NO.PZ2021091701000032

问题如下:

Which of the following is least likely to be true with respect to optimal capital

structure?

选项:

A.The optimal capital structure minimizes WACC.

The optimal capital structure is generally close to the target capital

structure

Debt can be a significant portion of the optimal capital structure because of

the tax-deductibility of interest.

解释:

B is correct. A company’s optimal and target capital structures may be very

different from one another.

可以解释下C选项吗?后半句没明白。他的意思是抵税可以使得企业价值上升?

PPT 125页找到一句话:

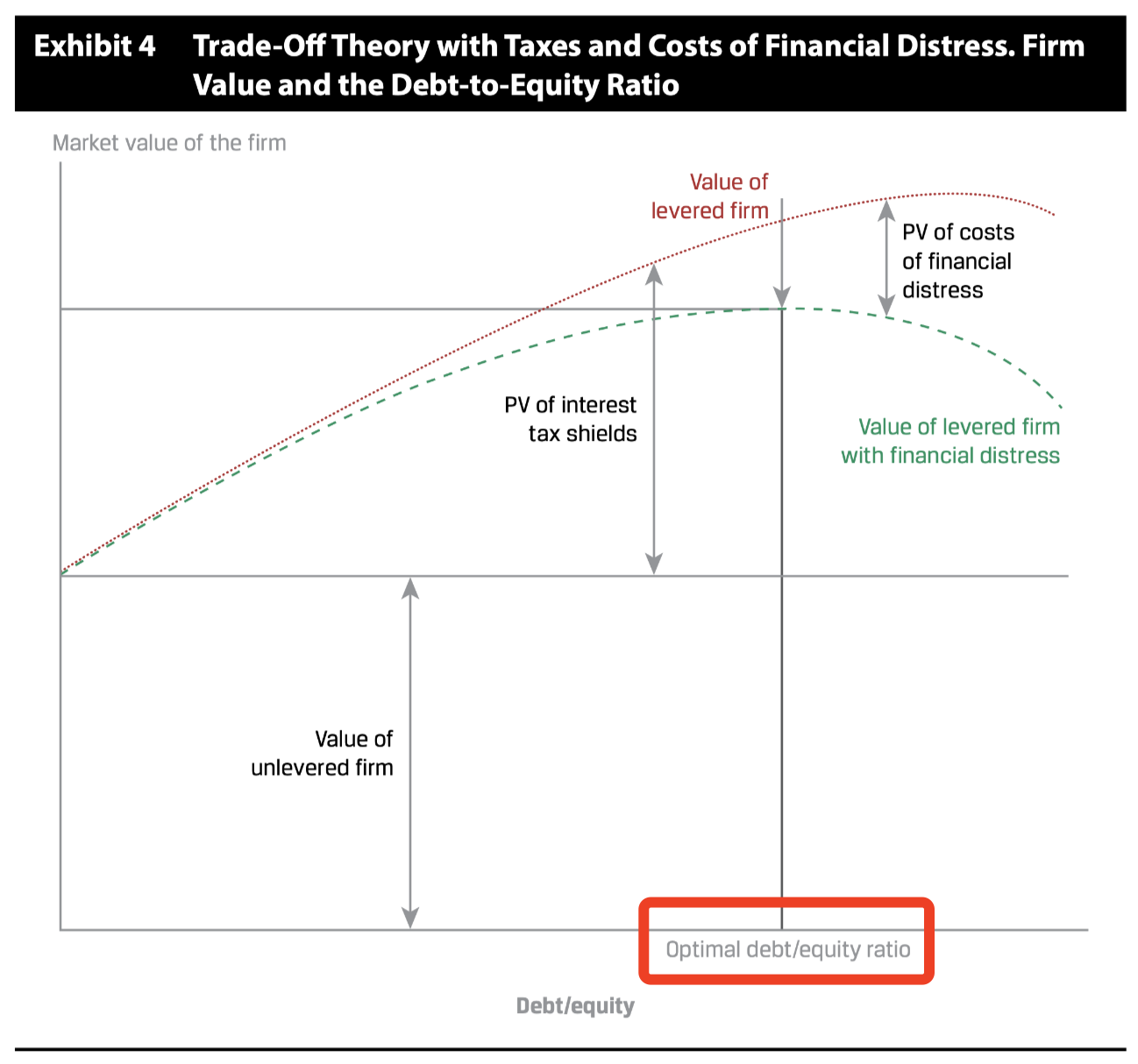

the value enhancing effect from tax dedectibility of interest must be compared against the value-reducing impact of the cost of financial distress.

也没明白。