NO.PZ2021091701000004

问题如下:

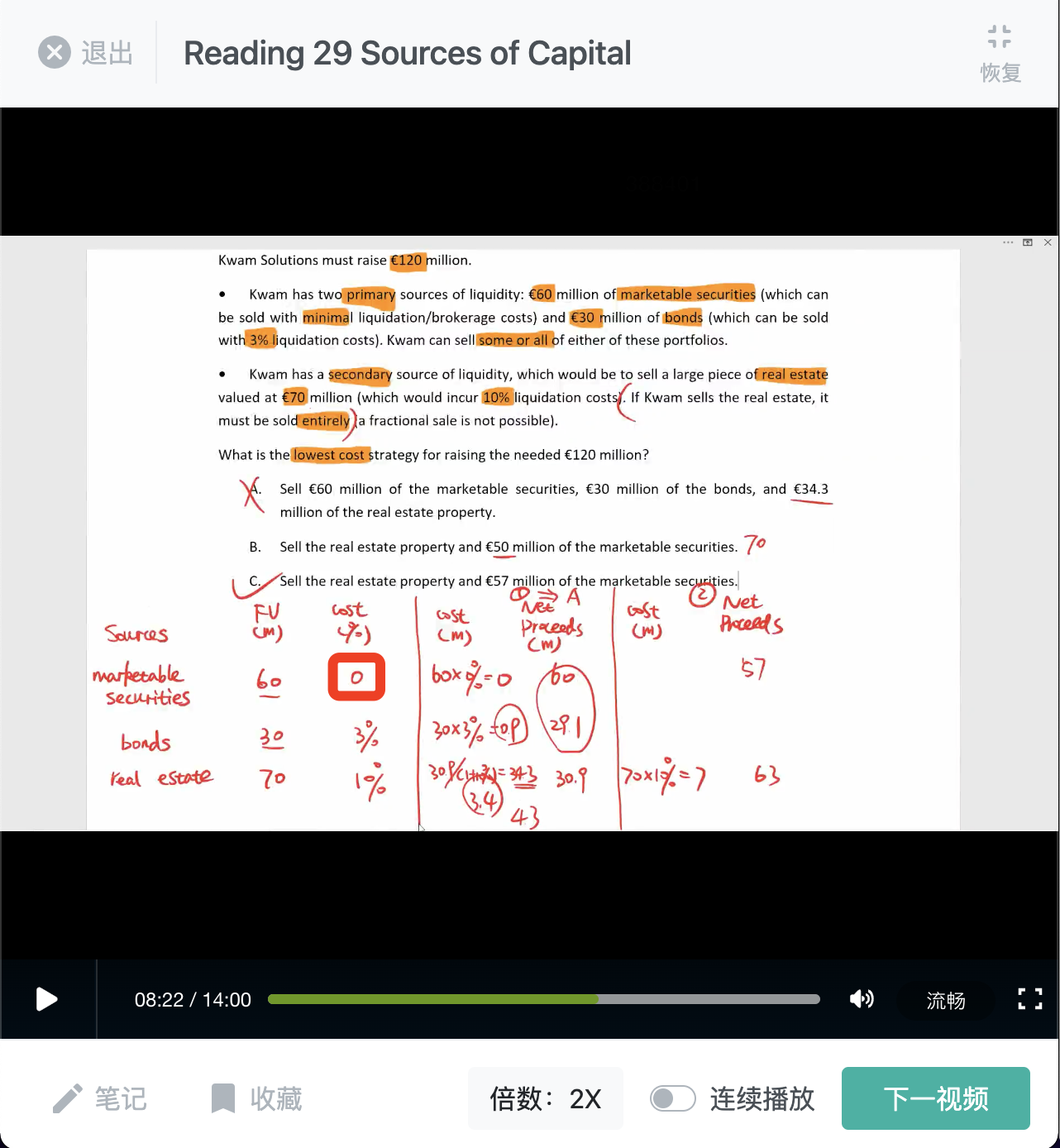

Kwam Solutions must raise €120 million. Kwam has two primary sources of liquidity: €60 million of marketable securities (which can be sold with minimal liquidation/brokerage costs) and €30 million of bonds (which can be sold with 3% liquidation costs). Kwam can sell some or all of either of these portfolios. Kwam has a secondary source of liquidity, which would be to sell a large piece of real estate valued at €70 million (which would incur 10% liquidation costs). If Kwam sells the real estate, it must be sold entirely (a fractional sale is not possible). What is the lowest cost strategy for raising the needed €120 million?

选项:

A.Sell €60 million of the marketable securities, €30 million of the bonds, and

€34.3 million of the real estate property.

Sell the real estate property and €50 million of the marketable securities.

Sell the real estate property and €57 million of the marketable securities.

解释:

C is correct. Kwam must sell the entire real estate property because the two primary sources (marketable securities and bonds) will not raise the needed €120 million. A is incorrect because it assumes a fractional real estate sale. The real estate sale will raise a net of €63 million (€70 million minus 10% liquidation expenses). To raise the rest of the funds needed (€120 million - €63 million = €57 million), Kwam can sell €57 million of marketable securities, which have minimal liquidation/brokerage costs.

题干:“€60 million of marketable securities (which can be sold with minimal liquidation/brokerage costs) ”

1.“minimal liquidation/brokerage costs”如何理解?

2.该项证券的成本如何计算?