NO.PZ2020042003000024

问题如下:

Which of the following statement about

repurchase agreements is NOT correct?

选项:

A. Repurchase agreements or repos are matched

pairs of the spot sale and forward repurchase of a security.

The forward repurchase price of the security

is determined at the end of the agreement.

Repo investments pay a short-term rate without

sacrificing much liquidity or incurring significant default risk.

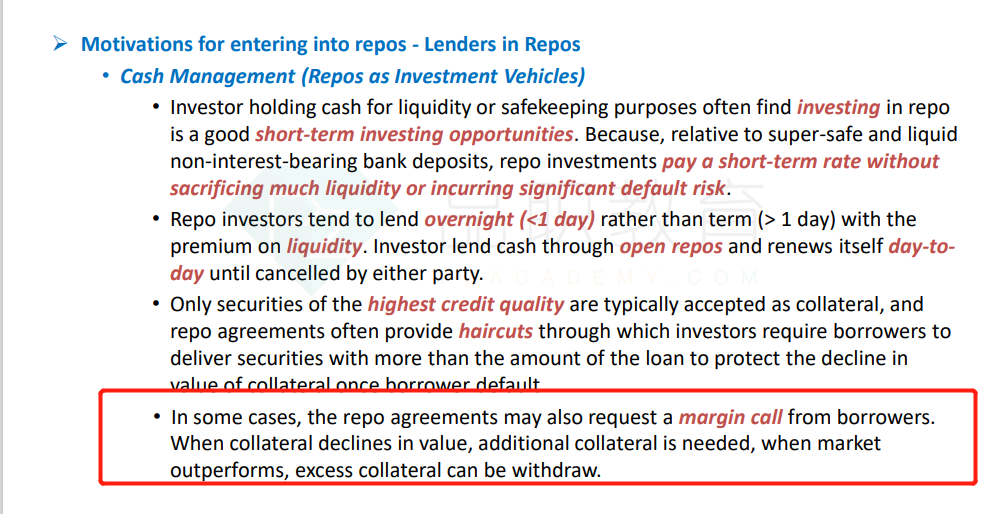

In some cases, the repo agreements may also request a margin call from borrowers. When collateral declines in value, additional collateral is needed, when market outperforms, excess collateral can be withdrawn.

解释:

考点:对Repurchase Agreements的理解

答案:选项B描述错误,本题选B

解析:

B选项错误,在Repos中,未来的Repurchase price在期初就已约定好:Both the spot

and forward price are agreed now, and the difference between them implies an

interest rate.

回购协议中不是lender方made margin call吗?怎么是borrower呢?麻烦老师解释一下,谢谢!