NO.PZ2018110601000007

问题如下:

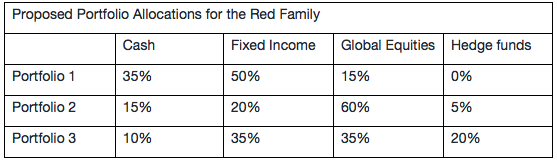

The Red family has the investable assets of $1.2 million. Tom, the portfolio manager of the Red family, finds that a portfolio of 70% global equities and 30% bonds reflects an appropriate balance of expected return and risk for the Red with respect to a 25-year time horizon for the moderately important goals. Tom follows a goal-based approach to asset allocation and offers three possible portfolios to consider.

The Red express a high probability of success to fund a family foundation in 25 years, which has an estimated present value of $400,000. Which portfolio best meets the Reds’ goal to fund the family foundation?

选项:

A.Portfolio 1

B.Portfolio 2

C.Portfolio 3

解释:

B is correct.

考点:goal-based approach.

解析:Portfolio 1中现金和债券占比过高,而family foundation有长达25年的实现期限,所以A可以排除。

另一方面,family foundation的实现意愿为high probability of success , 重要程度较高 ,但不是最高程度的,因此可以承担一定风险。 Portfolio 2相比3股票的占比更高,因此有一定的价值成长空间。而Portfolio 3中hedge fund占比最高,风险最大,对于 foundation的成功概率会有影响。

什么条件下,会选择hedge fund占比较大的portfolio?