NO.PZ2020021205000029

问题如下:

The current exchange rate for a currency is 1.2000 and the volatility of the exchange rate is 10%. Calculate the value of a call option to buy 100 units of the currency in two years at an exchange rate of 1.2500. The domestic and foreign risk-free interest rates are 3% and 5%, respectively.

解释:

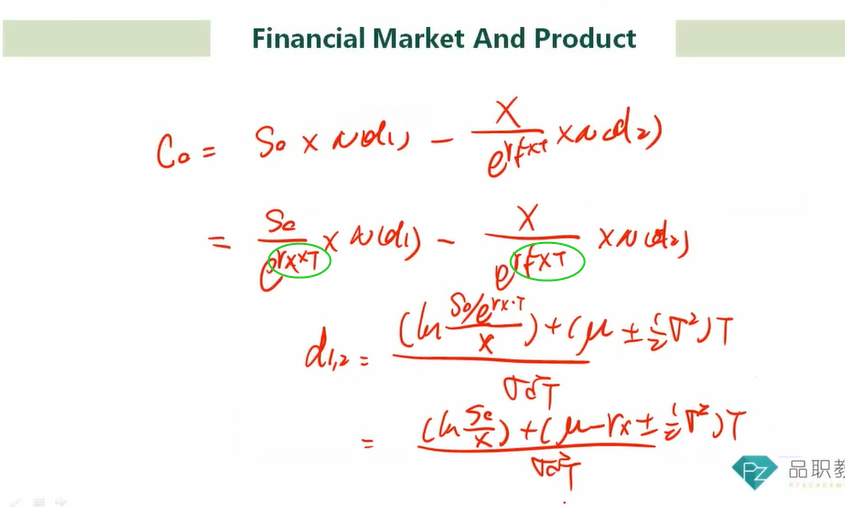

In this case, S0 = 1.2000, K = 1.2500, r = 0.03,

rf = 0.05, u = 0.1, and T = 2, and Equation (15.10)

gives

d,== -0.5008

d2 == -0.6422

C = 1.2OOON(-O.5OO8) - 1.25OON(-O.6422)= 0.028

This is the value of an option to buy one unit of the currency. The value of an option to buy 100 units is 2.8.

汇率互换不是要把外国的利率当时分红来处理,S0应该*e的-(r-q)T吧?为什么是5%呢