NO.PZ2017092702000014

问题如下:

Grandparents are funding a newborn’s future university tuition costs, estimated at $50,000/year for four years, with the first payment due as a lump sum in 18 years. Assuming a 6% effective annual rate, the required deposit today is closest to:

选项:

A.$60,699.

B.$64,341.

C.$68,201.

解释:

B is correct.

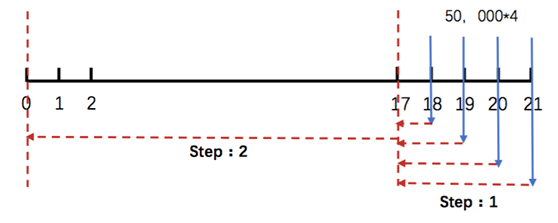

First, find the present value (PV) of an ordinary annuity in Year 17 that represents the tuition costs: = $50,000 × 3.4651 = $173,255.28. Then, find the PV of the annuity in today’s dollars (where FV is future value):

PV0 = $64,340.85 ≈ $64,341.

“with the first payment due as a lump sum in 18 years”这句的意思不是“用18年凑够了这些学费,并且第一次开始交是一次性交”嘛。所以不应该算出FV=17325.88后,理解为N=18,1/Y=6%,PMT=0,然后求直接用计算器求PV嘛。

(如果老师可以用画图说明一下就更好啦~谢谢!)