NO.PZ2019052801000050

问题如下:

A US company entered into a one-year currency swap with quarterly reset six months ago. The notional principle is $1,000,000, At the swap’s initiation, the US company receives the notional amount in Australian dollars and pays to the counterparty the notional amount in US dollars. At the swap’s expiration, the US company pays the notional amount in Australian dollars and receives from the counterparty the notional amount in US dollars.The annual fixed swap rates for Australian dollars is 4% and for US dollars is 3.6%.The current spot exchange rate is A$1.2 / $ .

The US term structure is:

-

r(90)=3.58%

- r(180)= 3.74%

- r(90)=3.82%

- r(180)= 4.1%

What is the value of the currency swap to US company?

选项:

A.

$-142,145million.

B.

$142,145million.

C.

$166 ,385.

D.

$-166 ,385.

解释:

C is correct.

考点:货币互换估值.

解析:

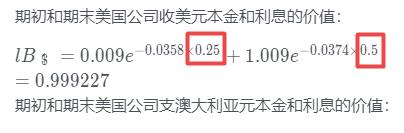

期初和期末美国公司收美元本金和利息的价值:

期初和期末美国公司支澳大利亚元本金和利息的价值:

题干说每季度reset一次,最近是6个月之前,那是站在哪个时间点折现,又要折回什么时候?能画图说明吗