NO.PZ201601200500005004

问题如下:

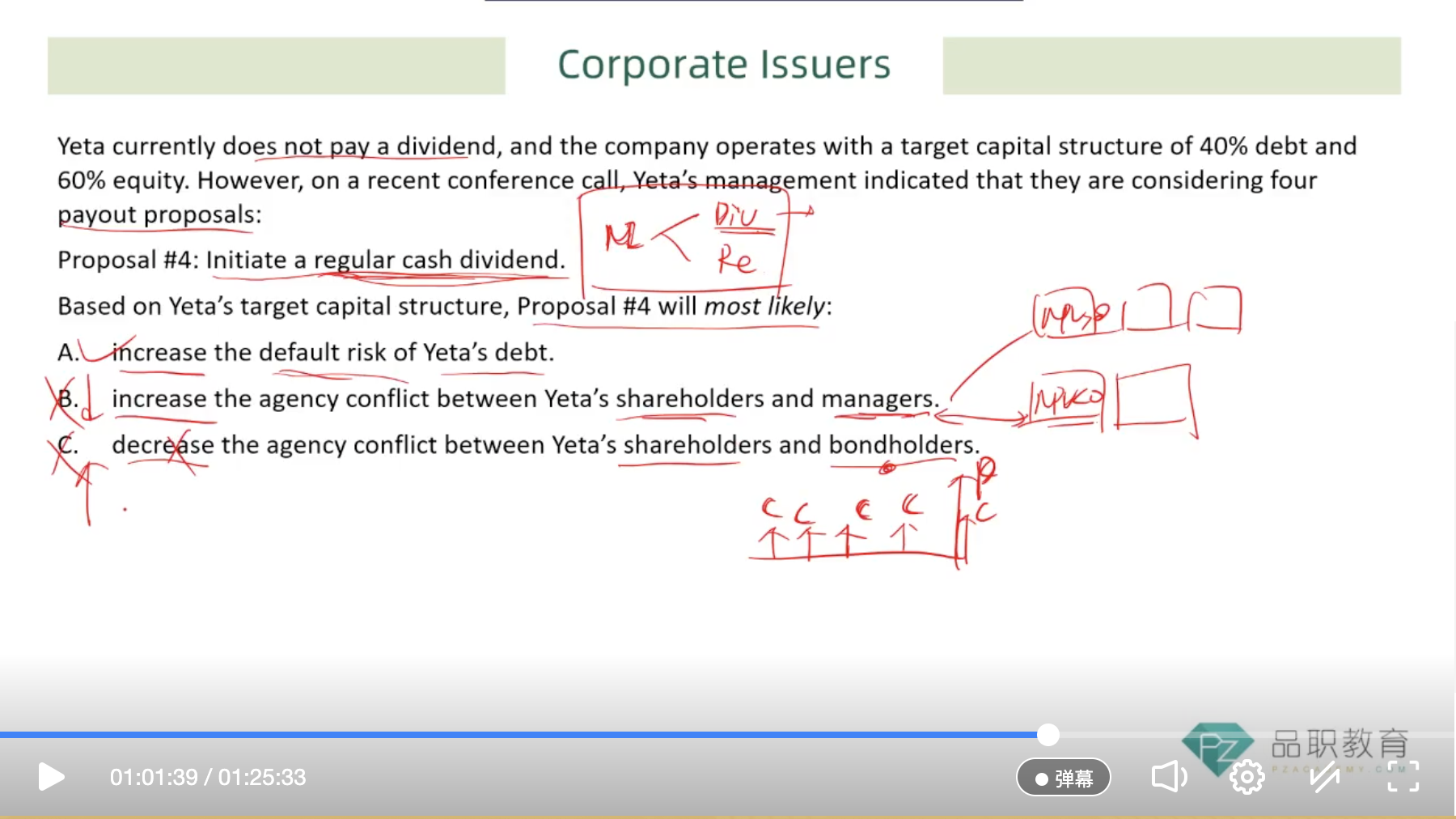

Based on Yeta’s target capital structure, Proposal #4 will most likely

选项:

A.

increase the default risk of Yeta’s debt

B.

increase the agency conflict between Yeta’s shareholders and managers

C.

decrease the agency conflict between Yeta’s shareholders and bondholders

解释:

A is correct. Yeta is financed by both debt and equity; therefore, paying dividends can increase the agency conflict between shareholders and bondholders. The payment of dividends reduces the cash cushion available for the disbursement of fixed required payments to bondholders. All else equal, dividends increase the default risk of debt.

B is incorrect because the agency conflict between shareholders and managers would decrease (not increase) with the payment of dividends. Paying out free cash flow to equity in dividends would constrain managers in their ability to overinvest by taking on negative net present value (NPV) projects.

C is incorrect because paying dividends can increase (not decrease) the agency conflict between shareholders and bondholders. The payment of dividends would reduce the cash cushion available to Yeta for the disbursement of fixed required payments to bondholders. The payment of dividends transfers wealth from bondholders to shareholders and increases the default risk of debt.

选项C错在哪里了呢?谢谢老师