NO.PZ202110280100000101

问题如下:

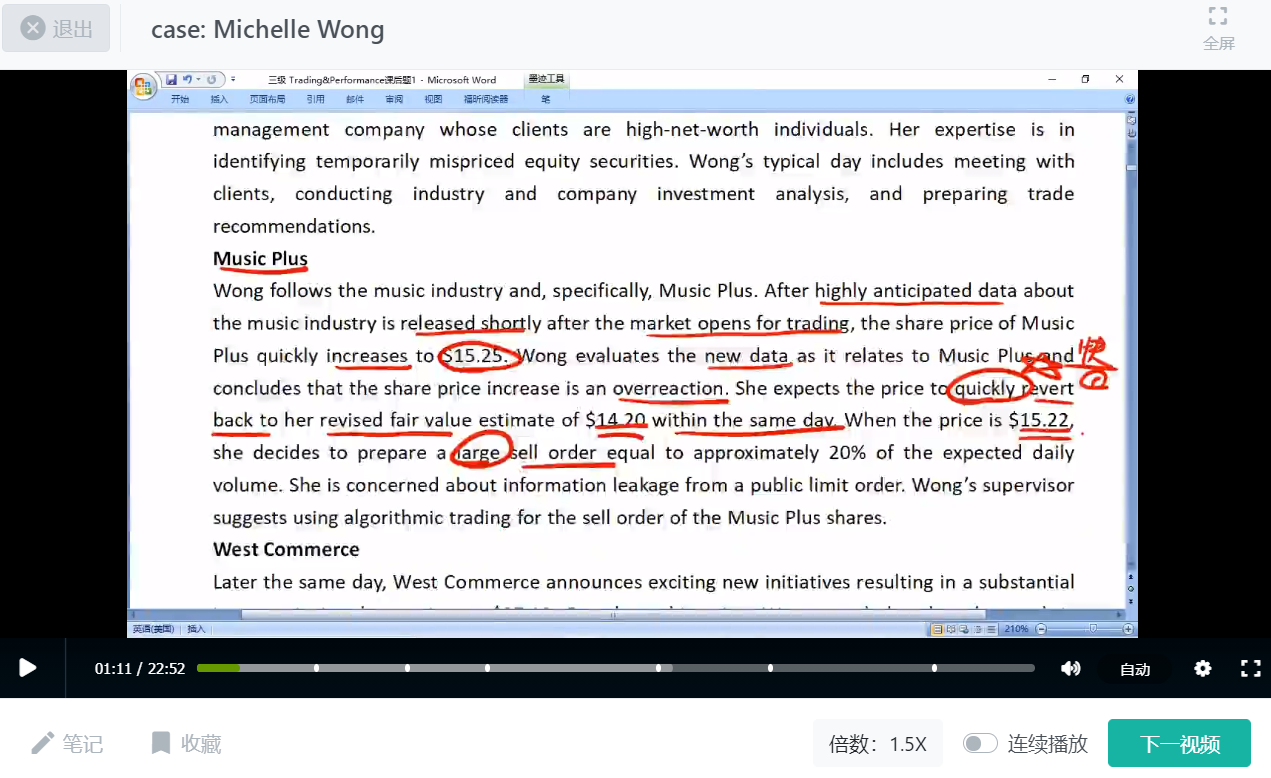

The most appropriate price benchmark for the sell order of Music Plus shares is the:

选项:

A.closing price. B.decision price. C.time-weighted average price (TWAP).解释:

B is correct. A pre-trade benchmark is often specified by portfolio managers who are buying or selling securities seeking short-term alpha by buying undervalued or selling overvalued securities in the market. Wong believes the stock of Music Plus is overvalued and is seeking short-term alpha with the sell order. Since Wong has an exact record of the price of Music Plus when the decision for the sell order was made ($15.22), the decision price is the most appropriate pre-trade benchmark for the sell order.

A is incorrect because a closing price is a post-trade benchmark and is typically used by index managers and mutual funds that wish to execute transactions at the closing price for the day. A portfolio manager who is managing tracking error to a benchmark will generally select a closing price benchmark since the closing price is the price used to compute the fund’s valuation and resulting tracking error to the benchmark. This is not the objective of the sell order of Music Plus. Wong’s objective is to execute the sell trade as quickly as possible to capture the short-term alpha she identified. She expects the price of Music Plus to revert back to $14.20 within the day. Therefore, she will need to execute her trading prior to the price when the market closes; thus, the closing price is not the appropriate price benchmark.

C is incorrect because a TWAP benchmark price is used when portfolio managers wish to exclude potential trade outliers. Trade outliers may be caused by trading a large buy order at the day’s low or a large sell order at the day’s high. Therefore, a TWAP benchmark is not appropriate for the sell order of Music Plus because Wong would like to execute a large sell order near the day’s high price, which would likely be an outlier.

请问这道题从哪里看出来它trade with urgent的?