NO.PZ2018062019000014

问题如下:

A three-year investment requires an initial outlay of £1,000. It is expected to provide three year-end cash flows of £200 plus a net salvage value of £700 at the end of three years. Its internal rate of return (IRR) is closest to:

选项:

A.10%

B.11%

C.20%

解释:

B is correct.

IRR is determined by setting the net present value equal to zero for the cash flows shown in the table.

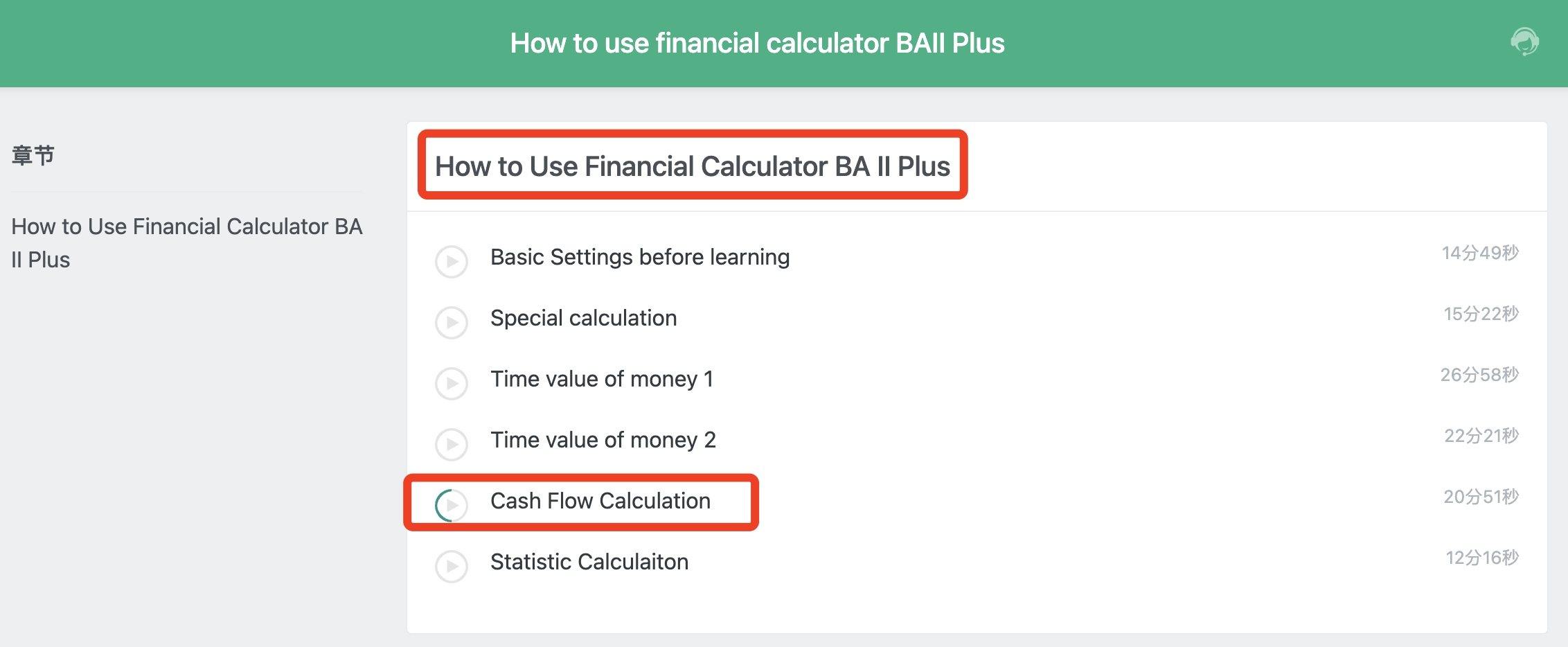

我对答案讲解的没问题,但问题怎么求IRR?

NPV=0=-1000+200/(1+IRR)+200/(1+IRR)^2+900/(1+IRR)^3 ? 手算吗?太难了吧?可以用计算器吗?问题怎么用计算器计算呢?谢谢,在计算器哪里可以输入NPV=0呢?