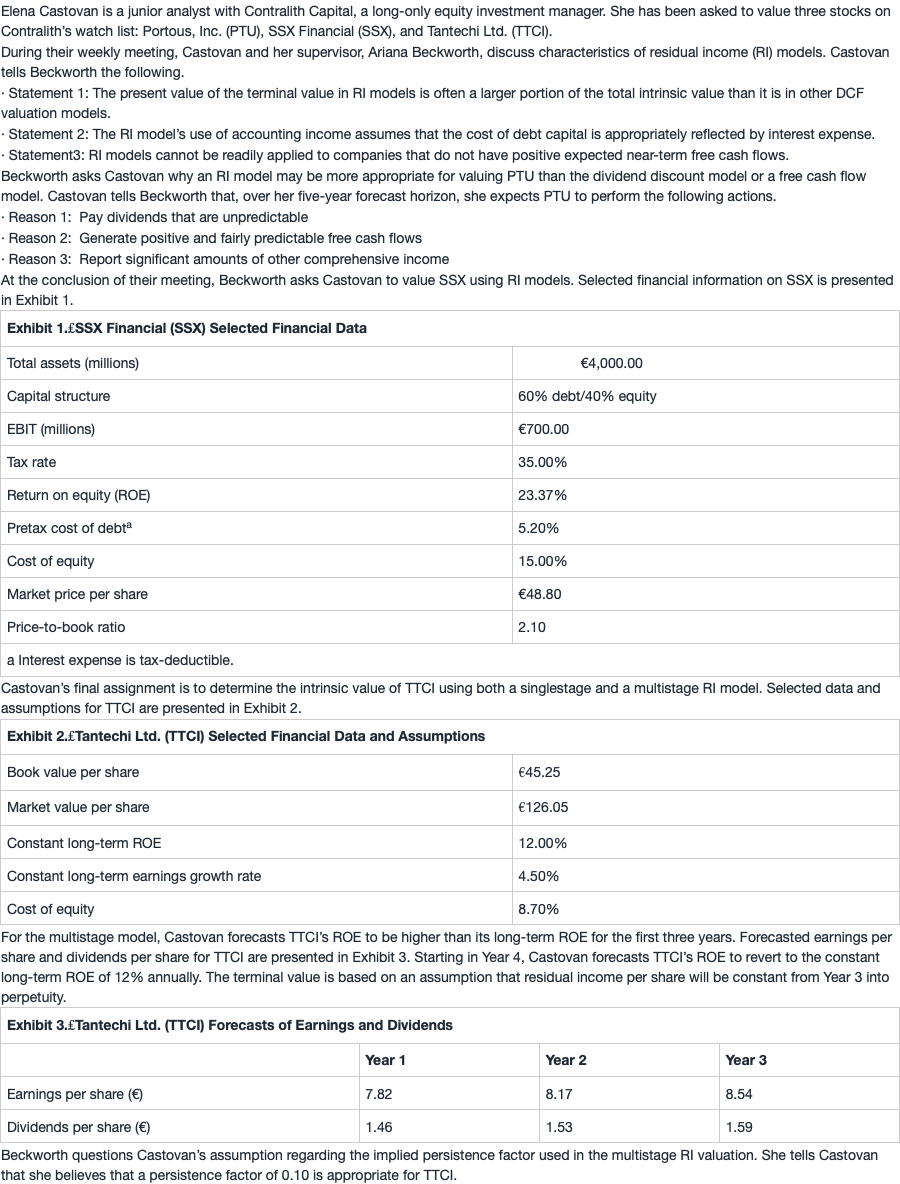

NO.PZ201710200100000404

问题如下:

4. Based on Exhibit 1, residual income for SSX is closest to:

选项:

A.€40.9 million.

B.€90.2 million.

C.€133.9 million.

解释:

C is correct.

The residual income can be calculated using net income and the equity charge or using net operating profit after taxes (NOPAT) and the total capital charge. Residual income = Net income – Equity charge

Calculation of Net Income (values in millions):

Equity charge = Total assets × Equity weighting × Cost of equity

Equity charge = €4,000 million × 0.40 × 0.15 = €240 million

Therefore, residual income = €373.9 million – €240 million = €133.9 million.

Alternatively, residual income can be calculated from NOPAT as follows.

Residual income = NOPAT – Total capital charge

NOPAT = EBIT × (1 – Tax rate)

NOPAT = €700 million × (1 – 0.35) = €455 million

The total capital charge is as follows.

Equity charge = Total assets × Equity weighting × Cost of equity

= €4,000 million × 0.40 × 0.15

= €240 million

Debt charge = Total assets × Debt weighting × Pretax cost of debt × (1 – Tax rate)

= €4,000 million × 0.60 × 0.052(1 – 0.35)

= €81.1 million

Total capital charge = €240 million + €81.1 million

= €321.1 million

Therefore, residual income = €455 million – €321.1 million = €133.9 million

王园圆_品职助教 · 5 个月前

嗨,爱思考的PZer你好:

同学你好,首先公式(ROE-Re)*B(t-1)这个公式是没有问题的,李老师在上课过程中也有推导过该公式。如果题目有给出ROE和re,是可以用该公式计算的。

但是本题的解析是从RI的一般计算式RI = NI - B(t-1)*Re来进行第一种计算的。

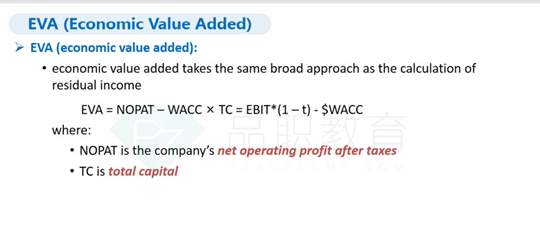

第二种计算是在RI这一章刚开始介绍的关于economic value adde的计算方法。这里也附上讲义截图。

这道题目两种方法计算出来的结果一致,是想告诉考生,其实在绝大多数情况下,RI的计算和EVA的计算是一致的。

----------------------------------------------

努力的时光都是限量版,加油!