NO.PZ2022010501000004

问题如下:

Use the information in the following table to answer this question (amounts in €):

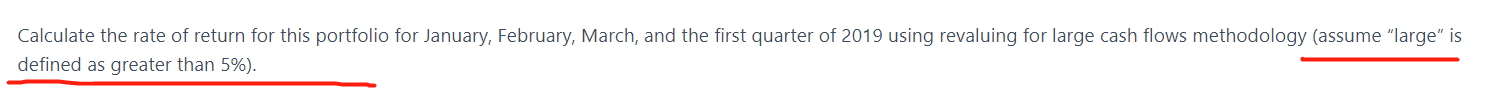

Calculate the rate of return for this portfolio for January, February, March, and the first quarter of 2019 using revaluing for large cash flows methodology (assume “large” is defined as greater than 5%).

选项:

解释:

January:

RJan= (208,000 − 200,000)/200,000 = 4.00%

February:

RFeb1- 15 = (217,000 − 208,000)/208,000 = 4.33%

RFeb16- 28= (263,000 − 257,000)/257,000 = 2.33%

RFeb1-28 = [(1 + 0.0433) × (1 + 0.0233)] − 1 = 6.76%

March:

RMar1- 21 == (270,000 − 263,000)/263,000 = 2.66%

RMar22- 31= (245,000 − 240,000)/240,000 = 2.08%

RMar1- 31= [(1 + 0.0266) × (1 + 0.0208)] − 1 = 4.80%

Quarter 1:

RQT1 = [(1 + 0.0400) × (1 + 0.0676) × (1 + 0.0480)] − 1 = 16.36%

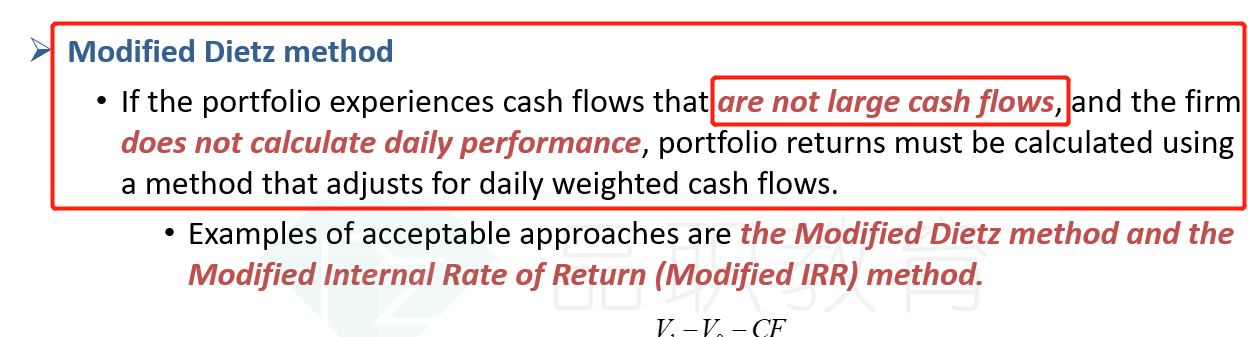

why i cant use the cash flow to calculate the return?