NO.PZ201601050100001701

问题如下:

Based on Exhibit 1, the number of Treasury futures contracts Whitacre should

sell to fully hedge Portfolio A is closest to:

选项:

A.650.

743.

1,026.

解释:

B is correct.

The basis point value of Portfolio A (BPVP) is $130,342.94, and

the basis point value of the cheapest-to-deliver bond (BPVCTD) is $127.05 with

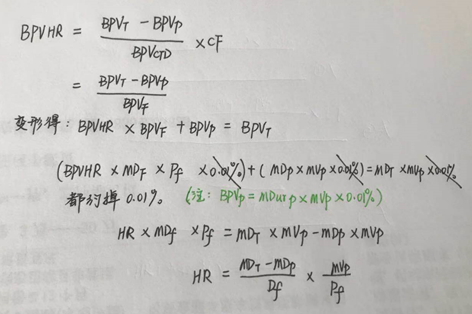

a conversion factor of 0.72382. The basis point value hedge ratio (BPVHR), in

the special case of complete hedging, provides the number of futures contracts

needed, calculated as follows:

中文解析:

本题考察的是使用债券期货合约调节组合的duration。

题干信息说想要完全对冲掉利率的影响,因此BPVT=0,直接带入公式

,计算即可。

注意最后的结果742.58需要四舍五入取整数,负号代表short,因此需要sell 743份合约。

BPV为什么不等于MD*MV*1bp