NO.PZ201710200100000205

问题如下:

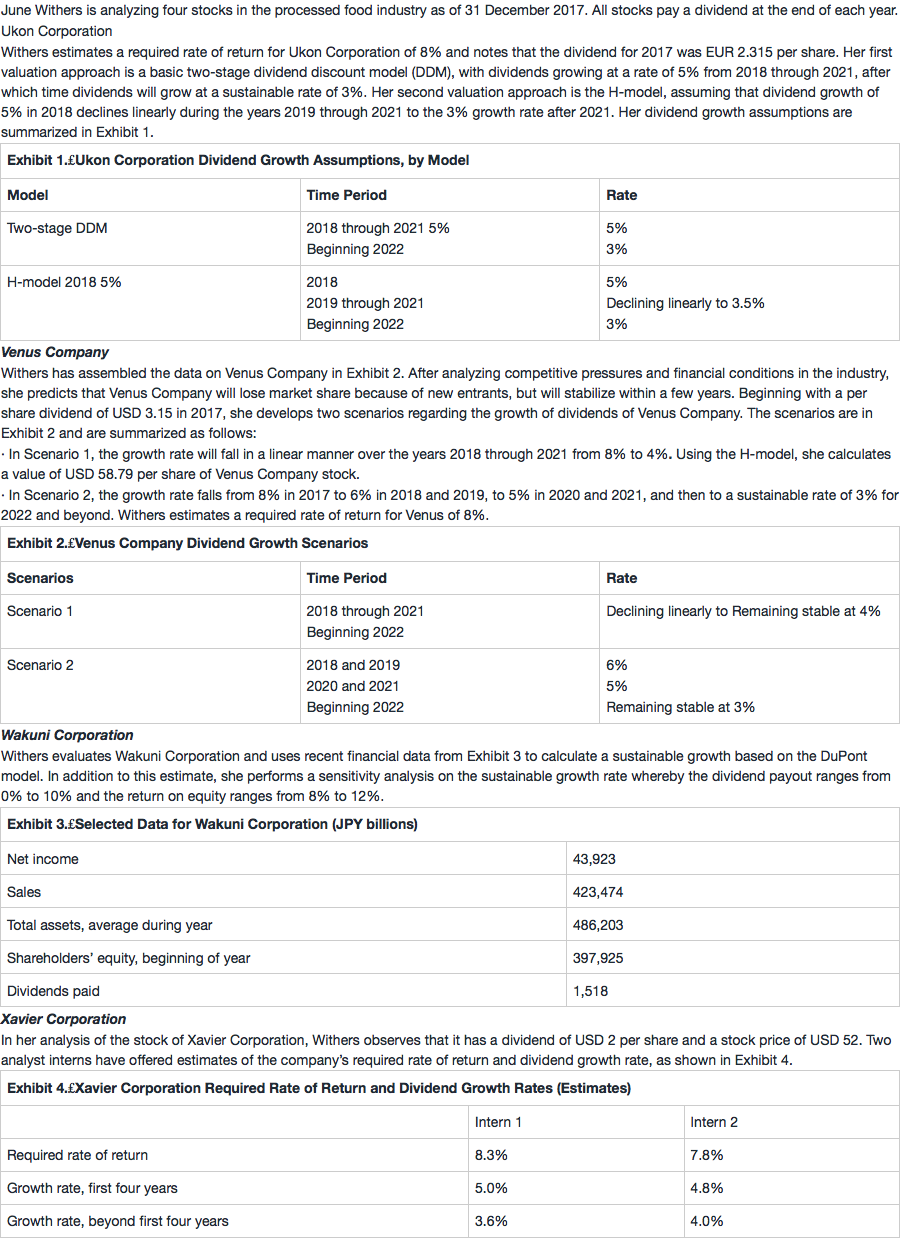

5. Under Scenario 2 and based on Exhibit 2, Withers estimates that the value of the Venus Company stock to be closest to:

选项:

A.USD 69.73.

B.USD 71.03.

C.USD 72.98.

解释:

B is correct based on the present value of forecasted dividends. The dividend at the end of 2017, based on case material, is USD 3.15 per share.

老师你看啊,2017年年初的时候是3.15,2017年增长是8%,那么从2018年年初也就是2017年年底的时候应该是从3.4(3.15x1.08)开始算啊?不对么?