NO.PZ2021101401000022

问题如下:

Howie Rutledge is a senior portfolio strategist for an endowment fund. Rutledge meets with recently hired junior analyst Larry Stosur to review the fund’s holdings.

Rutledge asks Stosur about the mechanics of exchange-traded funds (ETFs). Stosur responds by making the following statements:

- Statement 1 Unlike mutual fund shares that can be shorted, ETF shares cannot be shorted.

- Statement 2 In the ETF creation/redemption process, the authorized participants (APs) absorb the costs of transacting securities for the ETF’s portfolio.

- Statement 3 If ETF shares are trading at a discount to NAV and arbitrage costs are sufficiently low, APs will buy the securities in the creation basket and exchange them for ETF shares from the ETF sponsor.

Which of Stosur’s statements regarding ETF mechanics is correct?

选项:

A.Statement 1

Statement 2

Statement 3

解释:

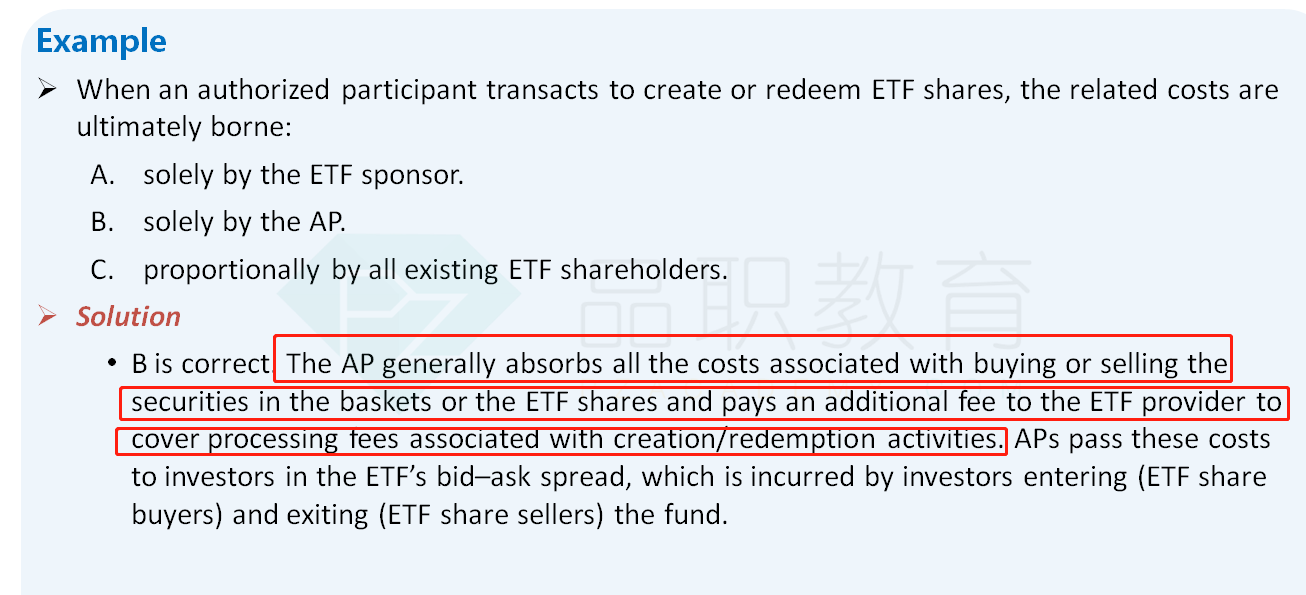

B is correct.

Statement 2 is correct. A significant advantage of the ETF creation/ redemption process is that the AP absorbs all costs of transacting the securities for the fund’s portfolio. APs pass these costs to investors in the ETF’s bid–ask spread, incurred by ETF buyers and sellers. Thus, non-transacting shareholders of an ETF are shielded from the negative impact of transaction costs caused by other investors entering and exiting the fund. In contrast, when investors enter or exit a traditional mutual fund, the mutual fund manager incurs costs to buy or sell investments arising from this activity, which affects all fund shareholders. This makes the ETF structure inherently fairer: Frequent ETF traders bear the cost of their activity, while buy-and-hold ETF shareholders are shielded from those costs. Investors cannot short mutual fund shares, but they can short ETF shares. Also, if ETF shares are trading at a discount to NAV and arbitrage costs are sufficiently low, APs will buy ETF shares and exchange them for the securities in the redemption basket. Statement 3 describes the scenario that would occur if the ETF shares are trading at a premium to NAV.

A is incorrect because Statement 1 is incorrect. Investors cannot short mutual fund shares, but they can short ETF shares.

C is incorrect because Statement 3 is incorrect. If ETF shares are trading at a discount to NAV and arbitrage costs are sufficiently low, APs will buy ETF shares and exchange them for the securities in the redemption basket. Statement 3 describes the scenario that would occur if ETF shares are trading at a premium to NAV.

我记得课上老师讲的是,AP只接收creation basket,而dealer直接对接投资者。