NO.PZ2019012201000048

问题如下:

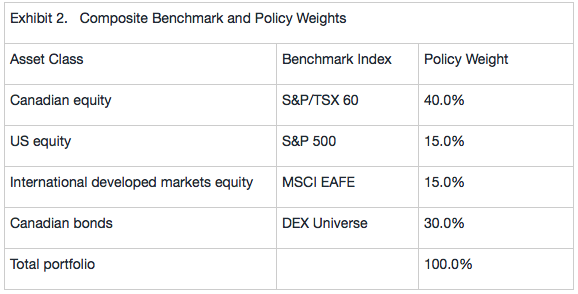

After determining

Winthrop’s objectives and constraints, the CAD147 million portfolio’s new

strategic policy is to target long-term market returns while being fully

invested at all times. Tong recommends quarterly rebalancing, currency hedging,

and a composite benchmark composed of equity and fixed-income indexes.

Currently the USD is worth CAD1.2930, and this exchange rate is expected to

remain stable during the next month. Exhibit 2 presents the strategic asset

allocation and benchmark weights.

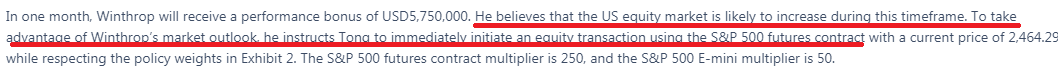

In one month,

Winthrop will receive a performance bonus of USD5,750,000. He believes that the

US equity market is likely to increase during this timeframe. To take advantage

of Winthrop’s market outlook, he instructs Tong to immediately initiate an equity

transaction using the S&P 500 futures contract with a current price of

2,464.29 while respecting the policy weights in Exhibit 2. The S&P 500

futures contract multiplier is 250, and the S&P 500 E-mini multiplier is

50.

In

preparation for receipt of the performance bonus, Tong should immediately:

选项:

A.buy two US E-mini equity futures contracts

sell nine US E-mini equity futures contracts

buy seven US E-mini equity futures contracts

解释:

The amount of the

performance bonus that will be received in one month (USD5,750,000) needs to be

invested passively based upon the strategic allocation recommended by Tong.

Using the strategic allocation of the portfolio, 15% (USD862,500.00) should be

allocated to US equity exposure using the S&P 500 E-mini contract, which

trades in US dollars. Because the futures price is 2,464.29 and the S&P 500

E-mini multiplier is 50, the contract unit value is USD123,214.50 (2,464.29 ×

50).

The correct number

of futures contracts is (5,750,000.00 × 0.15)/123,214.50 = 7.00.

Therefore, Tong

will buy seven S&P 500 E-mini futures contracts.

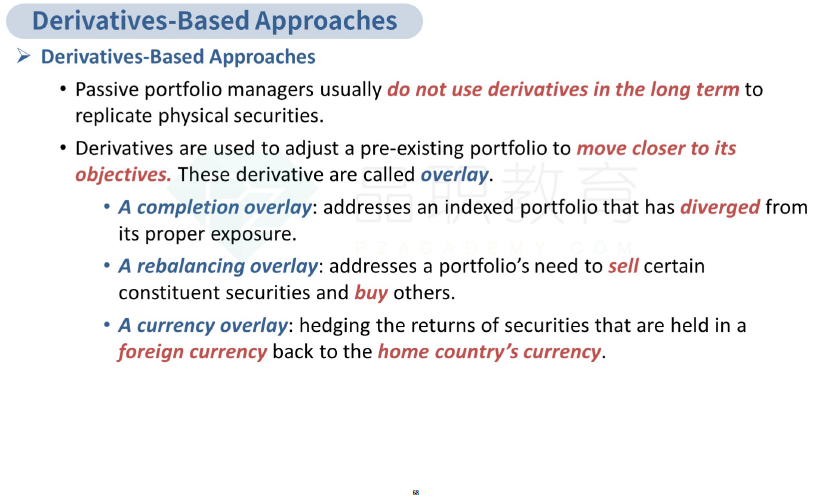

我在这个知识点当中完全没看到相关的计算, 麻烦老师指出来是在equity中关于Derivatives-Based Approaches当中关于这算题的知识点在哪? 而且我感觉李老师在equity中关于Derivatives-Based Approaches也没讲解计算题, 是不是你们视频少放了?