NO.PZ201809170400000603

问题如下:

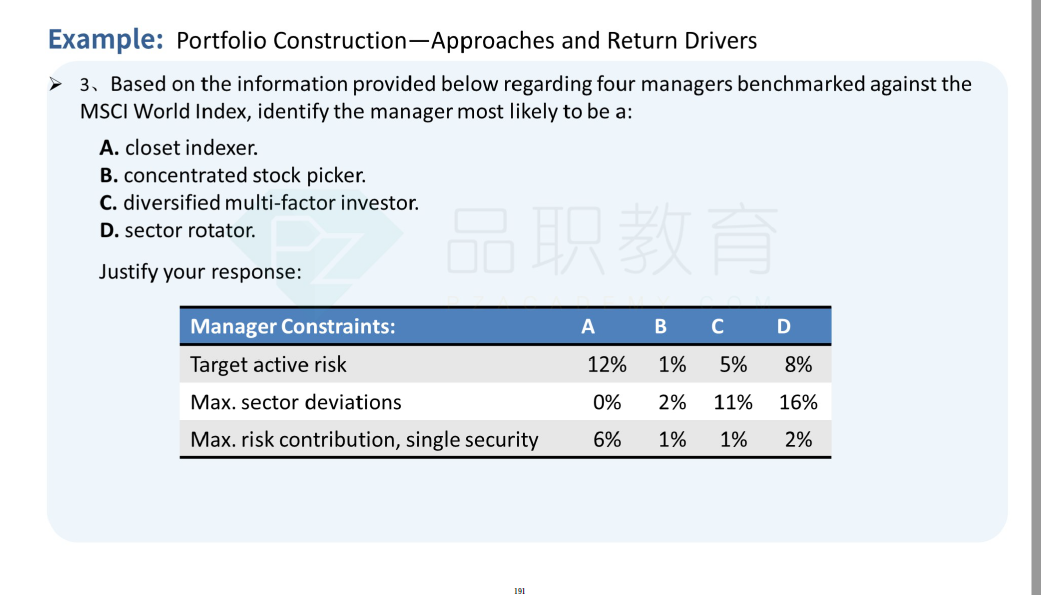

Manager B’s portfolio is most likely consistent with the characteristics of a:

选项:

A.pure indexer.

B.sector rotator.

C.multi-factor manager.

解释:

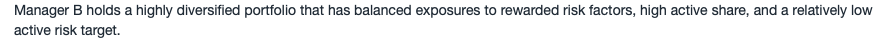

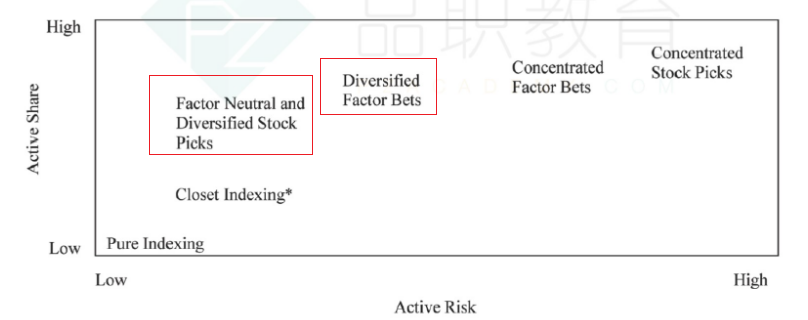

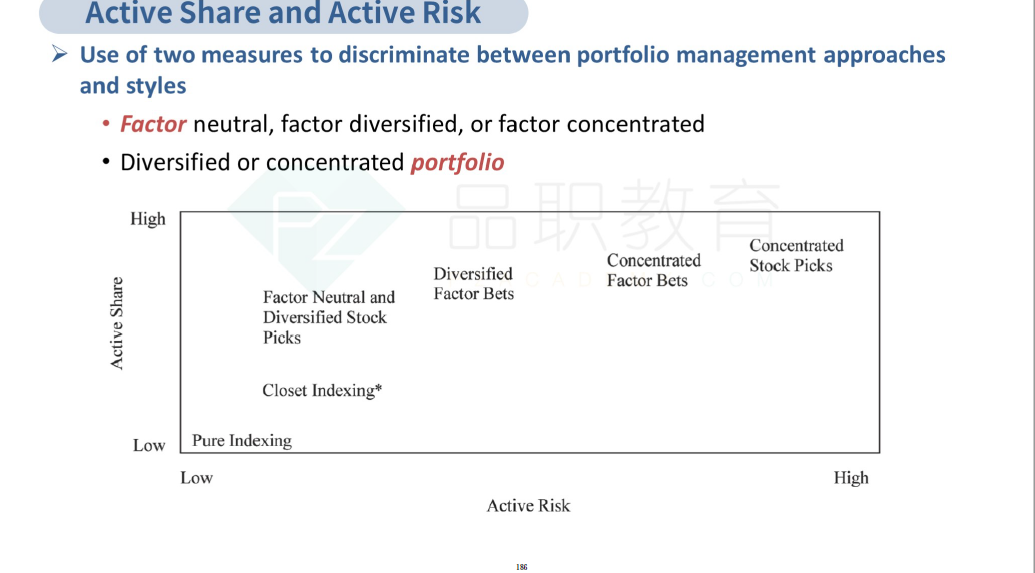

C is correct. Most multi-factor products are diversified across factors and securities and typically have high active share but have reasonably low active risk (tracking error), often in the range of 3%. Most multi-factor products have a low concentration among securities in order to achieve a balanced exposure to risk factors and minimize idiosyncratic risks. Manager B holds a highly diversified portfolio that has balanced exposures to rewarded risk factors, a high active share, and a relatively low target active risk—consistent with the characteristics of a multi-factor manager.

如题