NO.PZ2016031201000051

问题如下:

Combining a protective put with a forward contract generates equivalent outcomes at expiration to those of a:

选项:

A.fiduciary call.

B.long call combined with a short asset.

C.forward contract combined with a risk-free bond.

解释:

A is correct.

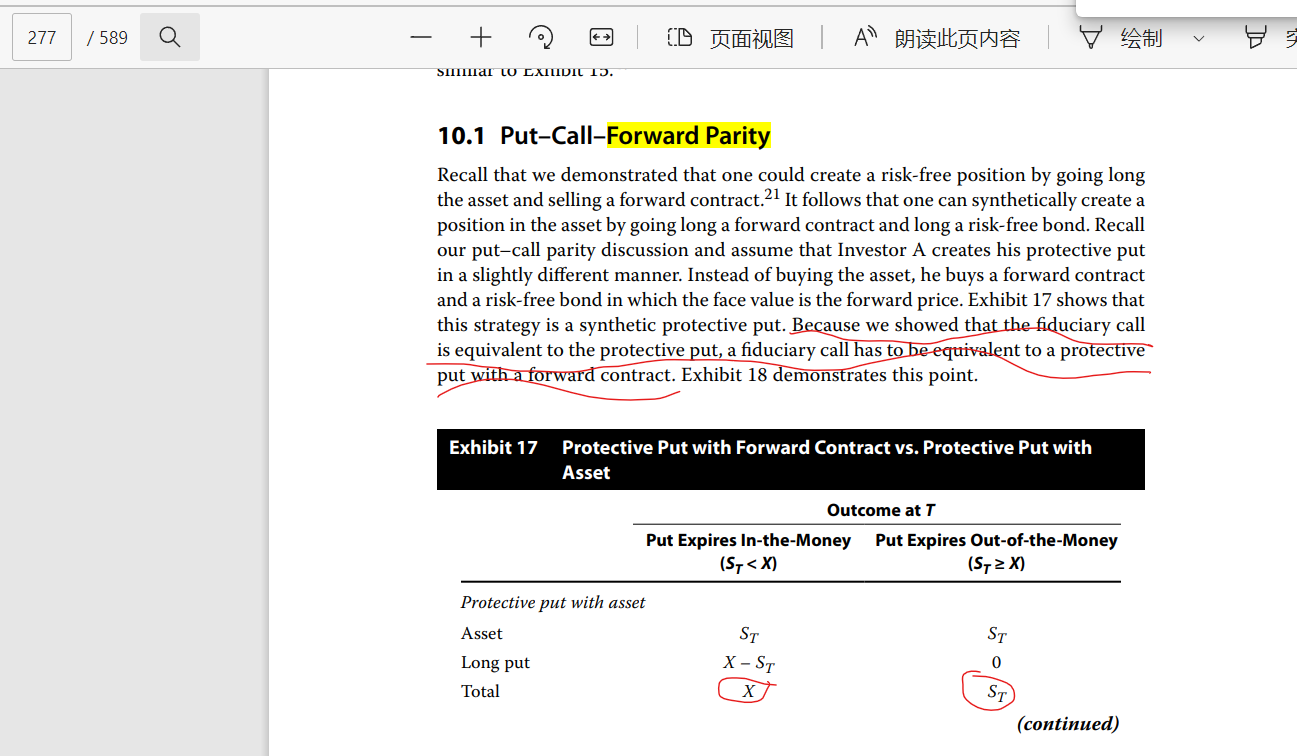

Put−call forward parity demonstrates that the outcome of a protective put with a forward contract (long put, long risk-free bond, long forward contract) equals the outcome of a fiduciary call (long call, long risk-free bond). The outcome of a protective put with a forward contract is also equal to the outcome of a protective put with asset (long put, long asset).

中文解析:

本题考察的是put-call-forward parity,它的推导逻辑如下:

因为 long stock+short forward 可以合成一个无风险头寸,即Long risk-free bond(注意这里的bond面值为远期合约价格,即FP)

将该等式变形可得: long stock=long forward+long risk-free bond,

所以proctive put with asset= long put+long stock中的stock可以用上面粗体的公式替代,可得:

protective put with forward= long put+long forward +long risk-free bond

我们发现无论期末股票价格如何变化,protective put with forward的payoff与fiduciary call是一样的。具体过程如下图:

这里再强调一遍,protective put with forward中的bond面值为FP,而fiduciary call中的bond面值为X。

put call forward parity不应该是C+K=P+FORWARD+BOND吗,题干只说了forward和put,不应该还少了一个bond吗