NO.PZ2021061002000045

问题如下:

Which of the following

statements about put–call–forward parity is incorrect?

选项:

A.Put–call–forward parity is

based on the assumption that arbitrage is impossible in the spot, forward and

options markets.

It is required to long a

forward contract and a risk- free bond with the face value of F0 (T)

The cost of the fiduciary call may not

equal the cost of the synthetic protective put,

解释:

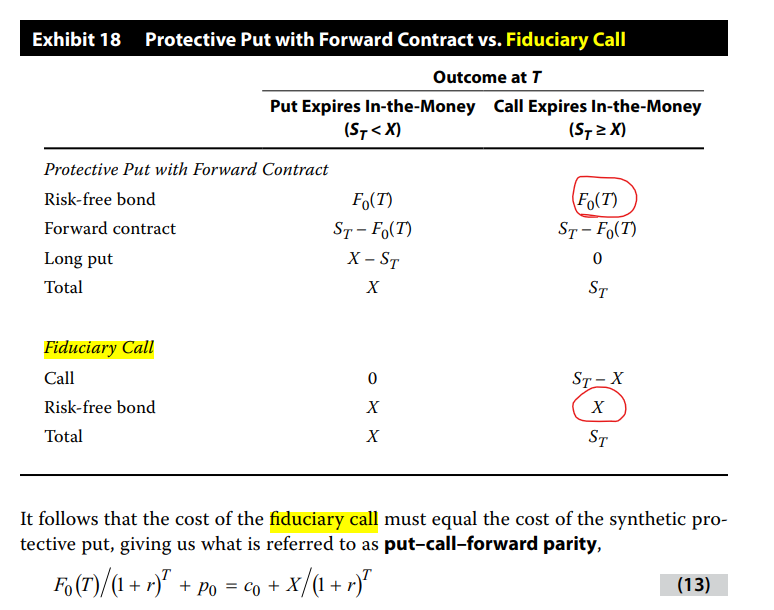

C is correct

本题需要选出表述错误的选项,只有C是错误的,因为fiduciary call的成本= synthetic protective put的成本。

Put–call–forward parity基于在现货、远期和期权市场内不可能进行套利的假设。A 表述是正确的,不能选。

synthetic protective put要求long put,long forward,long risk-free bond,其中bond的面值为F0 (T)。B表述正确,不能选。

如题