Ireland-based Old Galway Capital runs several investment trusts for its clients. Fiona Doyle has just finished rebalancing the dynamic currency hedge for Overseas Investment Trust III, which has an IPS mandate to be fully hedged using forward contracts. Shortly after the rebalancing, Old Galway receives notice that one of its largest investors in the Overseas Investment Trust III has served notice of a large withdrawal from the fund.

1 Given the sudden liquidity need announced, Doyle’s best course of action with regard to the currency hedge is to:

A do nothing.

B reduce the hedge ratio.

C over-hedge by using currency option

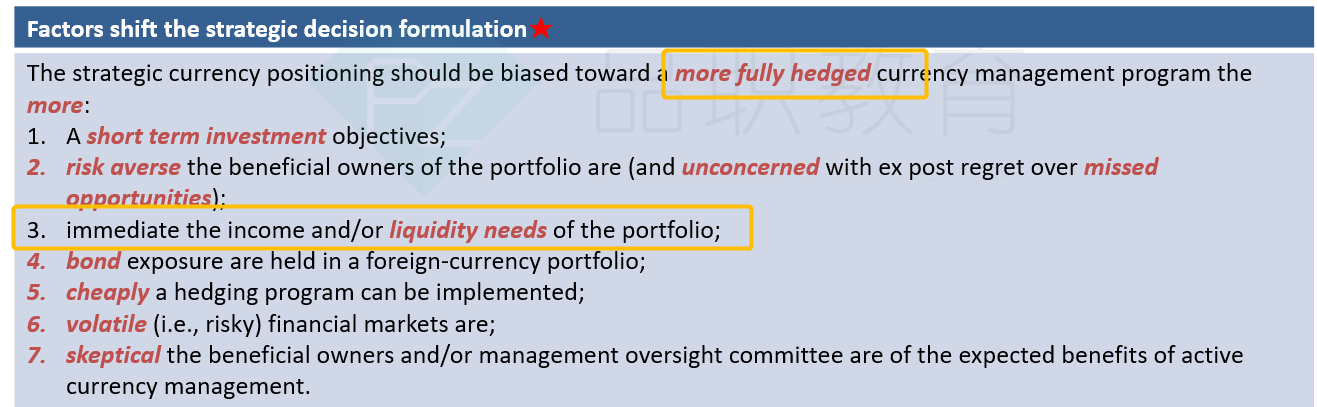

原版书例题,答案A is correct. After rebalancing, the Overseas Investment Trust III is fully hedged; currency risk is at a minimum, which is desirable if liquidity needs have increased. Choices B and C are incorrect because they increase the currency risk exposures.

这题当前的portfolio是fully hedged,但是最大的投资者要撤回一大笔资金,为何还是do nothing,而不是降低hedge ratio?假设最大的投资者撤回的资金占了总portfolio的一半,这时候do nothing,不就等于是原有的hedge ratio从100%提升到200%吗?