NO.PZ201601050100001201

问题如下:

Calculate the contribution of foreign currency to the Bhatt account’s total

return. Show your calculations.

选项:

解释:

Currency movements contributed 1.5% to the account’s 7.0% total (US dollar)

return, calculated as follows:

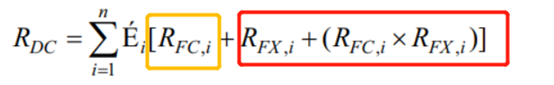

The domestic-currency return (RDC ) on a portfolio of multiple foreign assets is

Where RFC ,i is the foreign-currency return on the ith foreign asset, RFX ,i is the

appreciation of the ith foreign currency against the domestic currency, and Éi

is the weight of the asset as a percentage of the aggregate domestic-currency

value of the portfolio. This equation can be rearranged as

Therefore, the domestic-currency return is equal to the sum of the weighted

asset return, the weighted currency return, and the weighted cross-product

of the asset return and the currency return. The latter two terms explain the

effects of foreign-currency movements on the Bhatt account’s total (US dollar)

return of 7.0%.

The weighted asset return is equal to 5.5%, calculated as follows:

(0.50 × 10.0%) + (0.25 × 5.0%) + [0.25 × (–3.0%)] = 5.5%.

The weighted currency return is equal to 1.5% calculated as follows:

(0.50 × 0.0%) + (0.25 × 2.0%) + (0.25 × 4.0%) = 1.5%.

The weighted cross-product is equal to –0.005%, calculated as follows:

[0.50 × (10.0% × 0.0%)] + [0.25 × (5.0% × 2.0%)] + [0.25 × (–3.0% × 4.0%)] =

–0.005%.

Therefore, the contribution of foreign currency equals 1.5%, calculated as the

7.0% total (US dollar) return less the 5.5% weighted asset return. Alternatively,

the contribution of foreign currency to the total return can be calculated as the

sum of the weighted currency return of 1.5% and the weighted cross-product of

–0.005%:

1.5% + (–0.005%) = 1.495%, which rounds to 1.5%.

中文解析:

本题考察的是外汇投资中return的计算。

表格中给到的currency return是对应单个资产的,而本题中是投资了三个外币资产,因此是一个资产组合,所以涉及到加权平均的过程。

另外需要注意的是“the contribution of foreign currency”是包含了交叉项部分的return的。

老师,如果我们老老实实算,

EURO这个资产用USD计算的收益应该是:(1+5%)*(1+2%)-1=7.1%,因为他的比例是25%,所以最后应该是7.1%*25%=1.775%计算入总portfolio对吧?

同理,Japan资产,用USD计算的收益应该是:(1-3%)*(1+4%)=0.88%,按比例25%计算,最后是0.22%计算入总portfolio return

答案里虽然给了展开式,但是我用最基础的ΣwiR(dc)算并没有省略任何的部分呀,为什么1.775%+0.022%+50%*10%=6.995%而不等于7呢?

另外,问题是问,foreign currency return 对整个portfolio的贡献。 为什么不能理解为[R(dc)-euro]+[R(dc)-japan]对于总体return的贡献呢?