NO.PZ2020021205000011

问题如下:

A stock price is currently 50. Its volatility is 20% per annum. The risk-free rate is 4% per annum with continuous compounding. Use a two-step tree to determine the value of a six-month European call option on the stock with a strike price of 48.

选项:

解释:

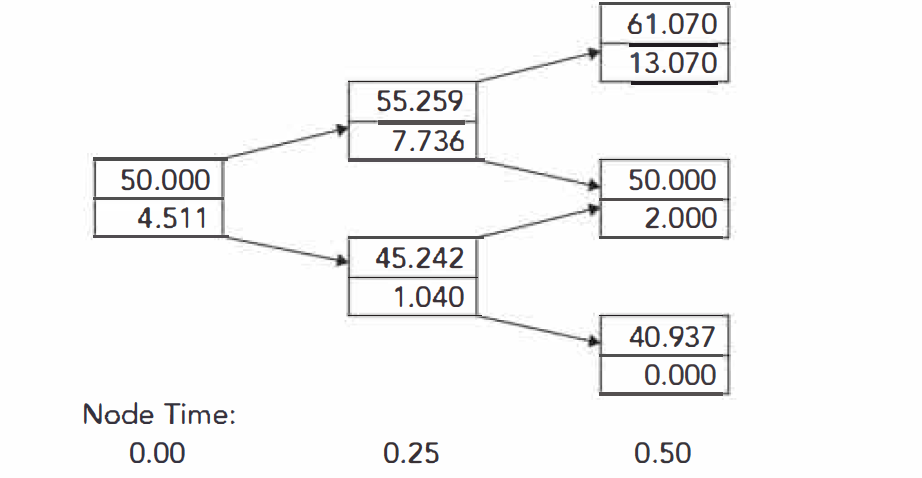

In this case, u = 1.1052, d = 0.9048, and p = 0.5252.

The following two-step tree shows that the value of the

option is 4.511.

请老师帮忙解释一下,或者我应该去第几节看这个知识点呀