NO.PZ2018111302000052

问题如下:

There are two statements on PE investment.

Statement 1: VC firms tend to invest in companies with predicable cash flows and experienced management teams.

Statement 2: Buyout firms tend to invest in companies with high EBITDA or EBIT growth and where an exit is fairly predictable.

Which statement is correct?

选项:

A.Only statement 1.

B.Only statement 2.

C.Both statement 1 and statement 2.

解释:

B is correct.

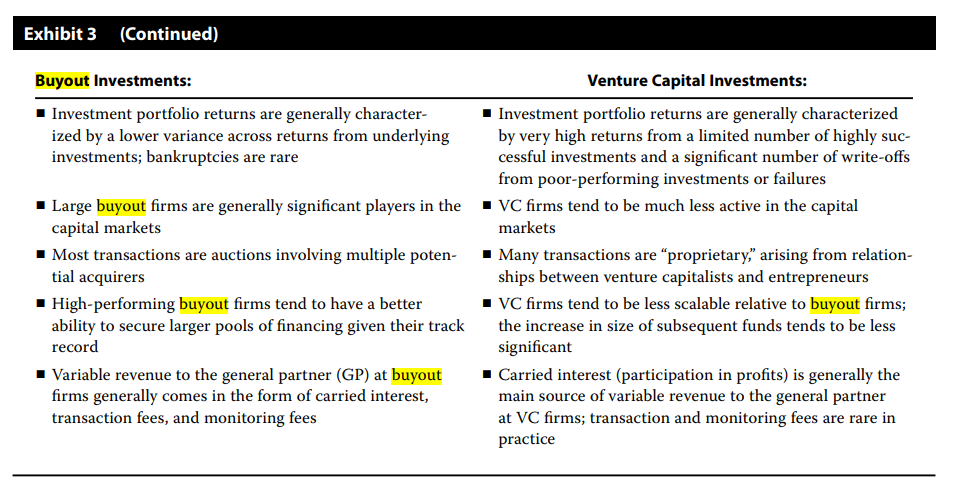

考点:VC和Buyout区别

解析:并购私募通常投资的是现金流很好预期、盈利性提升(EBITDA/EBIT快速增长)、管理团队富有经验的公司,退出的可预见性也比较高,而VC私募通常都是投资于早期新技术公司,销售收入不稳定,cash flow的预测性低,管理层是比较有经验的创业者,但是由于早期公司很小,退出的可预见性偏低。所以statement 1当中关于现金流的说法是错误的。

那么我们投资VC,应该通过哪些因素去投呢