NO.PZ2018062007000085

问题如下:

Under put–call–forward parity, which of the following transactions is risk free?

选项:

A.Short call, long put, long forward contract, long risk- free bond.

Long call, short put, long forward contract, short risk- free bond.

C.Long call, long put, short forward contract, short risk- free bond.

解释:

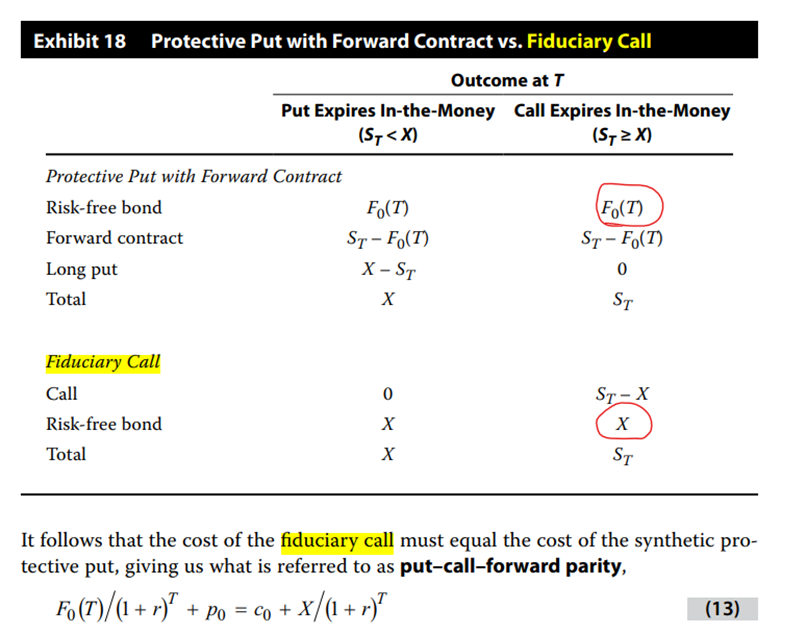

A is correct. Purchasing a long forward contract and a risk- free bond creates a synthetic asset. Combining a long synthetic asset, a long put, and a short call is risk free because its payoffs produce a known cash flow of the value of the exercise price.

中文解析:

这道题考察的是put-call parity的一个变型。

我们知道S是一个不确定的现货价格,那么假设持有S同时short forward contract,就可以得到一个无风险收益,可以等效为一个risk-free bond,也就是S + short forward contract = long risk-free bond,等式两边变换一下可以得到:S = -short forward contract + long risk-free bond = long forward contract + long risk-free bond;

再把这个等式带入到P + S = C + K,得到P + long forward contract + long risk-free bond = C + K,K是无风险债券 Risk free bond,

K = P + long forward contract + long risk-free bond - C,这样就构造了一个无风险组合,A选项对。

再把这个等式带入到P + S = C + K,得到P + long forward contract + long risk-free bond = C + K,K是无风险债券 Risk free bond,

K = P + long forward contract + long risk-free bond - C,这样就构造了一个无风险组合,A选项对。

这题左图得long risk free bond 和右图得无风险债券是什么关系?能否约掉?