NO.PZ201909280100000908

问题如下:

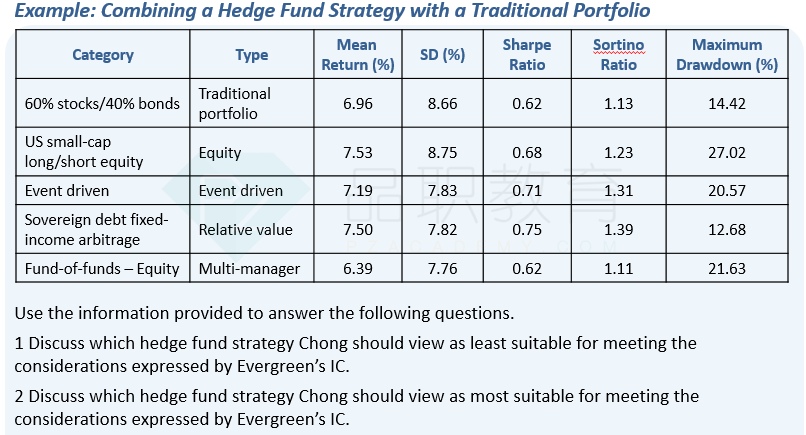

Based on the IC’s primary considerations for a

combined portfolio, which simulated hedge fund strategy portfolio in Exhibit 1

creates the most suitable combined portfolio?

选项:

A.Merger arbitrage B.Systematic futures C.Equity market neutral解释:

C is correct. The

equity market-neutral strategy makes for a combined portfolio that has a

standard deviation below the maximum specified and has the highest Sortino

ratio.

The primary

consideration is that the variance of the combined portfolio must be less than

90% of that of the current portfolio. Since variance is the square of standard

deviation, the maximum variance allowed is

And standard deviation is the

square root of variance, so the maximum standard deviation allowed is

All three portfolios are below

the maximum specified variance.

The next consideration is that

the portfolio should maximize the risk-adjusted return with the expectation of

large negative events. For hedge fund strategies with large negative events,

the Sortino ratio is a more appropriate measure of risk-adjusted return than

the Sharpe ratio. The Sharpe ratio measures risk-adjusted performance, where

risk is defined as standard deviation, so it penalizes both upside and downside

variability. The Sortino ratio measures risk-adjusted performance, where risk

is defined as downside deviation, so it penalizes only downside variability

below a minimum target return. Of the portfolios that meet the variance

requirement, the one with the highest Sortino ratio is the portfolio with the

equity market-neutral allocation, with a Sortino ratio of 1.80. Therefore, the

portfolio with the equity market-neutral allocation is the most suitable

portfolio for the considerations specified by the IC.

A is incorrect because the

portfolio with an allocation to the merger arbitrage hedge fund strategy, while

meeting the variance requirement, has a lower Sortino ratio (1.35) than the

portfolio with an allocation to the equity market-neutral hedge fund strategy

(1.80). Although the portfolio with the merger arbitrage allocation has the

lowest value of maximum drawdown (5.60), the relevant measure of downside risk

is the Sortino ratio. As a result, the portfolio with the equity market-neutral

allocation is the most suitable portfolio given the considerations specified by

the IC.

B is incorrect because the

portfolio with an allocation to the systematic futures hedge fund strategy,

while meeting the variance requirement, has a lower Sortino ratio (1.68) than

the portfolio with an allocation to the equity market-neutral hedge fund

strategy. As a result, the portfolio with the equity market-neutral allocation

is the most suitable portfolio given the considerations specified by the IC.

The equity market-neutral strategy使得组合投资组合的标准差低于指定的最大值并且具有最高的 Sortino 比率。

客户主要考虑的是合并后的投资组合的方差必须小于当前投资组合的 90%。由于方差是标准偏差的平方,因此允许的最大方差为

标准差是方差的平方根,所以允许的最大标准差是

所有三个投资组合都低于最大指定方差。所以第一条都满足。

下一个考虑是投资组合应该在预期出现大的负面事件的情况下最大化风险调整后的回报。对于具有较大负面事件的对冲基金策略,与夏普比率相比,Sortino 比率是一种更合适的风险调整回报指标。夏普比率衡量风险调整后的绩效,其中风险被定义为标准差,因此它对向上(就是价格变高)的波动和向下(就是价格变低)的波动都作为分母纳入计算。 Sortino 比率衡量风险调整后的绩效,其中风险被定义为下行偏差,因此它仅考察低于最低目标回报的下行波动。在满足方差要求的投资组合中,Sortino比率最高的是The equity market-neutral strategy,Sortino比率为1.80。因此,The equity market-neutral strategy的投资组合是最适合指定考虑因素的投资组合。

这道题考的什么知识点?