NO.PZ201803130100000201

问题如下:

Based on Exhibit 1 and the risk aversion coefficient, the preferred asset allocation for Perkins is:

选项:

A.Asset Allocation A.

B.Asset Allocation B.

C.Asset Allocation C.

解释:

C is correct.

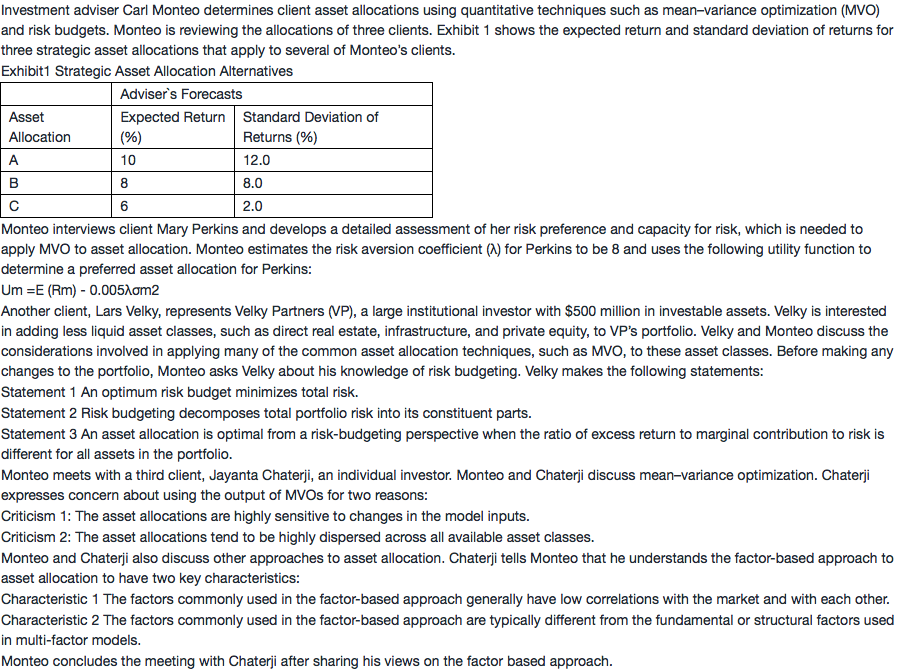

The risk aversion coefficient (λ) for Mary Perkins is 8. The utility of each asset allocation is calculated as follows:

Asset Allocation A:UA = 10.0% – 0.005(8)(12%)2= 4.24%

Asset Allocation B:UB = 8.0% – 0.005(8)(8%)2= 5.44%

Asset Allocation C:UC = 6.0% – 0.005(8)(2%)2= 5.84%

Therefore, the preferred strategic allocation is Asset Allocation C, which generates the highest utility given Perkins’s level of risk aversion.

我A B C 算出来的效用分别是9.94%、7.97%以及6%?