NO.PZ2019012201000083

问题如下:

let’s consider the performance of the Russell 1000 between February 1990 and December 2016. The monthly arithmetic return was 0.878%, and the volatility, as measured by the standard deviation of return, was 4.199%. What is the geometric return?

选项:

A.0.79%

B.0.62%

C.0.54%

解释:

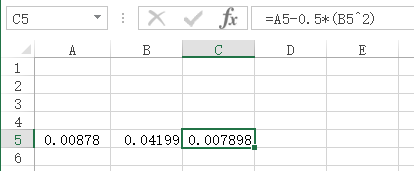

We know that the expected compounded/geometric return of an asset (Rg) is approximately related to its expected arithmetic/periodic return (Ra) and its expected volatility (σ):

0.878%-(0.04199^2/2)=0.8771又或者0.878%-(4.199^2/2)=-7.938,后者是负数明显是错误的。麻烦解释一下。