NO.PZ2016021705000030

问题如下:

Happy Resorts Company currently has 1.2 million common shares of stock outstanding and the stock has a beta of 2.2. It also has $10 million face value of bonds that have five years remaining to maturity and 8 percent coupon with semi-annual payments, and are priced to yield 13.65 percent. If Happy issues up to $2.5 million of new bonds, the bonds will be priced at par and have a yield of 13.65 percent; if it issues bonds beyond $2.5 million, the expected yield on the entire issuance will be 16 percent. Happy has learned that it can issue new common stock at $10 a share. The current risk-free rate of interest is 3 percent and the expected market return is 10 percent. Happy's marginal tax rate is 30 percent. If Happy raises $7.5 million of new capital while maintaining the same debt-to-equity ratio, its weighted average cost of capital is closest to:

选项:

A.14.5 percent.

B.15.5 percent.

C.16.5 percent.

解释:

B is correct.

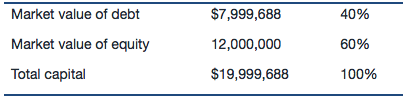

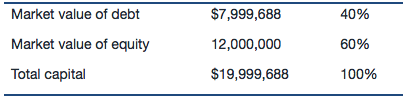

Capital structure:Market value of debt: FV = $10,000,000, PMT = $400,000, N = 10,I/YR = 13.65%/2. Solving for PV gives the answer $7,999,688.Market value of equity: 1.2 million shares outstanding at $10 = $12,000,000

To raise $7.5 million of new capital while maintaining the same capital structure, the company would issue $7.5 million × 40% = $3.0 million in bonds, which results in a before-tax rate of 16 percent.

rd(1 − t) = 0.16(1 − 0.3) = 0.112 or 11.2%

re = 0.03 + 2.2 (0.10 − 0.03) = 0.184 or 18.4%

WACC = [0.40(0.112)] + [0.6(0.184)] = 0.0448 + 0.1104 = 0.1552 or 15.52%

Happy Resorts Company currently has 1.2 million common shares of stock outstanding and the stock has a beta of 2.2. It also has $10 million face value of bonds that have five years remaining to maturity and 8 percent coupon with semi-annual payments, and are priced to yield 13.65 percent. If Happy issues up to $2.5 million of new bonds, the bonds will be priced at par and have a yield of 13.65 percent; if it issues bonds beyond $2.5 million, the expected yield on the entire issuance will be 16 percent. Happy has learned that it can issue new common stock at $10 a share. The current risk-free rate of interest is 3 percent and the expected market return is 10 percent. Happy's marginal tax rate is 30 percent. If Happy raises $7.5 million of new capital while maintaining the same debt-to-equity ratio, its weighted average cost of capital is closest to:

您的回答A, 正确答案是: B

A

不正确14.5 percent.

B

15.5 percent.

C

16.5 percent.

To raise $7.5 million of new capital while maintaining the same capital structure, the company would issue $7.5 million × 40% = $3.0 million in bonds, which results in a before-tax rate of 16 percent.

rd(1 − t) = 0.16(1 − 0.3) = 0.112 or 11.2%

re = 0.03 + 2.2 (0.10 − 0.03) = 0.184 or 18.4%

WACC = [0.40(0.112)] + [0.6(0.184)] = 0.0448 + 0.1104 = 0.1552 or 15.52%

问题1

7,999,688我算出来了,1.2millions of common shares of stock是指市值还是股票数量,我看老师回答里面有人问,老师回答是股票数量,但这里奇怪,Happy has learned that it can issue new common stock at $10 a share,这里应该用的是债券和股票的market value对吗?,发行价10元是primary market,二级市场可高可低,一级市场的股票价格算market value of stock price吗?

问题2:我没看懂后面40% 60%,股债比应该是7999688/12000000把?这个结果是0.66,和40% 60%没关系?这数字哪里来的?

问题3:If Happy raises $7.5 million of new capital while maintaining the same debt-to-equity ratio。那就是股债比和之前一样是0.66? new capital指的是股票+债券对吗?因为这里没有明确说raise 啥

问题4:16%不是entire issuance吗?应该是债加股才对?这里答案怎么用到债券上了?

谢谢,请讲下求出7999688以后的解题思路