NO.PZ2018062007000064

问题如下:

For a given CDO, which of the following tranches is most likely to have the highest expected return?

选项:

A.

Equity.

B.

Senior.

C.

Mezzanine.

解释:

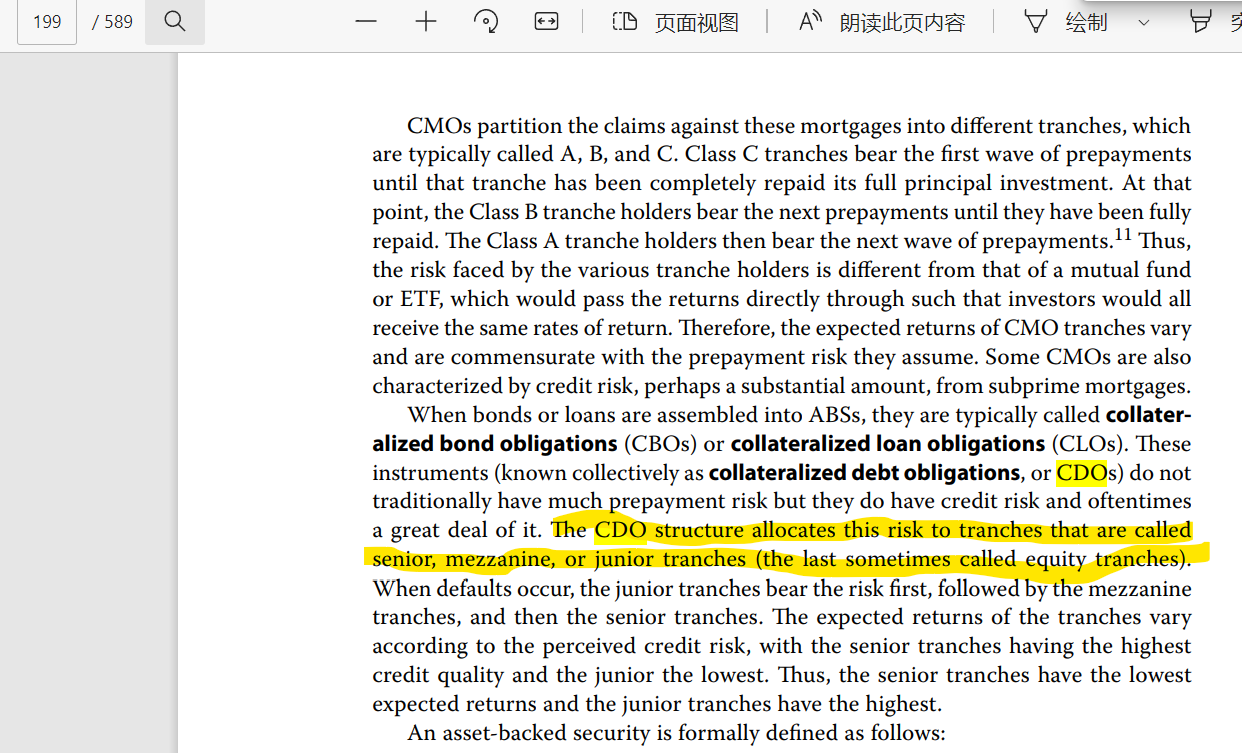

A is correct. The expected returns of the tranches vary according to the perceived credit risk, with the senior tranches having the highest credit quality and the junior tranches the lowest. Thus, the senior tranches have the lowest expected returns and the junior tranches have the highest. The most junior tranche is sometimes called the “equity tranche.”

B is incorrect because the senior tranches in a CDO have the lowest expected returns and the junior (or equity) tranches have the highest.

C is incorrect because the senior tranches in a CDO have the lowest expected returns and the junior (or equity) tranches have the highest. A mezzanine tranche is intermediate between the senior and junior tranches.

中文解析:

A对,各等级的预期收益面临的风险不同而不同,其中最高等级的信用质量最高,次级等级的信用质量最低。因此,优先级的预期收益最低,次级级的预期收益最高。最次要的部分有时被称为“权益部分”。

B错,因为CDO中的高级部分有最低的预期回报,而次级(或股权)部分有最高的。

C错,因为CDO中的高级部分具有最低的预期回报,而次级(或股权)部分具有最高的预期回报。夹层级是介于优先级和次级级之间的。

A选项为什么说 equity 就可以理解为Junior的层级