No.PZ2021051201000032 (选择题)

来源:

Which of the following is least likely correct regarding the gamma hedge?

您的回答B, 正确答案是: B

A

To be fully hedged against a small change in the stock price, the proper strategy to construct the hedge is to use call option delta and add the call option gamma to arrive at the number of shares required

B

正确To achieve a gamma neutral portfolio, the portfolio delta should be neutralized firstly

C

Gamma can be managed to an acceptable level by buying or selling options

解析

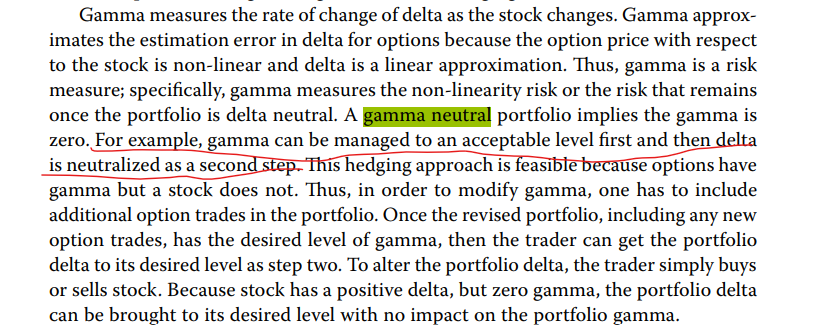

B is incorrect.

A gamma neutral portfolio implies the gamma is zero. To achieve a gamma neutral portfolio, First, gamma can be managed to an acceptable level by buying or selling options; Second, then delta is neutralized. To alter the portfolio delta, the trader simply buys or sells stock

考点:衍生- Valuation of Contingent Claims – Dynamic Hedging

老师,我怎么不记得课上讲过这个结论呢?请指导一下,谢谢