NO.PZ201709270100000304

问题如下:

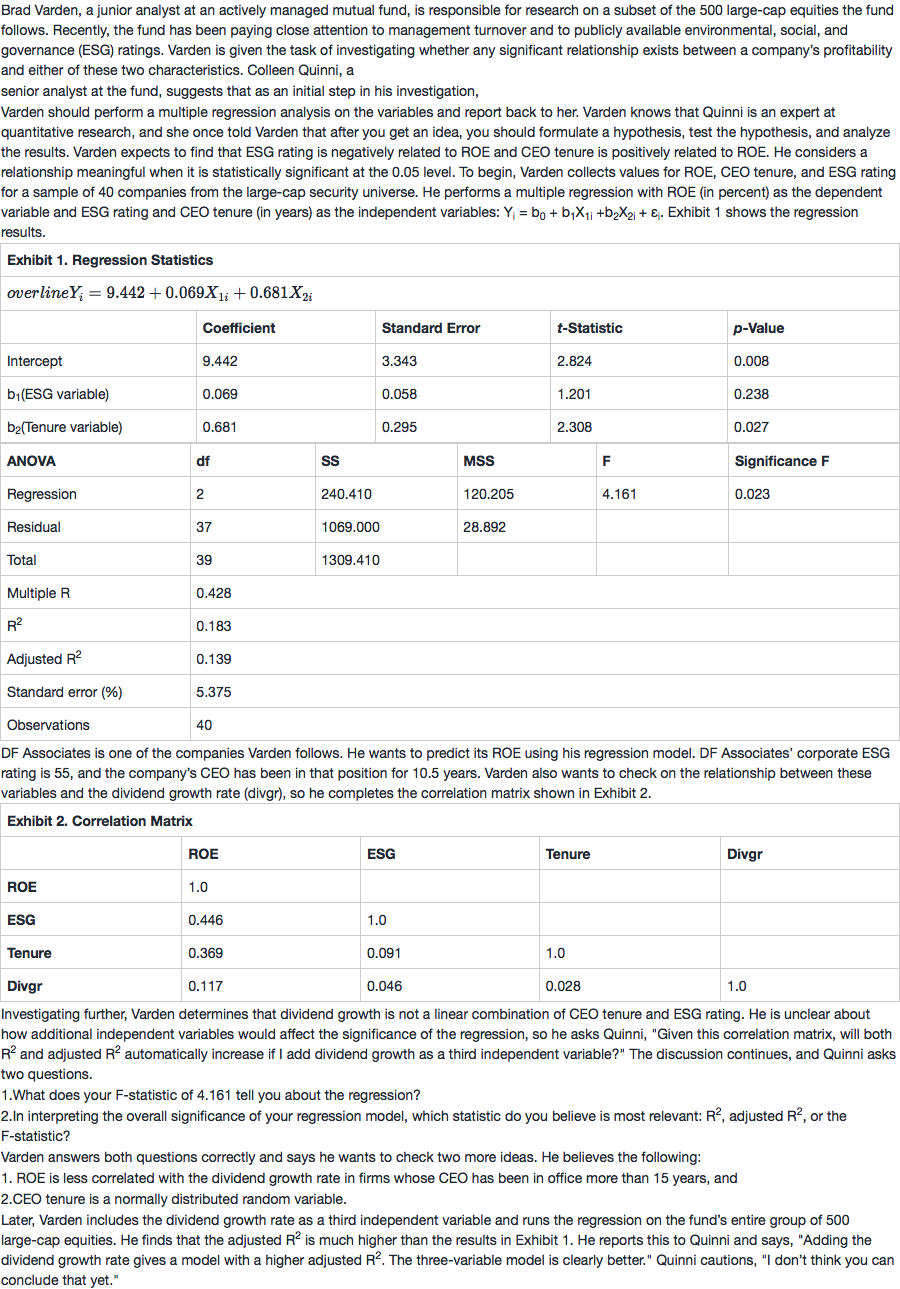

4. Based on Exhibit 1, the predicted ROE for DF Associates is

closest to:

选项:

A. 10.957%.

B. 16.593%.

C. 20.388%.

解释:

C is correct. The regression equation is as follows:

题目原文里面说的这句话Varden expects to find that ESG rating is negatively related to ROE and CEO tenure is positively related to ROE.但是为何公式里面的b1是大于0的呢?