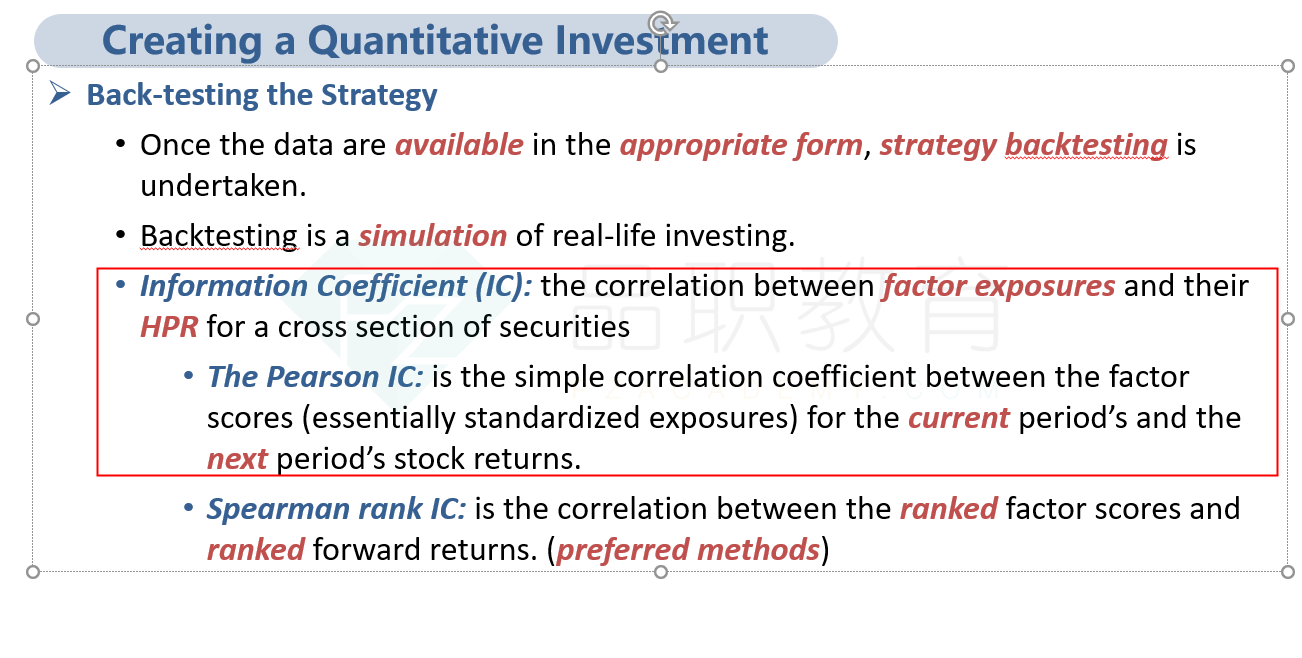

Leeter’s third

statement is most accurate. Generally, quantitative methods use past data to

identify systematic factors that can be overweighted or underweighted in a

portfolio based on an information coefficient.

A is incorrect.

Leeter’s first statement is not accurate. Manager discretion has a minimal role

in quantitative approaches.

B is incorrect.

Leeter’s second statement is not accurate. Loss aversion is more symptomatic of

fundamental approaches rather than quantitative approaches.

information coefficients between firm returns and model factors这在这个课程前103页都没有提到, 可以解释一下到底跟量化的投资方式有什么关联