NO.PZ2018062006000064

问题如下:

Alex wants to buy a 3-year bond with the coupon rate of 5%. The coupon is paid annually. Spot rates are as follows: 1-year spot rate=4%; 2-year spot rate=4.5%; 3-year spot rate=5%.

The price of the bond is:

选项:

A.110.00

B.100.09

C.90.16

解释:

B is correct.

PV = 100.09

考点:Pricing Bonds with Spot Rates

解析:通过未来现金流折现求和,第一年的现金流(5)用S1 折现,第二年的现金流(5)用S2 折现,第三年的现金流(100+5)用S3 折现,可得债券价格为100.09,故选项B正确。

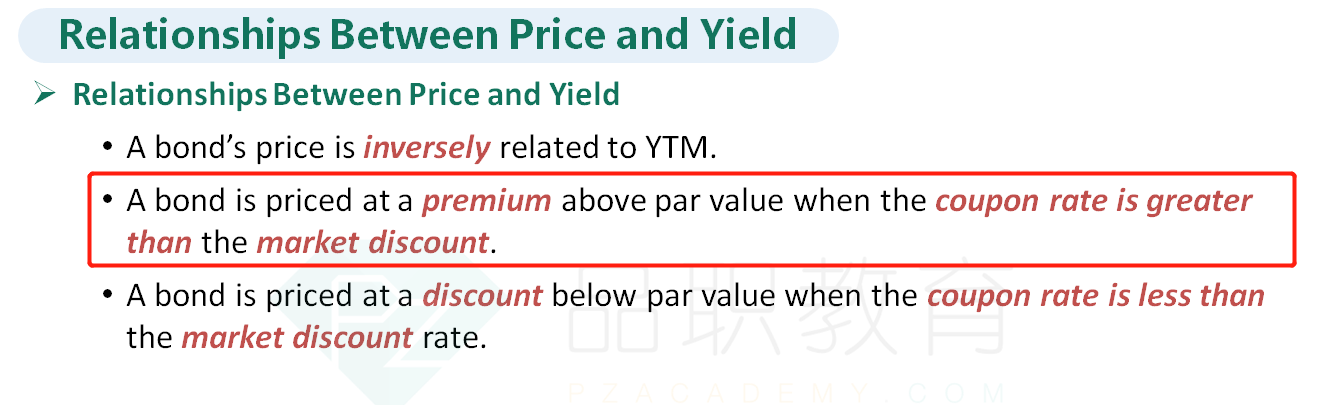

如果不通过计算,coupon rate是5%,discount rate是低于等于5的,为什么price还大于100呢